Prices

October 13, 2015

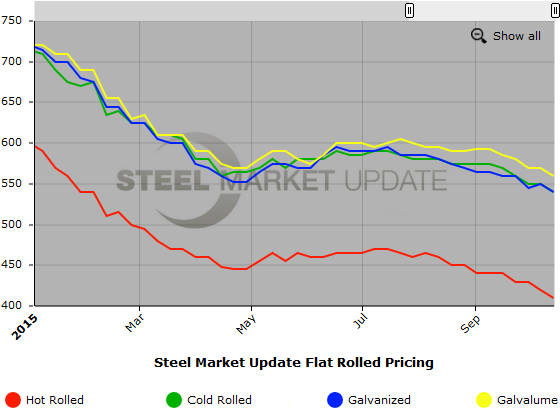

SMU Price Ranges & Indices: Lower End of Range Continues to Slide

Written by John Packard

Flat rolled steel buyers and industry executives reported steel mills in both Canada and the United States as “aggressively looking for business” to run across their lines. Steel Market Update spoke with a manufacturing company on Monday who told us their company had been approached by a domestic mill not usually associated with cheap hot rolled business. The mill offered a $380 base plus waived an extra that was worth an additional $30 to $40 per ton (depending on mill).

Then earlier today (Tuesday) we were speaking with a couple of hot rolled buyers who pointed to Essar Steel Algoma as being especially “desperate” to sell steel and we were advised the numbers being quoted (and orders taken) were $380 delivered into the Chicago area.

Other buyers reported that is was “easy” to get $400 per ton pricing with one executive pegging the marker at below $400 for larger tons (1,000+), $400 to $410 for medium sized orders and most everybody else should be able to get $420 per ton.

Steel mills continue to resist dropping cold rolled and coated products below $26.00/cwt base pricing but, one mill told us that “meaty” orders should be in the $25.50/cwt-$26.50/cwt range and smaller orders would be somewhere in the “27’s.”

The president of a Midwest based service center warned us (and our readers in the process), “Dramatic drops in pricing means we are fast approaching the bottom. On the demand side the buyers are starting to say these numbers are beginning to look good. It may be time to try to lock in not just for a month but 3 or 6 months or more.”

A national service center chain executive told us regarding contract negotiations, “…everybody is talking but no one is settling. The buyers are worried about where prices may ultimately go. They are also worried about market conditions and where they will be next year.”

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $380-$440 per ton ($19.00/cwt- $22.00/cwt) with an average of $410 per ton ($20.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to last week while the upper end remained the same. Our overall average is down $10 over one week ago. SMU price momentum for hot rolled steel has prices moving lower over the next 30 days.

Hot Rolled Lead Times: 2-4 weeks.

Cold Rolled Coil: SMU Range is $520-$560 per ton ($26.00/cwt- $28.00/cwt) with an average of $540 per ton ($27.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to week ago while the upper end declined $20 per ton. Our overall average is down $10 compared to last week. SMU price momentum for cold rolled steel is for prices to slip over the next 30 days.

Cold Rolled Lead Times: 4-7 weeks.

Galvanized Coil: SMU Base Price Range is $26.00/cwt-$28.00/cwt ($520-$560 per ton) with an average of $27.00/cwt ($540 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $10 per ton compared to our last published prices. Our overall average is down $10 per ton compared to one week ago. Our price momentum on galvanized steel is for prices to move lower over the next 30 days.

A note to those buying galvanized and watching our .060″ G90 pricing (seen below). We are adjusting the G90 extra to $60 per ton from $69 per ton. This means that $9 per ton of price movement above and beyond the $10 per ton shown above is built into the .060 index number. Our understanding is CRU will also adjust their .060 coating extra when their prices are released tomorrow (Wednesday).

Galvanized .060” G90 Benchmark: SMU Range is $580-$620 per net ton with an average of $600 per ton FOB mill, east of the Rockies. The .060″ G90 extra has been revised from $69 per ton ($3.45/cwt) to $60 per ton ($3.00/cwt).

Galvanized Lead Times: 3-7 weeks.

Galvalume Coil: SMU Base Price Range is $27.00/cwt-$29.00/cwt ($540-$580 per ton) with an average of $28.00/cwt ($560 per ton) FOB mill, east of the Rockies. The lower end of our range declined $20 per ton compared to week ago while the upper end remained the same. Our overall average is down $10 per ton compared to last week. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards Lower prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $831-$871 per net ton with an average of $851 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-7 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.