Prices

October 1, 2015

Hot Rolled Futures: Will HRC Prices test the $400/ton Level?

Written by Spencer Johnson

The following article is written by Spencer Johnson of FC Stone LLC. With six years of experience, Spencer provides his customers strategic and tactical advice on protecting themselves against commodity price volatility in the steel markets. Spencer will rotate weekly futures articles with Andre Marshall of Crunch Risk, LLC. Spencer can be reached at spencer.johnson@intlfcstone.com.

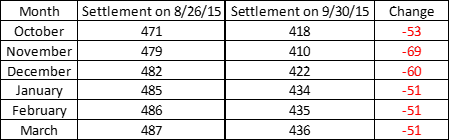

This is yet another headline to which we might prefer to reply with another resounding “No!”, but the facts can’t be changed and the reality is that recent trades for November futures put us very much within striking distance of a $400/ton level on HRC forward months. As usual we will compare the most recent settlement price for futures with where they settled when we wrote our last piece.Here is how it looks:

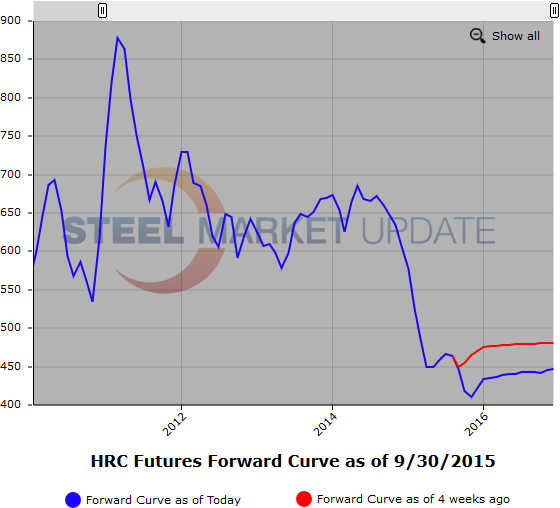

There is nothing we could write here that would explain more clearly what is happening in the HRC market than the chart above. A month ago there was an optimistic outlook for pricing that saw trade case filings likely creating supply tightness and thus justifying a premium for future months relative to the spot price. Not only has that premium (“contango” is the preferred nomenclature for the futures world) been erased, we have moved into a steep backwardation where future months are now trading at considerable discount to spot price index assessments.

Some would suggest this is, at least in part, because those indices seem to be lagging the true declines in the spot market. That is very likely, but we see more to this backwardation than just a lag effect on the index level. The key might be scrap prices, which have seen a slew of extremely bearish news headlines ranging from predictions of further price collapse to the chapter 11 filings of more cash strapped recycling companies. In our mind, never at any point in recent history has the ferrous scrap market been in more dire need of a way to hedge inventories, as yards have very few good choices about how to manage those inventories in the midst of this year’s near constant slide lower.

That lack of hedging opportunity has put yards in a situation where they can either sell into the declining market, or continue to stack inventory in the hopes of a rebound. Any yards who have operated with the “stack and hope” strategy this year are feeling an incredible pinch, as pricing has not shown any signs of a rebound. Mills were heard to be cancelling several orders in the week leading up to month-end, leaving some dealers to scramble to find a new home for metal.

This situation is echoed in the steel service center world, where some players seem to have reloaded inventory with the belief that prices were bouncing along the bottom, only to see more substantial declines than anyone could have anticipated. The result is an abundance of metal without any home and the price result has played out predictably given those circumstances. So is there anything on the horizon that would make us optimistic? Not much, it would seem as though the impasse between unions and USS/ArcelorMittal is not stopping negotiations from continuing, and it would then appear that all parties involve know the consequences of a stoppage in the midst of these market conditions could be unacceptably painful.

More long-term, we should start to see more of the key dates for the trade case filings and, of course, with buying prices what they are at scrap yards this week, we should expect a dramatic decline in flows. How long those phenomena take to impact the finished steel price is unclear, but forward months are, at least at this point, not showing much of anything in the way of expected upside.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

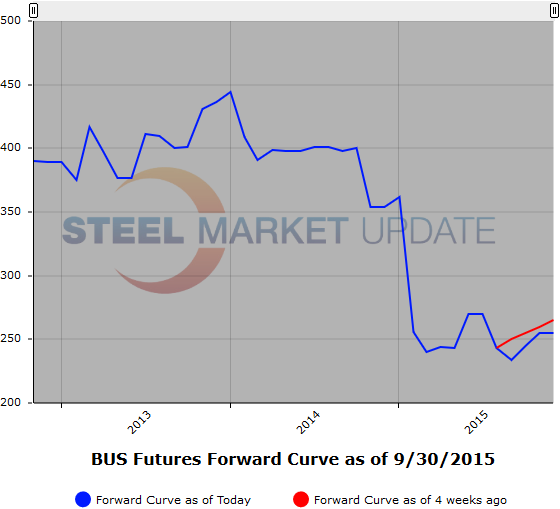

Below are two graphics of the HRC and BUS Futures Forward Curve. The interactive capabilities of the graphs can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.