Market Data

October 14, 2015

Manufacturing Surveys in New York and Philadelphia Show Weaker Conditions

Written by Sandy Williams

Two of the nation’s most watched manufacturing indicators showed weakening business conditions in October. Surveys of manufacturing firms conducted by the Federal Reserve Banks of Philadelphia and New York also indicated muted optimism for business conditions during the next six months.

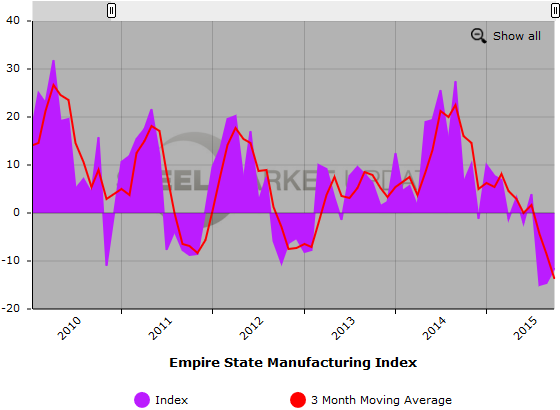

Empire State Manufacturing Survey

Manufacturing activity declined for the third consecutive month in New York according to the October 2015 Empire State Manufacturing Survey.

The headline general business index remained negative at -11.4 although picking up three points from September. New orders, shipments and unfilled orders declined at steeper pace than last month.

Input prices were relatively steady but selling prices dropped at the fastest pace since 2009. Employee levels were down for the fourth month in a row and the workweek hours remained negative at -7.6.

Looking ahead at the next six-months, manufacturers were not impressed with the outlook. The index for future business conditions remained steady at 23.4 along with the indexes for new orders and future shipments. Manufacturers expect input and selling prices both to rise during the next six months.

Some increase in employment is expected as indicated by a rise to 10.4 on the future employment index. Capital expenditures are likely to remain at the same level and technology spending edged up to register 5.7 in September.

Philadelphia Manufacturing Business Outlook Survey

Philadelphia manufacturing conditions continued to weaken in October. The general activity index for the Manufacturing Business Outlook Survey edged slightly higher to -4.5 from -6.0 in September.

Indexes for new orders and shipments fell below into negative numbers this month. Delivery times and unfilled orders indexes also registered below zero. Thirty percent of survey respondents reporting lower inventories in October, pulling the inventory index down 15 points.

Prices for inputs and manufactured goods both remained steady. Upward price pressure has been nearly nonexistent since the beginning of the year. Employment levels showed decline along with average work week hours.

Philadelphia manufactures were somewhat less optimistic this month. The future general activity index fell to 36.7 in October from a reading of 44.0 in September but most survey respondents were optimistic new orders and shipments would increase during the next six months. The employment forecast weakened, falling 4 points in October.

In a special questions category, firms were asked about utilization rates. The average capacity utilization rate among those surveyed was 76 percent, in line with the current rate for the U.S. manufacturing sector.