Market Data

October 25, 2015

Capitulation!

Written by John Packard

Last week Steel Market Update conducted our mid-October flat rolled steel market analysis. We invited almost 600 companies to participate in our questionnaire which is focused on tracking trends affecting flat rolled steel buyers and users.

In our opinion, one of the most valuable pieces of information coming out of our market analysis is the responses we get from manufacturing companies and steel distributors regarding service center spot pricing. We believe service center spot prices can help forecast future steel mill price moves and whether mills will be able to collect price increases based on the support the distributors give to collecting (or not) higher prices from their spot customers.

Flat rolled steel pricing, and price support, are affected by a number of factors including inventory levels, demand at the end users and the psychology of the market. The psychology can be seen in our Steel Buyers Sentiment Indices as well as in the price support (or lack-their-of) provided by the domestic service centers.

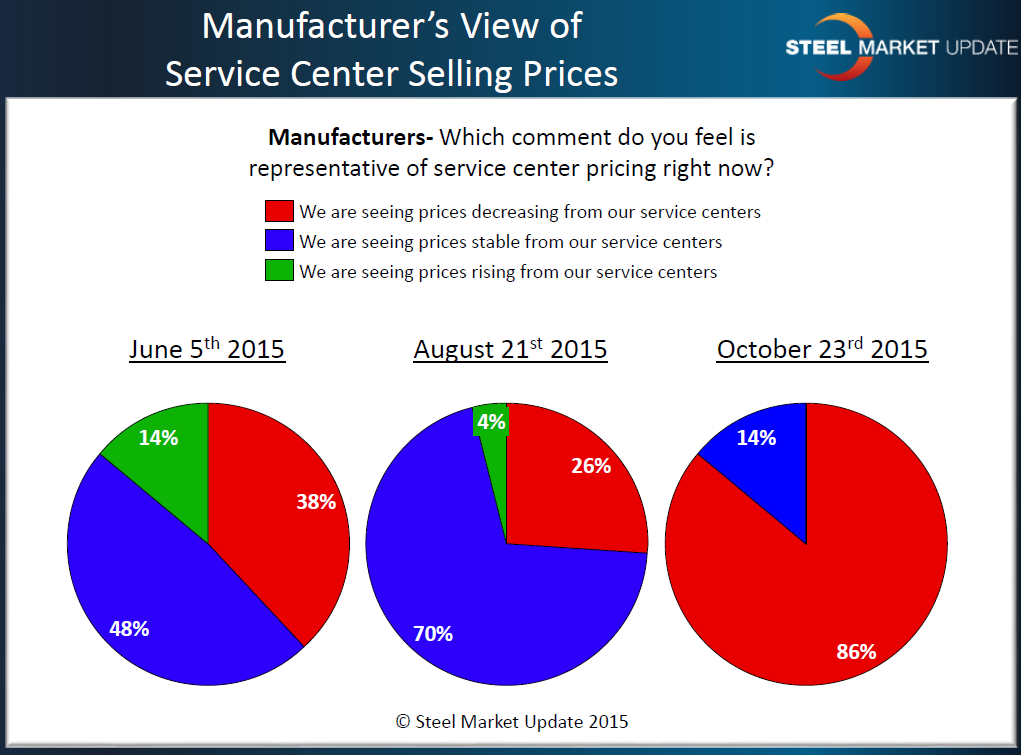

Twice per month we ask both manufacturing companies and service centers to comment on distributor spot prices. Last week 86 percent of the manufacturing companies participating in our questionnaire reporting service centers spot prices as “decreasing.” The balance (14%) reported prices as being “stable.”

In the graphic above you can see a snapshot of how manufacturing companies responded to the question in early June, mid-August and then this past week.

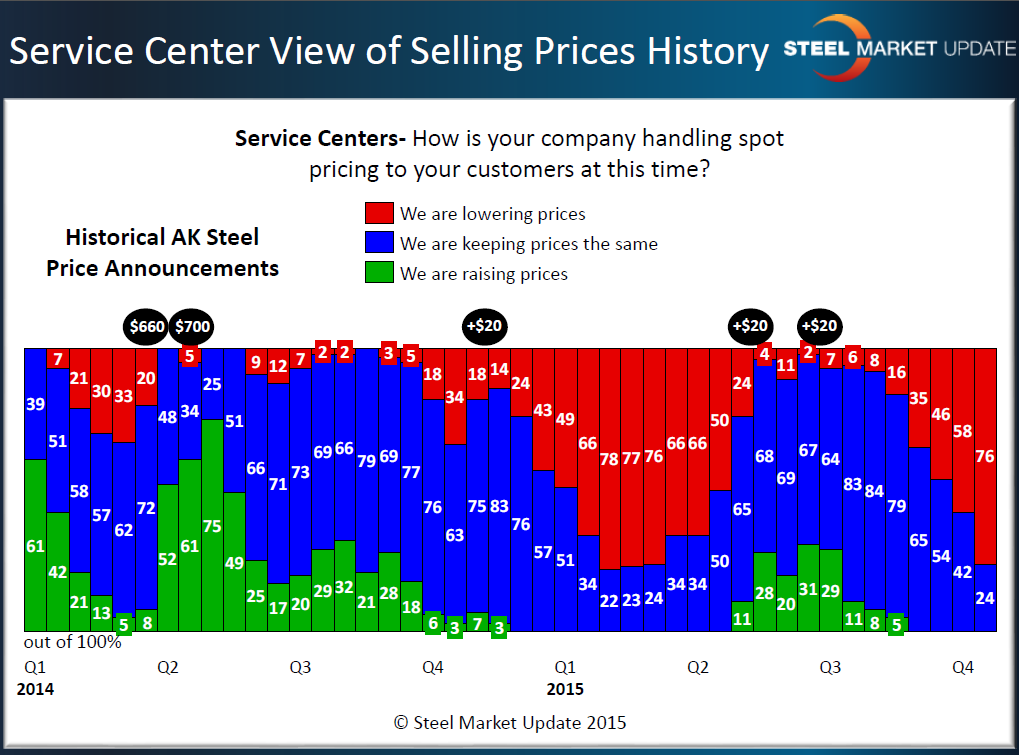

Below you will see a more detailed view of the same question only, instead of manufacturers responding, we posed the question to the distributors themselves. As you can see, there has been a steady push for service centers to become more aggressive by lowering spot prices.

The service centers have reached a point which SMU calls “Capitulation.” Capitulation is the point at which service centers are acting en masse and are dumping spot pricing to their customers.

It is SMU’s opinion that when 75 percent or more of the service centers queried report spot prices as dropping this means essentially all of the distributors are pushing to move off excess inventories and they are scrambling to get rid of high priced material. As the pain of selling steel at a loss sinks in, the distributors become more inclined to support price increases.

In the chart above we have included the AK Steel price increase announcements in the black ovals above the graphic (we use AK as their announcements are public knowledge as they are published as press releases on their website). If you go back to late this spring, you may recall we had a “dead cat bounce,” which was when the mills (including AK) made price announcements shortly after we reached the point of capitulation in 1st Quarter 2015. The green bars indicate there was a very muted attempt to support the price increases before the market collapsed.

Our belief is that the collapse at the end of the dead cat bounce occurred because demand was dropping and inventories at the service centers continued to grow out of control.

We anticipate that this period of Capitulation could continue for some time due to these same two factors: falling or sluggish demand and higher than anticipated inventories (now going into the end of the year tax considerations).