Prices

November 22, 2015

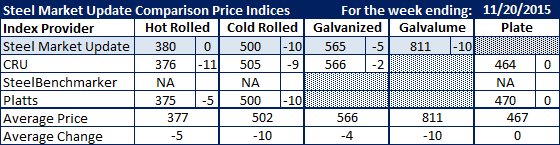

Comparison Price Indices: Still Moving Lower

Written by John Packard

Flat rolled steel and plate prices continued to slide this past week according to the various steel indexes followed by Steel Market Update. SMU saw prices as being sideways on hot rolled, down $10 on cold rolled, down $5 on galvanized and down $10 on Galvalume.

Both CRU ($376) and Platts ($375) dropped their averages below SMU which saw the market as being slightly higher at $380, although we believe the numbers will continue to trend lower in the coming days. SteelBenchmarker did not report prices this week so they have been eliminated from this week’s analysis. The average of SMU, CRU and Platts is $377 per ton ($18.85/cwt).

Cold rolled pricing dropped on all three indexes with both SMU and Platts coming in at $500 per ton and CRU slightly higher at $505 per ton. The average of the three indexes put CR at $502 per ton ($501.66).

Galvanized prices also fell but less than HR and CR. GI was down $5 on our index to $565 per ton while CRU was down $2 per ton to $566 per ton. Both numbers are based on .060” G90 with a $60 per ton coating extra.

Galvalume dropped $10 per ton on SMU and .0142” AZ50, Grade 80 is now being reported as averaging $811 per ton.

Plate prices were unchanged at both CRU and Platts.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.