Market Data

October 22, 2015

Steel Buyers Tell SMU: Steel Mills Anxious to Negotiate Pricing

Written by John Packard

SMU spoke with a service center executive earlier today. During our conversion this Midwest based service center expressed his opinion regarding the ability to negotiate domestic steel prices in the current market environment when he told us, “I am beginning to think that with a firm bid you could get a better deal domestically than what you would get if you went foreign.”

In our HARDI galvanized steel conference call held earlier this week we heard from a number of wholesalers who reported the mills as, “…more willing to negotiate and we are seeing prices that we have not seen since 2008.”

Those responding to our mid-October flat rolled steel market analysis this week did not express opinions regarding domestic versus foreign pricing. What they did agree on is the domestic steel mills are aggressively negotiating price on all flat rolled products.

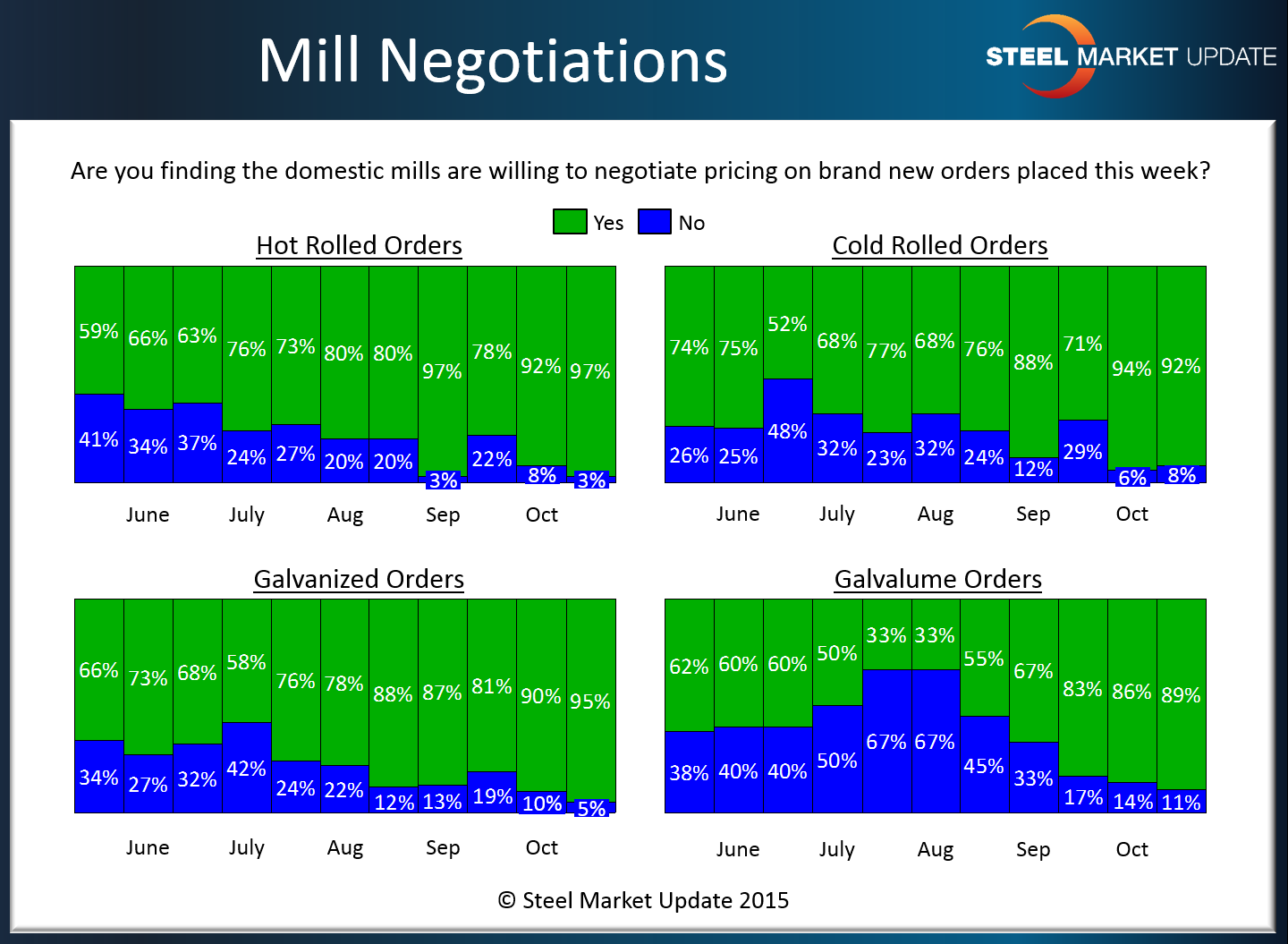

Those respondents reporting the mills as negotiating hot rolled prices rose from 92 percent to 97 percent (meaning 97 percent of the respondents reported mills as negotiating pricing).

Cold rolled also remained above 90 percent with 92 percent reporting the mills as willing to negotiate CR spot pricing.

Galvanized rose from 90 percent to 95 percent.

Galvalume rose from 86 percent to 89 percent.

Here is how negotiations have trended since the beginning of June 2015.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.