Market Data

October 13, 2015

SMU Flat Rolled Steel Market Analysis View of Demand

Written by John Packard

There are two groups of people who get access to a good portion of our flat rolled steel market analysis which is conducted by Steel Market Update twice per month. The two groups are: the people who participate in our research and our Premium level members.

We believe our analysis is superior to others which exist in the marketplace due to the uniqueness of both the questions and the effort put into qualifying those who participate in the research.

We are watching a number of trends besides flat rolled steel pricing. We have an article in tonight’s newsletter about both manufacturing and service center views of distributor spot pricing. We believe this to be an important key in determining if/when steel mills may be able to announce and then collect price increases.

We found some interesting tidbits in our latest analysis which was conducted this past week. One of the most important is regarding demand.

In the graphic below we believe you should be able to clearly see the trend which developed at the beginning of the 2nd Quarter 2015 and has continued through this past week. The trend is an overall weakening of demand being reported by our participants as a group. At 30 percent reporting demand as declining we are at the highest levels measured over the past two years. At the same time the 10 percent reporting improving demand is at the lowest level seen during that same time period.

In each analysis done by SMU we dig deeper and break out details for the two largest steel buying units: service centers and manufacturing companies.

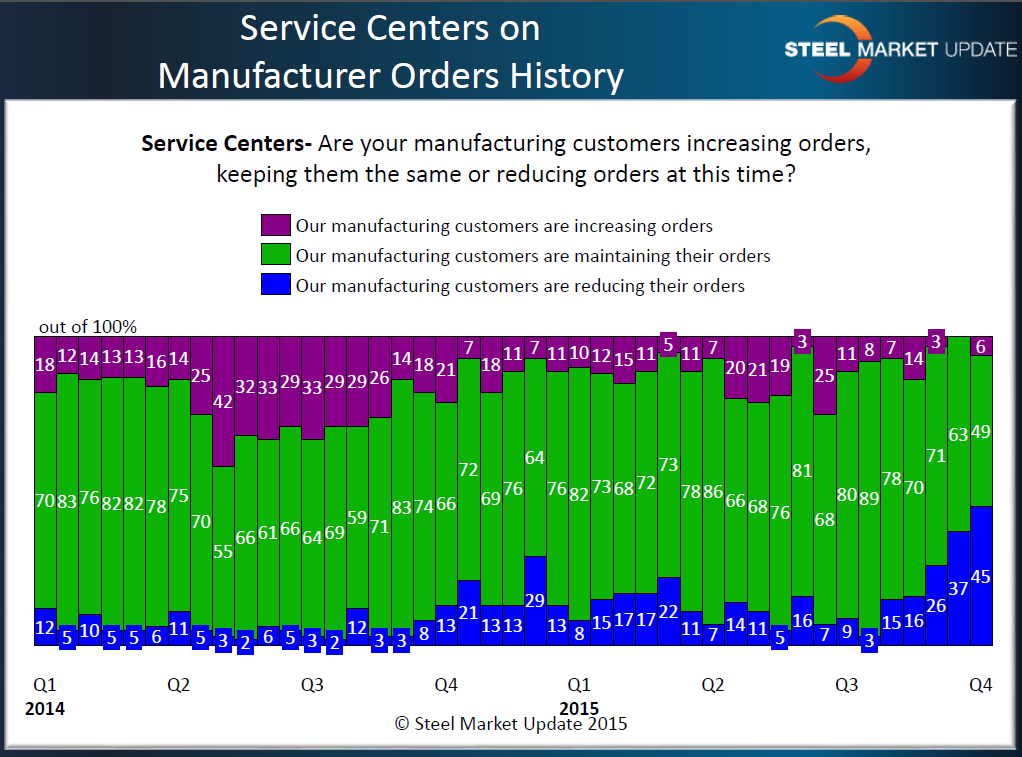

We asked service centers if their manufacturing customers were increasing, reducing or maintaining their orders right now. As you can see by the graphic below the trend for order reduction is moving in full force.

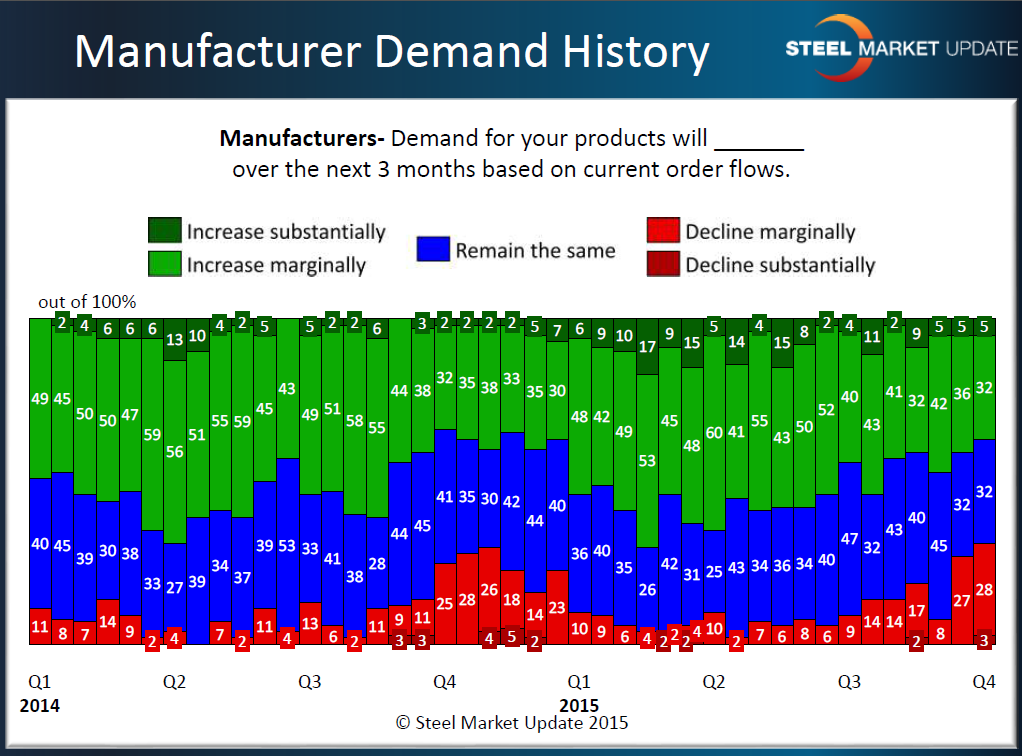

Manufacturers are also asked about order flows only we concentrate on the direction of where they might be 3 months out into the future. Both the service centers and manufacturers are painting a less than stellar picture for the next few months.

But, our Key Market Indicators (also a Premium level product which can be found on our website) and the information shared with us by Alan Beaulieu of the Institute for Trend Research (ITR) at our Steel Summit Conference suggest 2016 will be a better year than 2015.

The question then becomes, when will this pessimistic cycle break and when will we begin to see demand move to the upside?