Prices

October 27, 2015

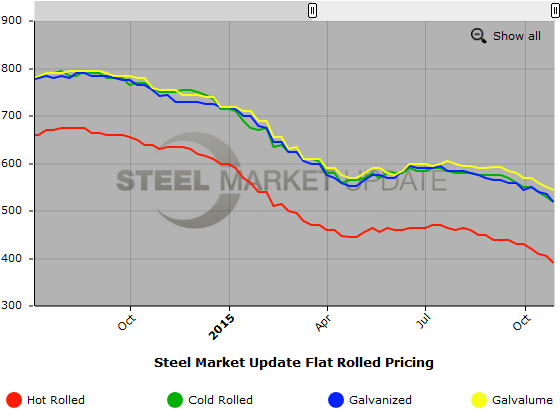

SMU Price Ranges & Indices: We Crash Through $400 Barrier on HRC

Written by John Packard

Steel Market Update (SMU) asked a manufacturing company when they thought prices will stop dropping? Their response was both classic and profound, “Prices will stop going down, when they go up. Prices can’t go below absolute zero. Question then becomes as to what defines absolute zero…?”

Flat rolled steel prices continued their march lower this week and our hot rolled index is now below $400 per ton and is within $10 of the cycle low hit during the Great Recession of $380 per ton (which lasted all of one week before bouncing back – hard – from there).

We are hearing from more and more service centers that end users are beginning to buy. This is not a universal opinion as other service centers are telling SMU buyers are sitting on their hands waiting for a clear sign that a bottom has been made (see first comment made in this article above).

What is understood by some (and perhaps ignored by others) is all open offers will be “off the table” should US Steel or ArcelorMittal chose to lockout the USW union workers. The mills have been operating without a contract since September 2nd and many believe the two sides are at an impasse and something (or someone) will have to give – and soon. Maybe that is the reason why October slab licenses are so high???

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $370-$410 per ton ($18.50/cwt- $20.50/cwt) with an average of $390 per ton ($19.50/cwt) FOB mill, east of the Rockies. The lower end of our range declined $10 per ton compared to last week while the upper end fell $20 per ton. Our overall average is down $15 over one week ago. SMU price momentum for hot rolled steel has prices moving lower over the next 30 days.

Hot Rolled Lead Times: 3-6 weeks.

Cold Rolled Coil: SMU Range is $500-$540 per ton ($25.00/cwt- $27.00/cwt) with an average of $520 per ton ($26.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $10 per ton compared to our last published prices. Our overall average is down $10 per ton compared to one week ago. SMU price momentum for cold rolled steel is for prices to slip over the next 30 days.

Cold Rolled Lead Times: 4-6 weeks.

Galvanized Coil: SMU Base Price Range is $25.00/cwt-$27.00/cwt ($500-$540 per ton) with an average of $26.00/cwt ($520 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to last week while the upper end declined $20 per ton. Our overall average is down $15 over one week ago. Our price momentum on galvanized steel is for prices to move lower over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $560-$600 per net ton with an average of $580 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-7 weeks.

Galvalume Coil: SMU Base Price Range is $26.00/cwt-$28.50/cwt ($520-$570 per ton) with an average of $27.25/cwt ($545 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to week ago while the upper end declined $10 per ton. Our overall average is down $5 per ton compared to last week. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards lower prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $811-$861 per net ton with an average of $836 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-7 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.