Prices

November 17, 2015

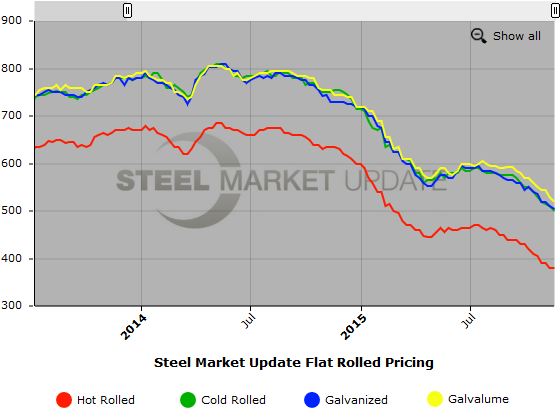

SMU Price Ranges & Indices: Looking for Green Shoots

Written by John Packard

Flat rolled steel prices moved sideways to slightly lower this week, an improvement from the almost straight-line dive we have been reporting for the last couple of months. Our benchmark hot rolled index remained the same as the week prior at $380 per ton ($19.00/cwt) but we did pick up some minor movement at the lower end of the range on cold rolled and galvanized steels. Everyone is looking for green shoots or evidence that the bottom is either here or near.

SMU heard from a number of different avenues that many steel buyers are holding off on buying contract tons, waiting for a sign that prices have bottomed and that they will not be hurt making commitments for 2016 tonnage. One service center told us, “We have so many customers on the sidelines who keep waiting for the numbers to come down.” He went on to say, “There is enough interest at these levels to give us a short term shot in the arm [once they begin ordering].”

Flat rolled inventories have dropped by approximately 250,000 tons according to MSCI data. SMU anticipates that inventories will drop again in November although we are concerned about demand levels after speaking with HARDI wholesalers earlier today (see Wholesaler article in this newsletter), as well as service centers, who are reporting tepid demand levels for this time of year (with the exception of automotive which continues to be strong).

We probed a number of large service centers to see where the resistant levels are on hot rolled. It appears the level is currently $360 per ton ($18.00/cwt). Although there are rumors of deals being cut at less than that, we have not yet seen proof of that being the case.

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $360-$400 per ton ($18.00/cwt- $20.00/cwt) with an average of $380 per ton ($19.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged from one week ago. SMU price momentum for hot rolled steel has prices moving lower over the next 30 days.

Hot Rolled Lead Times: 1-4 weeks.

Cold Rolled Coil: SMU Range is $480-$520 per ton ($24.00/cwt- $26.00/cwt) with an average of $500 per ton ($25.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $10 per ton compared to one week ago. Our overall average is down $10 per ton from last week. SMU price momentum for cold rolled steel is for prices to slip over the next 30 days.

Cold Rolled Lead Times: 4-7 weeks.

Galvanized Coil: SMU Base Price Range is $24.00/cwt-$26.50/cwt ($480-$530 per ton) with an average of $25.25/cwt ($505 per ton) FOB mill, east of the Rockies. The lower end of our range declined $10 per ton compared to last week while the upper end remained the same. Our overall average is down $5 per ton compared to one week ago. Our price momentum on galvanized steel is for prices to move lower over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $540-$590 per net ton with an average of $565 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3-7 weeks.

Galvalume Coil: SMU Base Price Range is $25.00/cwt-$27.00/cwt ($500-$540 per ton) with an average of $26.00/cwt ($520 per ton) FOB mill, east of the Rockies. The lower end of our range declined $20 per ton compared to one week ago while the upper end remained the same. Our overall average is down $10 per ton compared to last week. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards lower prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $791-$831 per net ton with an average of $811 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-7 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.