Market Data

November 10, 2015

SMU Survey Respondents Report Slowing Demand

Written by John Packard

Last week Steel Market Update (SMU) conducted our early November flat rolled steel market analysis. During the two step process we asked our respondents to comment on demand trends, both as a group (step one) and then again when broken out into their various market segments (step two). We ask questions related to demand again so we can compare how various industry segments are seeing demand trends from their customers.

Step One:

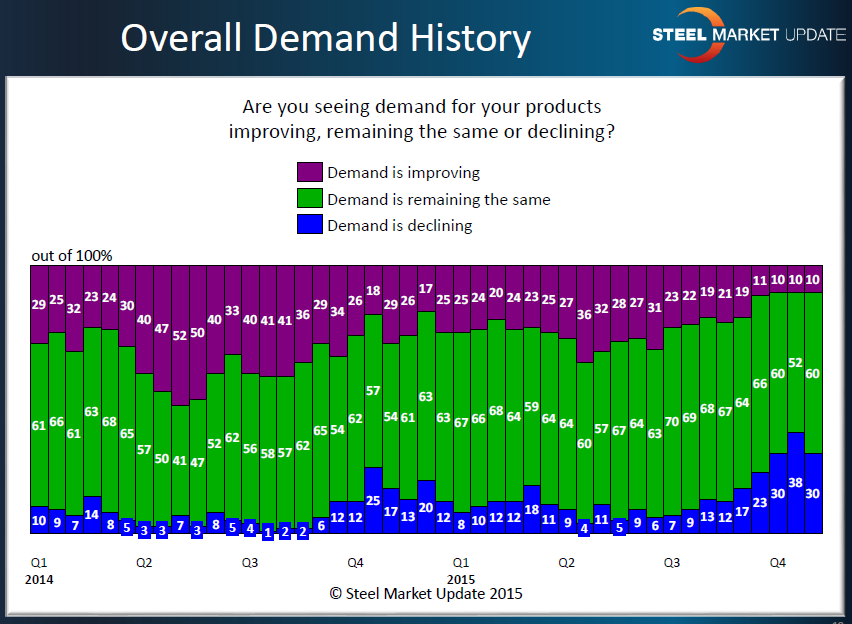

All of our respondents are hit with the following question early in the market analysis process: Are you seeing demand for your products improving, remaining the same or declining?

As you can see by the graphic below, since mid third quarter our respondents as a group have been indicating a change in the demand trend, with approximately one third of the respondents reporting demand as declining vs. 10 percent reporting demand as improving.

Step Two:

We break out into groups and we ask each group to comment on demand (or releases of steel by their customers). Manufacturing and distribution are the two main market segments we look at to understand how the groups view demand.

Manufacturing companies have been signaling a slowdown. Optimism has begun to wane going back to early third quarter when we saw a shrinking percentage of companies advising that demand for their products was improving. By late third quarter, and now into fourth quarter, the percentage of those companies reporting demand as declining began to grow. Slightly more than one third of our manufacturing respondents (and this is the single largest group that participates in our market analysis) reported demand as either declining marginally (33%) or substantially (4%).

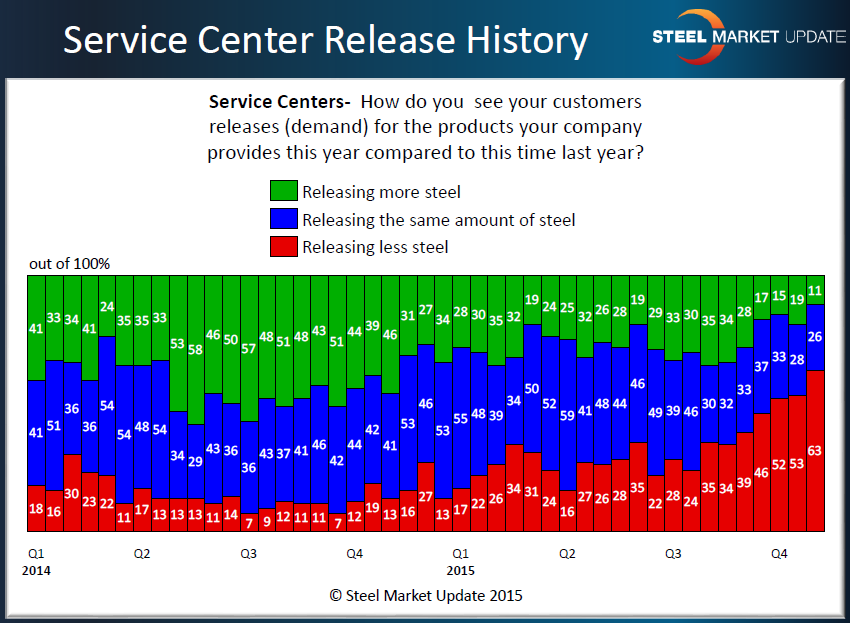

From the service center perspective you can see an even more dramatic view of the negative trend, expanding from the high 20’s at the beginning of the third quarter to last week’s 63 percent reporting their customers as releasing less steel.

Our Opinion:

In our opinion this reduction in demand is playing havoc with mill lead times, new orders and, ultimately, spot steel prices. Both the end users (manufacturing companies) and distributors are trying to control inventories (both spot and contract) which delays the re-order process.