Prices

October 8, 2015

Hot Rolled Futures: $400/ton Still Key Support for HRC

Written by Spencer Johnson

The following article is written by Spencer Johnson of FC Stone LLC. With six years of experience, Spencer provides his customers strategic and tactical advice on protecting themselves against commodity price volatility in the steel markets. Spencer will rotate weekly futures articles with Andre Marshall of Crunch Risk, LLC. Spencer can be reached at spencer.johnson@intlfcstone.com.

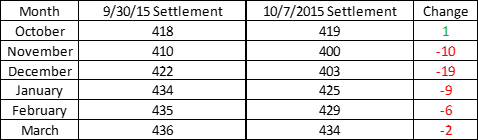

Last week’s headline was aimed at bringing attention to the possibility that HRC prices could very well breach another important psychological level this winter at $400/ton. This week we can report some trades done for Nov/Dec at exactly that $400/ton level, but so far nothing trading below that, at least not yet. Here is how it looks compared to a week ago:

So yes, the market is still under pressure, but it isn’t exactly in free-fall as it had been in the last few weeks. Admittedly, we are looking for any sign at this point that the market could offer some support given that November’s last settlement is barely more than $25/ton above the all-time contract lows set in June of 2009 ($372/ton was the all-time lowest settlement for the contract on a spot month continuous basis according to my data).

Basis the latest index prints, all signs are pointing to more pain through 2015 before we see any rebound, although a few new fundamental updates could change that, more on those below. Regardless of the headlines however, overall trade volumes seem to have stagnated now that the market has moved into a nearby backwardation. The strange thing in our mind is that we haven’t seen MORE buying interest at these levels near $400 on Nov/Dec. This is likely credited to the fact that in the midst of a nine-month slide in price, everyone is wary of pulling the trigger too soon.

The fundamental updates we mention above make up a slate of conflicting news items breaking over the last week or so which has kept market’s guessing as to where things will go from here. This likely adds to the rationale for the volume drop-off. The first item on this list is the UAW strike action against Fiat-Chrysler. News broke early this week that the UAW would reject the existing agreement and was threatening to strike if certain key concessions were not made. That kept markets on edge until last night, when we heard that the automaker had reached a “tentative” agreement with the union that would prevent any work stoppage. The key here was the word tentative, but for now the market doesn’t seem to be effected too dramatically.

So if the UAW strike was the most bearish potential event we learned about this week (given that automotive remains the last bright spot for demand), then the likely idling of USS’ Granite City steel operations would be the most bullish. The steelmaker has issued WARN notices to 2,000 employees at the facility and claims it is looking to do what is necessary to reorganize domestic steelmaking operations. There is no guarantee the mill will indeed be idled (we had a false alarm on this once already this year) but given pricing and the fact that the Granite City operations were a key supplier of the now idled Lonestar Tubular operations, it does seem likely that the facility could temporarily shut down. The market has not been quick to react however, as we will likely need something more concrete before we start pricing in the implications of those tons being out of production as we go into the next year.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

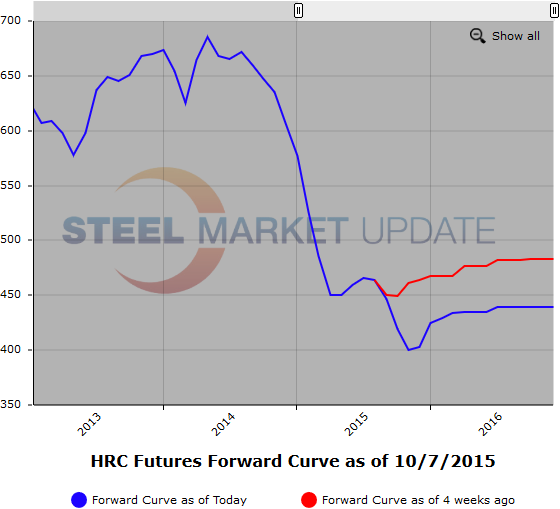

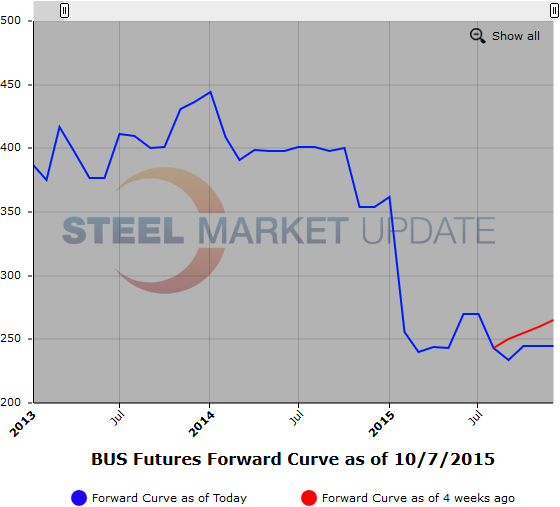

Below are two graphics of the HRC and BUS Futures Forward Curve. The interactive capabilities of the graphs can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.