Distributors/Service Centers

October 13, 2015

Service Centers Move Closer to Capitulation

Written by John Packard

SMU watches service center spot flat rolled steel prices to their end user customers very closely. As markets ebb and flow we have found that steel service centers reach a point of “capitulation,” which is seen as a point when distributors will support a change in the market environment – including accepting mill price increases.

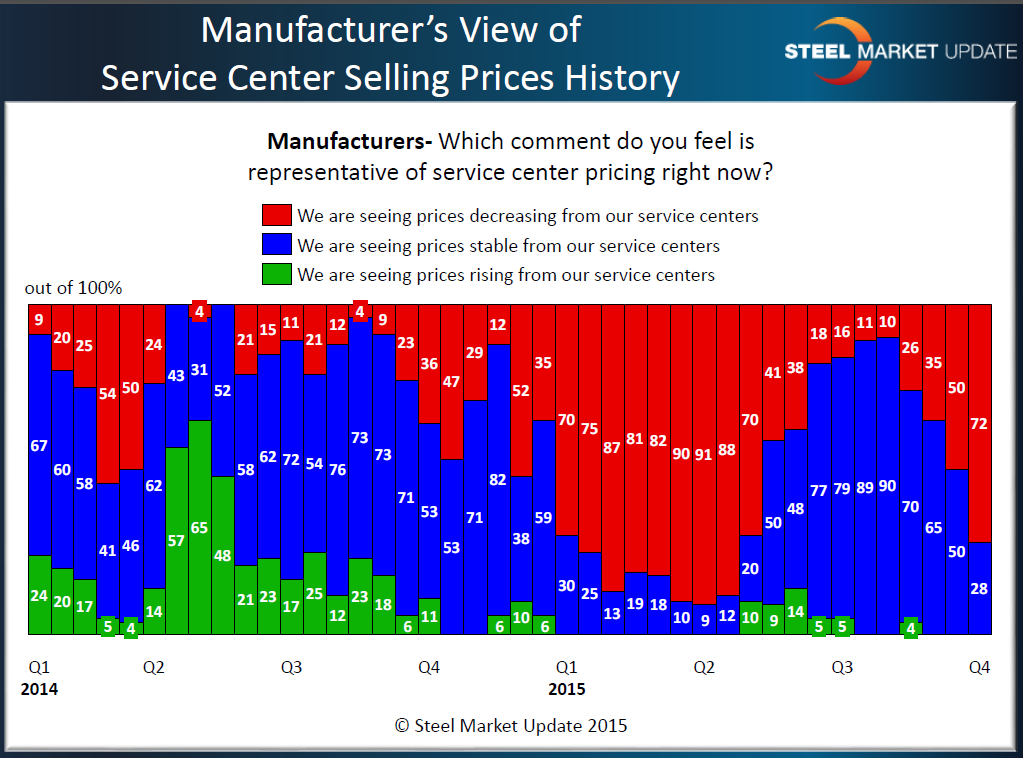

During our most recent flat rolled steel market analysis, 72 percent of the manufacturing companies responding to our query reported service center spot prices as decreasing. As you can see by the graphic below, the manufacturing companies have been reporting big changes in distributor spot pricing over the past two months. The 72 percent reported this past week is 22 percentage points higher than what we measured during the middle of September and more than twice the level reported at the beginning of September.

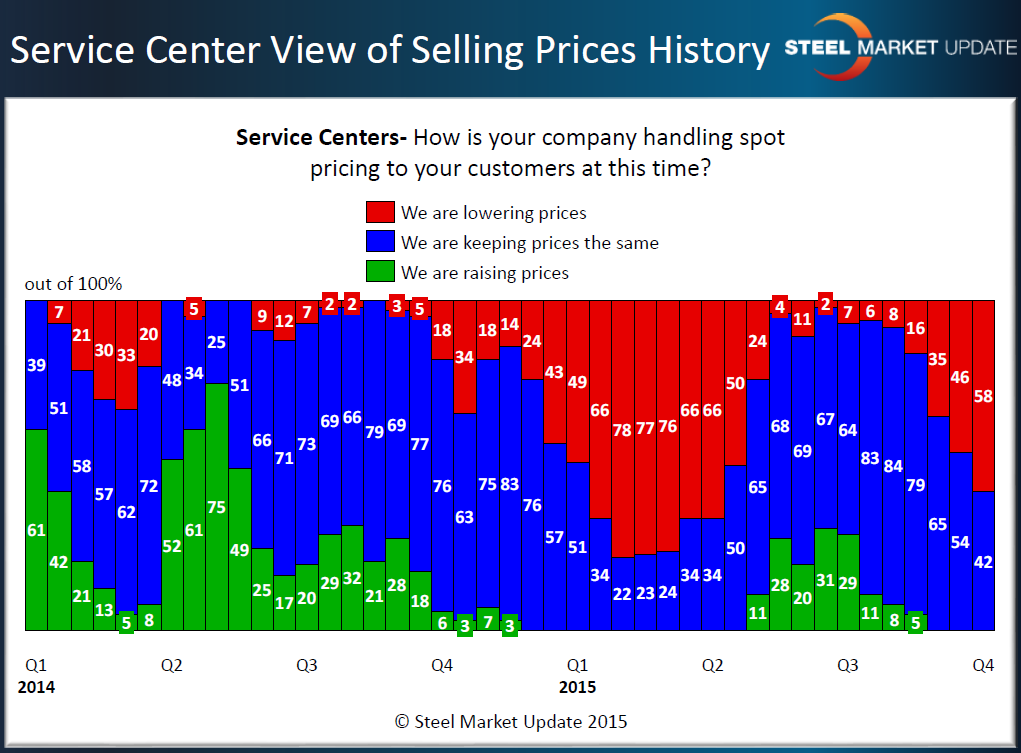

Manufacturing companies are not the only ones recognizing the changes occurring in the flat rolled spot markets; distributors themselves are reporting (albeit in smaller movements) spot pricing as being in decline. This past week 58 percent of the service centers reported that their company was dropping spot flat rolled pricing to their customers. This represents a 12 percentage point change from the middle of September and is 23 percentage points higher than what was reported at the beginning of September.

SMU considers 75 percent or greater of the service centers reporting that their company is reducing spot pricing as the point of “capitulation.”

Capitulation comes with a fair amount of pessimism found within the service center ranks and an increase in the percentage of distributors advising SMU that their company is reducing inventories. We found 55 percent of our respondents reporting their company as lowering inventories compared to only 20 percent during our mid-July 2015 analysis of service center spot pricing. (All of this data is available to our Premium level members in our Power Point presentations of each flat rolled steel market analysis conducted by SMU).

We will continue to monitor the percentages to see if the distributors get to a point at which they have no choice but to support pricing changes at the domestic mills. Most of the market participants believe this is still a number of weeks away (subject to adjustment should USS or AM lockout the USW). We want to remind our readers that November 2nd is the Preliminary Determination date for CORE (corrosion resistant steels – galvanized and Galvalume) and this could be the trigger for the mills to make a move…