Market Data

October 22, 2015

Steel Mill Lead Times: No Change

Written by John Packard

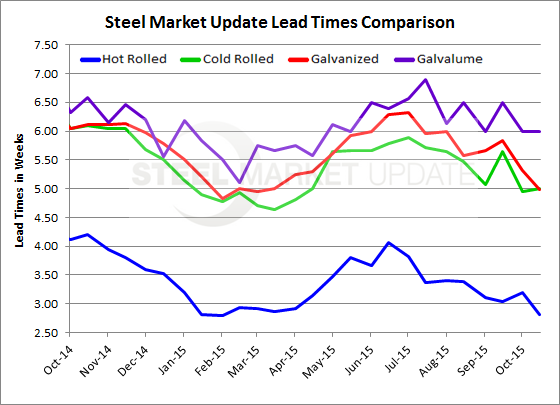

Buyers and sellers of flat rolled steel are reporting average lead times on hot rolled, cold rolled, galvanized and Galvalume steels as being essentially unchanged from what we reported at the beginning of the month.

However, when looking at the graphic below you can clearly see lead times have been in decline since the early summer months and are now at, or very near, their one year low point.

Hot rolled lead times moved fractionally lower to 2.82 weeks versus the 3.19 week average reported at the beginning of October. Hot rolled lead times are now 1.3 weeks shorter than what was being reported by SMU one year ago.

Cold rolled lead times remained the same as what was being reported at the beginning of the month. The 5.0 week lead average lead time is one week shorter than what we saw for an average during the middle of October 2014.

Galvanized lead times slipped slightly and at 4.98 weeks are very close to the lowest levels of the year and is slightly over one week shorter than what we reported as the GI average last year at this time.

Galvalume lead times remained the same as what was reported at the beginning of the month. The 6.0 week average is about one half a week shorter than what we reported AZ average lead times to be in mid-October 2014.

Weak or weakening lead times, in SMU opinion, is seen as one of the main culprits keeping prices from stabilizing.

To see an interactive history of our Steel Mill Lead Time data, visit our website here.