Prices

October 20, 2015

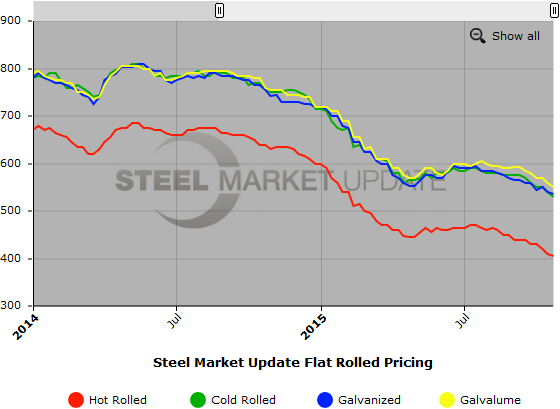

SMU Price Ranges & Indices: Another Day Another Drop in Pricing

Written by John Packard

Flat rolled prices dropped $5 to $10 per ton this week as the psychology of the market works against the sellers of steel. Hot rolled continues to be the weakest of the flat rolled products due to the energy, mining and agricultural markets. Other products are faring better (regarding demand) but not to the point where prices are able to rise from here. We are hearing of reports of sellers refusing to participate in the lower end of the markets – especially on hot rolled. SDI CEO Mark Millett stated earlier today during their earnings conference call with analysts that hot band was at “prices we weren’t interested in…” He went on to say that SDI was not chasing the numbers.

During our HARDI conference call this morning we heard similar comments from one of the wholesalers who reported to the group that his company “refuses to participate in these low price levels.” He went on to say that he believed that once the labor situation is resolved that steel prices will rise from here. We will have to wait to see if prices do rise any time soon.

At this point we want to warn our readers to be careful when catching a falling knife.

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $380-$430 per ton ($19.00/cwt- $21.50/cwt) with an average of $405 per ton ($20.25/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week while the upper end decreased $10 per ton. Our overall average is down $5 over one week ago. SMU price momentum for hot rolled steel has prices moving lower over the next 30 days.

Hot Rolled Lead Times: 3-6 weeks.

Cold Rolled Coil: SMU Range is $510-$550 per ton ($25.50/cwt- $27.50/cwt) with an average of $530 per ton ($26.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $10 per ton compared to our last published prices. Our overall average is down $10 per ton compared to one week ago. SMU price momentum for cold rolled steel is for prices to slip over the next 30 days.

Cold Rolled Lead Times: 4-6 weeks.

Galvanized Coil: SMU Base Price Range is $25.50/cwt-$28.00/cwt ($510-$560 per ton) with an average of $26.75/cwt ($535 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to last week while the upper end remained the same. Our overall average is down $5 over one week ago. Our price momentum on galvanized steel is for prices to move lower over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $570-$620 per net ton with an average of $595 per ton FOB mill, east of the Rockies. Note that last week the .060″ G90 extra was revised from $69 per ton ($3.45/cwt) to $60 per ton ($3.00/cwt).

Galvanized Lead Times: 4-7 weeks.

Galvalume Coil: SMU Base Price Range is $26.00/cwt-$29.00/cwt ($520-$580 per ton) with an average of $27.50/cwt ($550 per ton) FOB mill, east of the Rockies. The lower end of our range declined $20 per ton compared to week ago while the upper end remained the same. Our overall average is down $10 per ton compared to last week. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards lower prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $811-$871 per net ton with an average of $841 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-7 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.