Prices

October 25, 2015

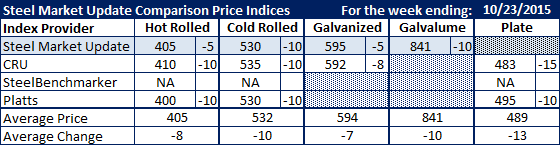

Comparison Price Indices: About to Break Through $400 Barrier

Written by John Packard

Hot rolled prices are poised to crash through the $400 per ton ($20.00/cwt) barrier and head toward lows not seen since 2009 when SMU’s HRC average briefly reached $380 per ton ($19.00/cwt).

This past week SMU saw flat rolled steel and plate prices drop on all of the indexes followed by SMU except SteelBenchmarker which did not report prices last week. We saw double digit drops in many of the products as we raced toward new lows.

Hot rolled prices are now averaging (remember, these are average prices and not the lows seen in the market) $405 per ton as Platts ($400) and CRU ($410) were both down $10 per ton this past week. Steel Market Update (SMU) came in down $5 per ton to $405 per ton ($20.50/cwt).

Cold rolled prices dropped $10 per ton across the board (all three reporting indexes for the week) with both SMU and Platts at $530 per ton ($26.50/cwt) and CRU at $535 per ton ($26.75/cwt).

Galvanized was the least volatile product during the week, down $5 per ton on SMU to $595 per ton ($29.75/cwt or a $26.75/cwt base on .060” G90 which is the product upon which the index is based). CRU was down $8 per ton on GI and is now at $592 per ton.

Galvalume dropped $10 per ton as well and the SMU index is now at $841 per ton on .0142” AZ50, Grade 80 (the benchmark product for AZ).

Plate prices dropped $15 per ton on CRU and are now at $483 per ton while Platts lowered their plate index average to $495 per ton, down $10.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.