Distributors/Service Centers

November 22, 2015

Spot Pricing Capitulation Continues to Haunt Service Centers

Written by John Packard

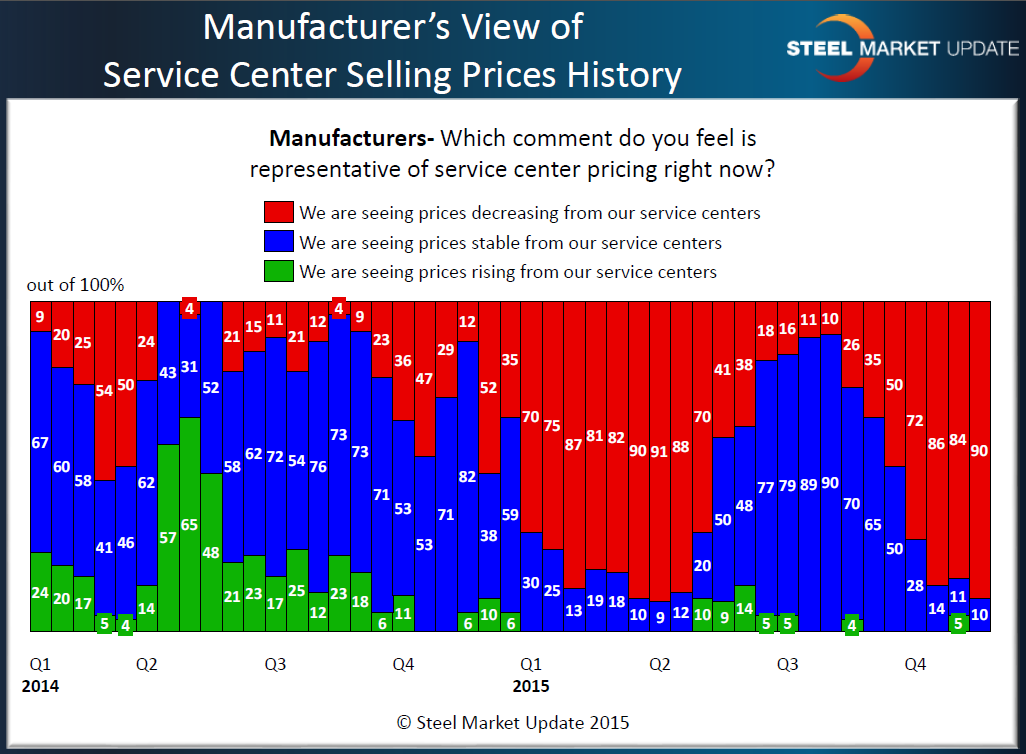

Manufacturing companies reported their service center suppliers dropping spot steel prices this past week. Ninety percent of the manufacturing respondents responding to last week’s SMU flat rolled steel market questionnaire reported service centers as dropping spot pricing. This continues a growing trend for distributors to dump inventory at reduced margins (or at no margins at all) in an effort to reduce higher priced inventories.

According to the manufacturers this trend began back in mid 3rd quarter 2015 and reached a point of saturation (80 percent or greater response ratio) at the beginning of the 4th Quarter.

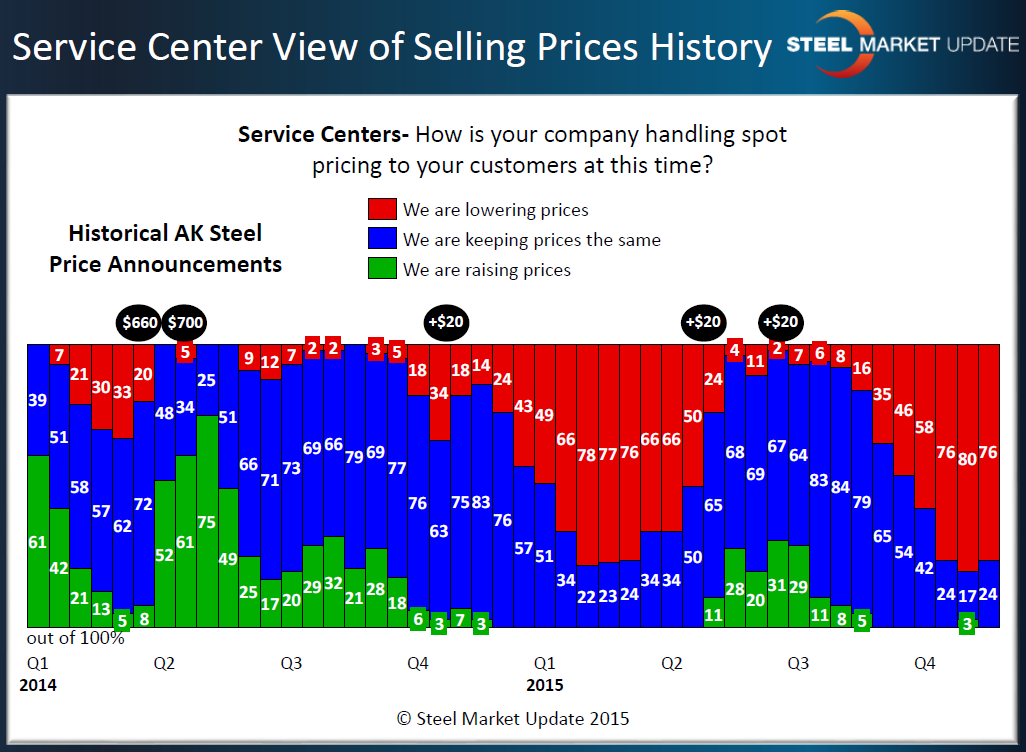

The last time manufacturers reported decreasing service centers pricing at a saturation level goes back to early 2nd Quarter. The trend toward lower spot pricing was stopped once the domestic steel mills announced price increases in late April/early May 2015. This can be seen in the graphic below (Service center view of spot pricing) where we have overlaid the AK Steel price increase announcements (since they are public and can be tracked on the AK Steel website) onto the service center responses regarding spot pricing.

Service Centers at Point of Capitulation

Since the middle of October the service centers participating in our flat rolled steel survey have indicated that at least 75 percent of them are reporting their company has lowering spot prices. Steel Market Update views this level to be a point of capitulation by the distributors and an important point to watch as rarely does this condition exist for too long a period before a move is made by the domestic steel mills to raise prices. You can see this in the graphic below.

SMU Opinion: Past history points to the domestic mills announcing a price increase within the next six weeks (or less). We also can go back and see a number of times when either just prior to or shortly after the Thanksgiving Holiday (late November/early December) at least one of the domestic mills made a run at higher prices. What may delay any price announcements would be sluggish order books at the mills and a drop in demand (and we have picked up demand weakness in our surveys).