Market Data

November 5, 2015

SMU Steel Buyers Sentiment Index 3MMA Still Trending Lower

Written by John Packard

The Steel Market Update (SMU) Steel Buyers Sentiment Index is continuing its downward trend, even though the Current Index is 4 points higher and the Future segment of the Index is 9 points higher than what we reported during the middle of October.

The numbers we follow closely are our 3 month moving averages (3MMA) and both the Current and Future Index 3MMA were lower this week.

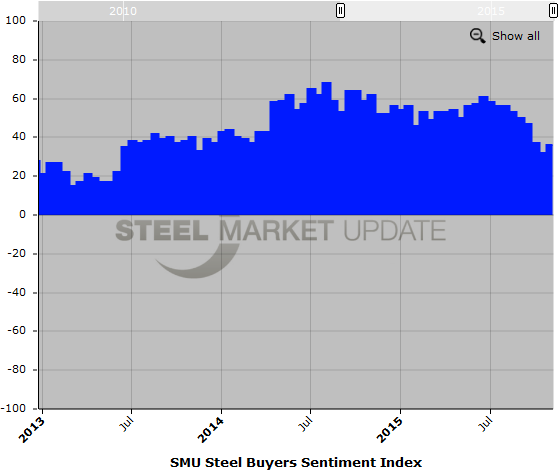

Current Sentiment +4 Points with 3MMA Down 3.33 points

The SMU Steel Buyers Sentiment Index has two separate measurement points of reference. Our Current Sentiment Index reflects how buyers and sellers of flat rolled steel feel about their company’s ability to be successful in the current market conditions. Our Index is being reported at +36 which is up 4 points from the +32 measured two weeks ago but is 1 point lower than what we reported one month ago. Current Sentiment has been dropping since the middle of June when our Current Sentiment was measured at the highest level (so far) for the year at +61.

Current Sentiment, when looked at based on a three month moving average, is being reported at +42.50 which is down 7.83 points from one month ago and 14.83 points less than the +57.33 reported in early August 2015.

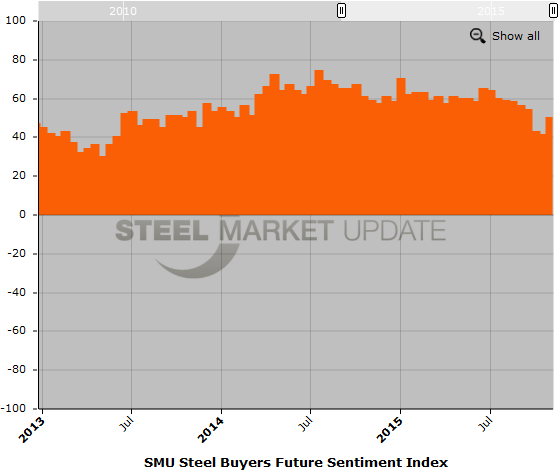

Future Sentiment Index Up 9 Points but 3MMA Lower by 1.5 Points

We also look at what buyers and sellers think about their company’s ability to be successful three to six months into the future. Traditionally, our respondents tend to be more optimistic when speaking about future business conditions. That trend continued as we measured Future Sentiment at +50 this week, up 7 points from one month ago.

The Future Sentiment 3MMA is being reported at +50.33 which is 4.67 points lower than what we measured one month ago. The trend moving away from high optimistic level began in early July when we were reporting the 3MMA as being 11.17 points higher.

What Our Respondents are Saying

“Our business is construction related, as we near the winter months, business will drop off.” Manufacturing company

“PLATE: we are well stocked and positioned to service the market with competitively priced quality plate.” Service center

“Weakening.” Service center

“Many complaining that they did not see any pickup in the fall that would help their poor spring due to weather.” Trading company

“Seeing some decline in automotive demand for model year changeover. Also seeing some quarterly customers draw down inventory in Q4.” Service center

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 46 percent were manufacturing and 40 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.