Prices

November 12, 2015

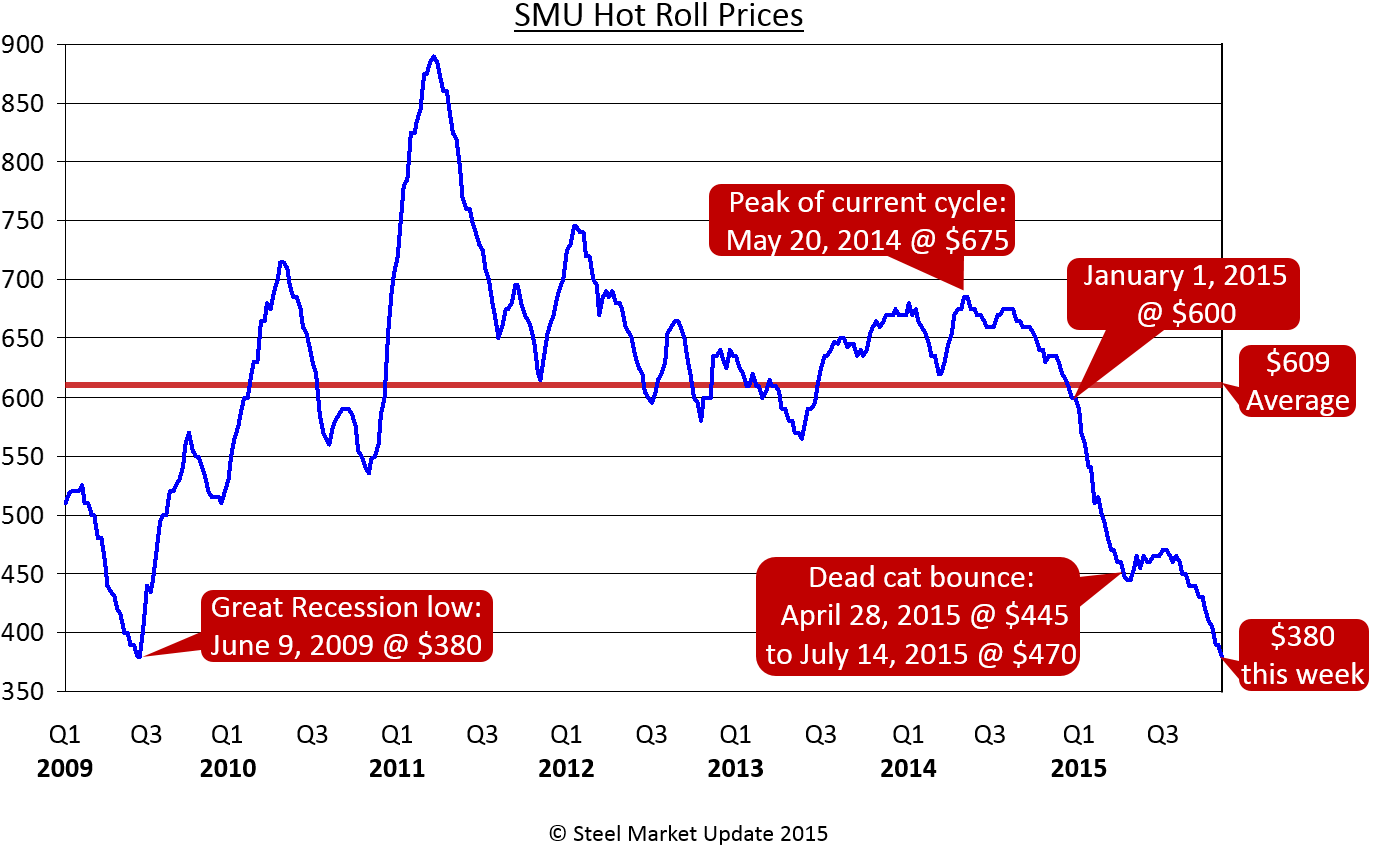

SMU HR Index at 7-Year Low

Written by John Packard

Earlier this week, Steel Market Update adjusted our benchmark hot rolled coil (HRC) index to reflect the average pricing we have been seeing as of the beginning of this week. We reported our average as being $380 per ton ($19.00/cwt) which also happens to be the lowest hot rolled price seen during the height of the Great Recession in 2009.

We thought our readers would be interested in seeing the path taken by hot rolled steel since the beginning of 2009 until today. What we find fascinating is the power of the jump in pricing since June 9, 2009 when it bottomed at $380 per ton. We saw prices jump almost to $900 per ton between then and early 2011.

Looking at the current market cycle which essentially began in early 2013, the peak of the cycle was achieved the week of May 20, 2014 when prices hit $675 per ton ($33.75/cwt). We began 2015 at $600 per ton ($30.00/cwt) and we have fallen almost non-stop since then with the exception of a short “dead cat bounce” between April 28 and July 14 of this year.

During this almost seven year process the average price for hot rolled coil was $609 per ton ($30.45/cwt).

Why are we at these kinds of levels?

In 2009 the issue was a massive erosion of demand (and confidence) which resulted in excessive inventories that had to be worked off.

Over the past couple of years, the U.S. market place has seen the highest steel prices in the world which attracted other countries to ship their excess steel to the United States. This resulted in a glut of supply and inventories growing out of control. During the 2nd half 2015 we also saw a slowing of demand which has also exacerbated the inventory situation. However, the slowdown in demand is no where near what it was during the 1st half 2009.

SMU Note: Can prices go lower from here – yes. How much lower is anyone’s guess but buyers may want to review the above graphic, read Spencer Johnson’s HRC futures article in tonight’s edition and review your own records of past price negotiations to determine if now is a good time to buy for next year…