Prices

October 18, 2015

Comparison Price Indices: Push Lower Reaching Psychological Barriers

Written by John Packard

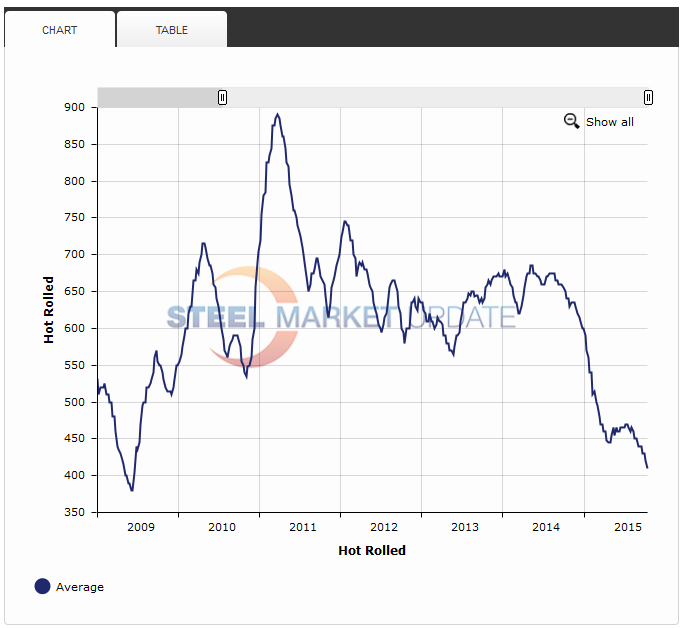

Flat rolled steel prices continued their downward spiral this past week based on our analysis of the four steel indexes followed by Steel Market Update. We will be watching prices closely over the next week or two to see if we breach the psychological $400 per ton number on benchmark hot rolled coil. We have not seen prices at current levels (or below) since June of 2009 – right in the midst of the Great Recession.

The graphic above was taken directly from our website (Pricing tab – Steel Prices – Hot Rolled, Average, Weekly) which you can access by logging into your account. Online, the graphic is interactive which means you can adjust the time period, product, include high and low as well as average pricing, etc.

So, we are reaching critical territory and the mills are reacting to it by taking capacity out of the marketplace (USS Fairfield, USS Granite City, AK Steel Ashland) which, when combined with the trade suits, is an effort to tighten supply thus forcing prices to reverse course.

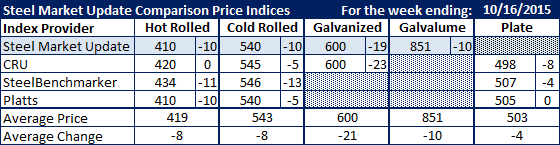

Going back to the indexes and our analysis for this past week:

Hot rolled prices dropped by double digits on all of the indexes except CRU. Steel Market Update (SMU) and Platts both dropped $10 per ton and by the end of the week were reporting $410 per ton ($20.50/cwt) as the average spot selling price for HRC. SteelBenchmarker, which only produces numbers twice per month, came in at $434 per ton while CRU stayed pat at $420 per ton.

Cold rolled prices dropped across the board as all of the indexes saw negative movement this past week. SMU and Platts both moved to $540 per ton ($27.00/cwt) while CRU dropped $5 per ton to $545 and SteelBenchmarker moved down $13 per ton to $546 per ton.

Galvanized pricing, which is based on .060″ G90, dropped double digits on both the CRU and SMU indexes. Part of the reason for the large decreases in pricing is due to the change in coating extras. Both indexes are now using $60 per ton for adding zinc instead of the $69 per ton used previously. This is due to most of the domestic mills adjusting their .060″ G90 extras to be in line with the move made by US Steel back in April. Both CRU and SMU reported galvanized as being $600 per ton which, when you remove the $60 per ton coating extra equates to a $27.00/cwt average base price.

Galvalume dropped $10 per ton to $851 per ton for .0142″ AZ50, Grade 80.

Lastly, plate prices were lower on CRU and SteelBenchmarker but unchanged on Platts. CRU is the first index to crash through the $500 per ton level as they reported plate prices as being $498 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.