Market Segment

October 19, 2015

NLMK USA 3Q Sales and Production

Written by Sandy Williams

NLMK USA third quarter 2015 sale volume totaled 494,000 tonnes, up 3 percent from Q2 but 7 percent below sales for third quarter 2014. Automotive demand and recovery of the construction sector contributed to the quarterly increase in sales.

Hot rolled sales of 271,000 tonnes were up 2 percent from Q2 but 13 percent below Q3 2014. Cold rolled steel sales totaled 133,000 tonnes and galvanized steel 89,000 tonnes, a year over year change of -3 percent and +10 percent, respectively.

Market conditions improved quarter over quarter with crude steel production at NLMK USA at 151,000 tonnes, up 15 percent from second quarter although down 14 percent year over year. Finished steel output rose 1 percent q/q to 50 million tonnes.

In nine month results, lower crude steel output of 380,000 tons (down 25 percent y/y) was due mainly to repair work at NLMK Indiana early in 2015. Nine month sales felt the effects of growing competition in the US market, declining to 1.4 million tonnes for the period. Galvanized steel sales fared better at 25 million tonnes, an increase of 7 percent year over year driven by steady demand for HVA products.

NLMK expects softening demand in North America in Q4 which could negatively affect results at NLMK USA.

NLMK USA includes NLMK Indiana, NLMK Pennsylvania, and Sharon Coating.

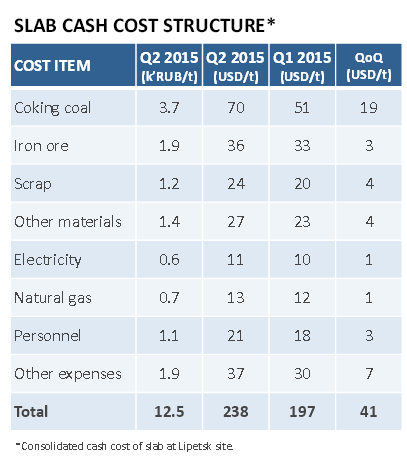

We thought our readers would be interested in the Russian parent company’s cost structure for the production of slabs (FOB Russia):