Prices

November 1, 2015

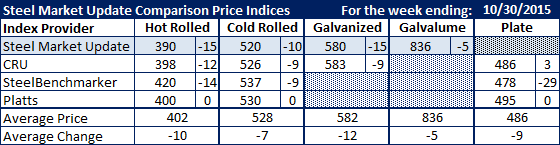

Comparison Price Indices: SMU/CRU Break Thru $400 HRC Barrier

Written by John Packard

Flat rolled steel prices continued to erode at a moderate pace this past week. Steel Market Update reviewed the results of three other steel indexes as well as our own for the week ending October 30, 2015. We found, with the exception of the Platts indices, all of the other indexes saw prices down by double digits ($10 per ton or more) on most products.

Benchmark hot rolled coil broke through the $400 per ton ($20.00/cwt) price barrier at both SMU ($390) and CRU ($398), followed by Platts ($400) and SteelBenchmarker ($420) which also reported prices this past week.

The range on cold rolled as of the end of the week stood at $520 per ton ($26.00/cwt) on base cold rolled (no extras included) according to SMU with CRU ($526) and Platts ($530) and then SteelBenchmarker ($537) at slightly higher price averages.

Galvanized prices also dropped and only $3 per ton separates CRU ($583) from SMU ($580) on .060” G90 galvanized.

SMU saw Galvalume prices as down $5 per ton and plate prices rose by $3 per ton according to CRU ($486) with Platts showing no change ($495) and SteelBenchmarker down $29 per ton to $478 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.