Prices

October 7, 2015

SMU Price Ranges & Indices: Mixed Results

Written by John Packard

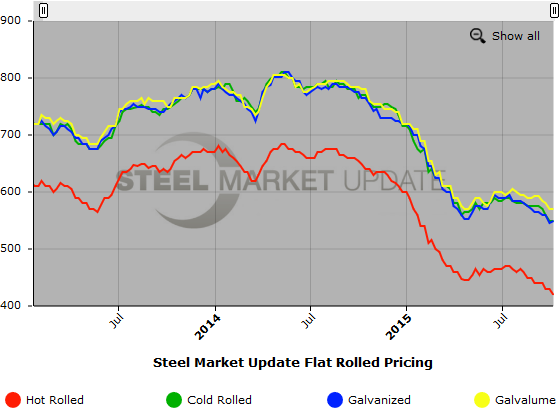

Flat rolled steel prices were mixed over this past week based on data reported in our survey as well as the channel checks we were able to make during these past two hectic days. We are aware of offers on hot rolled under $400 per ton but we have not reported the numbers as readily available. We believe hot rolled will continue to weaken – especially with reports that scrap will drop $50 per gross ton for October and the threat of lower billet offers to Turkey once the Chinese return from holiday (which could weaken prices further in the coming weeks).

We are very concerned that an automotive strike at Chrysler will put more pressure on the integrated mills to move tons into the spot market should the strike last for more than a week or two.

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $400-$440 per ton ($20.00/cwt- $22.00/cwt) with an average of $420 per ton ($21.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $10 per ton compared to our last published prices. Our overall average is down $10 per ton compared to one week ago. SMU price momentum for hot rolled steel has prices moving lower.

Hot Rolled Lead Times: 2-4 weeks.

Cold Rolled Coil: SMU Range is $520-$580 per ton ($26.00/cwt- $29.00/cwt) with an average of $550 per ton ($27.75/cwt) FOB mill, east of the Rockies. Both the upper and lower ends of our range remained the same as one week ago. Our overall average is also the same as what we reported last week. SMU price momentum for cold rolled steel is for prices to slip over the next 30 days. We expect the high end of our range show weakness pushing our average lower in the coming weeks.

Cold Rolled Lead Times: 4-7 weeks.

Galvanized Coil: SMU Base Price Range is $26.50/cwt-$28.50/cwt ($530-$570 per ton) with an average of $27.50/cwt ($550 per ton) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week while the upper end remained the same. Our overall average is up $5 over one week ago. Our price momentum on galvanized steel is for prices to move lower – especially when taking Nucor’s and Wheeling Nisshin move to adjust their coating extras in light of the lower zinc costs. We expect the rest of the steel mills to follow suit over the next couple of weeks.

Galvanized .060” G90 Benchmark: SMU Range is $599-$639 per net ton with an average of $619 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3-7 weeks.

Galvalume Coil: SMU Base Price Range is $28.00/cwt-$29.00/cwt ($560-$580 per ton) with an average of $28.50/cwt ($570 per ton) FOB mill, east of the Rockies. The lower end of our range rose $10 per ton compared to week ago while the upper end declined $10 per ton. Our overall average is unchanged compared to last week. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards Lower prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $851-$871 per net ton with an average of $861 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-7 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.