Prices

November 12, 2015

HRC Prices Still Falling; Time to Try Catching the Falling Knife?

Written by Spencer Johnson

The following article is written by Spencer Johnson of FC Stone LLC. With six years of experience, Spencer provides his customers strategic and tactical advice on protecting themselves against commodity price volatility in the steel markets. Spencer will rotate weekly futures articles with Andre Marshall of Crunch Risk, LLC. Spencer can be reached at spencer.johnson@intlfcstone.com.

Commodity markets are cyclical; any broker or analyst would tell you this free of charge. What comes up must come down and vice versa, right? Well HRC pricing is now in the midst of a fairly unprecedented string of declining prices and the panic is starting to feel palpable. In our last salvo for Steel Market Update, we touched on the distinct possibility that the psychologically important $400/ton level may not hold on HRC. That now feels like a distant dream, as hope for support at $400 has vanished with every major index assessing spot prices well below that mark.

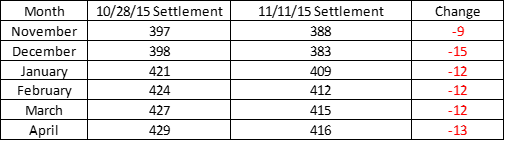

With the last trades done for December concluded at $383/ton, the next support level to check on will be $375/ton. Let’s take a look at our usual, “how much further have we fallen” matrix:

Buyers may have found some encouragement at the outset of the month as capacity closures were being announced and the declines in HRC prices had started to slow substantially. Any hope they may have had may have been dashed however as spot prices have fallen further. That has forced a reassessment of the forward valuations, and we have gone from last week’s Q1 2016 trading level of $420 to today, where buyers above $410 are no longer present. Bids seem to be hovering just above the $400/ton level, and that has led to a bit of an impasse in that period. Despite that, October volumes continue to show growing liquidity despite the price declines. We traded 131,180 tons in October, up 13.5% from the same month a year ago.

In other words, volumes may have been driven in part by the bright eyed optimism of a Q1 rally on the back of reduced capacity and the impact of trade cases. That optimism has subsided dramatically, and the market now looks to be convinced $400/ton will not be seen until next year and if we do see it next year, it won’t be breaking out of the current range in any dramatic fashion. We expect this will only increase volumes in the months ahead as sellers look to decrease risks and buyers look to lock in historically low pricing.

This brings us back to our title; is now the time to try and catch this falling knife? It’s never easy to say, and its generally a dangerous proposition, but the story we have been telling all along is that the 2009 recession era lows (around $370/ton) should be the key metric. Buyers who feel that locking in prices near a 7 year low will be hard to criticize at this point, regardless of what plays out in 2016. But commodity markets are cyclical, and what goes down will eventually come back up…the real question is when. Most analysts and market participants seem to be at a bit of a loss on how to answer that, but the truth is that the timetable has been pushed back several times already, and that has left buyers feeling skeptical for good reason. There remains few predictable catalysts for a sustained rally, but anything can happen.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

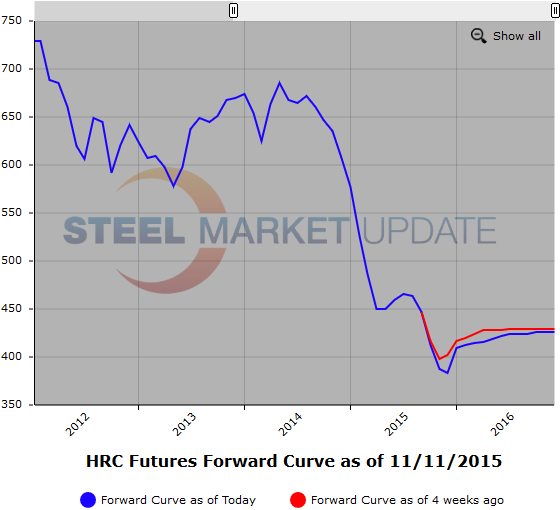

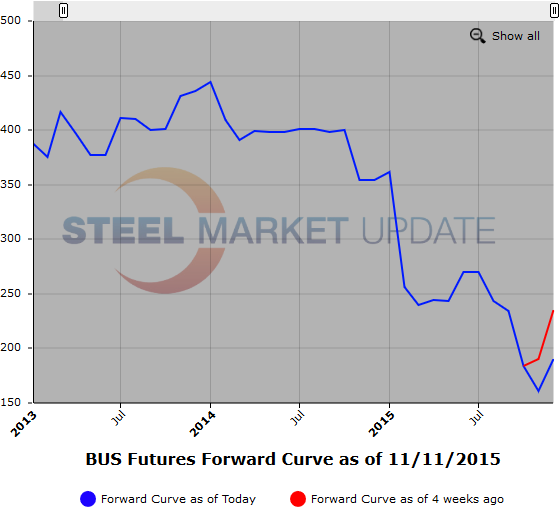

Below are two graphics of the HRC and BUS Futures Forward Curve. The interactive capabilities of the graphs can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.