Prices

October 4, 2015

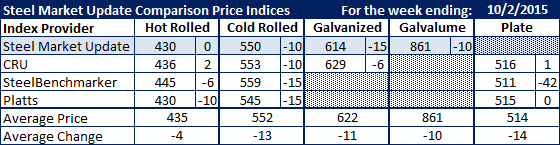

Comparison Price Indices: Weakness Continues

Written by John Packard

According to the various flat rolled steel indexes followed by Steel Market Update, hot rolled, cold rolled, galvanized, Galvalume and plate prices continue to be weak this past week.

Benchmark hot rolled was the most stable with all four indexes reporting last week. SMU and Platts were showing the HRC average as being $430 per ton while CRU moved up $2 to $436 and SteelBenchmarker came out at $445 (SteelBenchmarker only reports prices twice per month). The average of SMU, CRU and Platts was $432 per ton this past week.

Cold rolled dropped the most with all four indexes moving lower by double digits. Platts and SteelBenchmarker were down $15 per ton with CRU and SMUdown $10.

Galvanized also saw prices fall with SMU down $15 and CRU down $6 while Galvalume prices were down $10 per ton.

Plate prices remained close to the levels being reported by CRU and Platts for a number of weeks. Steel Benchmarker made a large move down $42 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.