Market Data

October 8, 2015

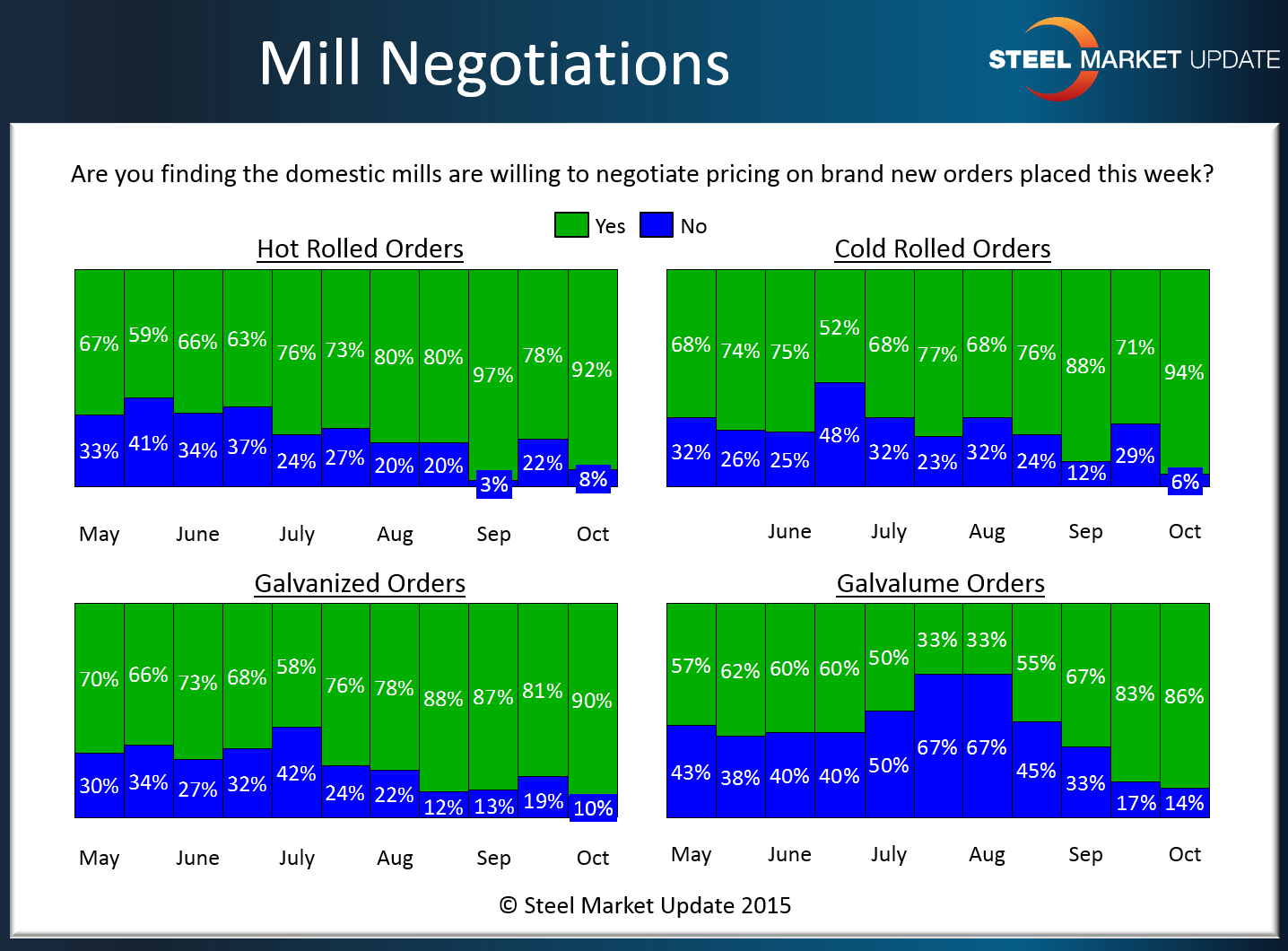

Steel Mill Negotiations: Working to Get Those Orders

Written by John Packard

With the short lead times (referenced in another article in tonight’s issue) the mills have little choice but to negotiate pricing with their customers as every order counts. Each of the flat rolled products followed by Steel Market Update are being reported, almost unanimously, that the mills are working with their customers. The graphic below says it all…

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.