Market Data

November 5, 2015

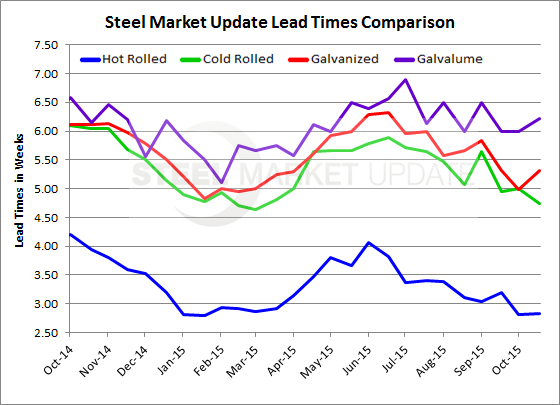

Lead Times Show Little Strength in Mill Spot Order Books

Written by John Packard

Twice per month, Steel Market Update (SMU) conducts an analysis of the flat rolled steel market from the perspective of active buyers and sellers of sheet and coil products. We invite approximately 560 companies to participate through the use of a questionnaire that we have been using since 2008.

One of the areas probed is in regards to North American (specifically U.S. and Canadian) steel mill lead times. We do not attempt to discover the exact lead times for new prime orders at specific mills rather we are looking for any changes in the trend over time.

For most of 2015 the trend has been for lead times to be much weaker than what was seen during the corresponding period one year ago.

The trend for shorter lead times has continued on all flat rolled products but Galvalume which is running about the same as one year ago. The short lead times are reflective of a weaker than wanted spot order book at the domestic steel mills. In SMU opinion we would need to see lead times move out by a minimum of one week in order for the mills to be able to tighten spot steel prices.

Benchmark hot rolled lead times were reported to average 2.83 weeks which is essentially unchanged from two weeks ago. Lead times have been averaging approximately 3.0 weeks over the past two to three months. One year ago HR lead times were at 3.95 weeks (4 weeks).

Cold rolled average lead times were reported to be 4.74 weeks at this time. This is slightly shorter than the 5.0 weeks reported two weeks ago and well below the 6.04 weeks reported during the first week of November 2014.

Galvanized lead times actually improved to 5.31 weeks from the 4.98 weeks reported two weeks ago. Even with the improvement, GI lead times are almost one week shorter than what was reported one year ago (6.11 weeks).

Galvalume lead times also made a slight move out from 6.0 weeks two weeks ago to 6.22 weeks this week. AZ lead times are just about the same today as they were one year ago (6.15 weeks).

To see an interactive history of our Steel Mill Lead Time data, visit our website here.