Distributors/Service Centers

November 10, 2015

Spot Pricing Stress Building at Service Centers

Written by John Packard

One of the questions Steel Market Update received from a service center early this week was, “WHEN” will the bottom of the pricing cycle be achieved (the emphasis provided by the person asking the question).

Stress levels continue to build at flat rolled steel distributors as evidenced by the percentage of our service center survey respondents reporting their company as lowering spot pricing into the marketplace. We have reached the point whereby service centers have capitulated and are moving inventory at whatever pricing is necessary in order to raise cash and remove dead (or dying) over-priced steel.

In the past SMU has seen, and we believe that over the next few weeks if the trend continues, we will see service centers wishing for a price increase announcement out of the domestic steel mills so their inventories will (hopefully) stop losing value. The distributors need prices to stabilize or, better yet, to increase in order for them to increase spot prices and potentially be able to add margin to inventories purchased over the past few weeks.

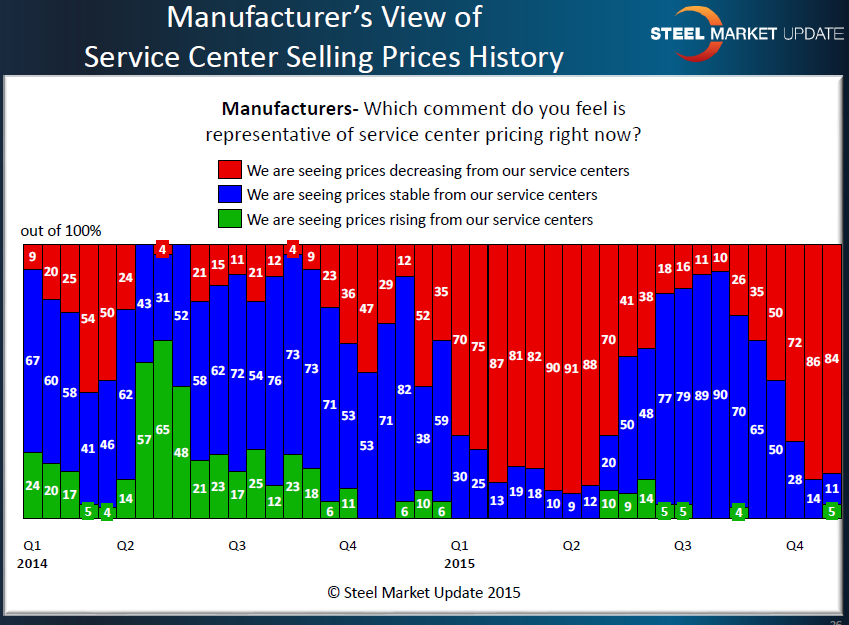

Capitulation has been defined by Steel Market Update in the past as when 75 percent or greater of the service center respondents report their company as lowering spot prices. At the same time we also see at least 80 percent of manufacturing company respondents reporting spot prices to their company as being in decline from their service center suppliers. Last week 84 percent of the manufacturing respondents reported distributor spot prices as being in decline (86 percent in mid-October).