Market Data

September 30, 2015

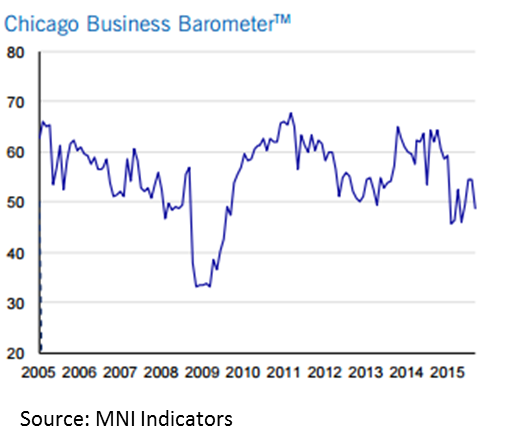

Chicago PMI Drops Unexpectedly in September

Written by Sandy Williams

The Chicago Business Barometer, or Chicago PMI as it is more commonly known, surprised economists by dropping 5.7 points to 48.7 in September The decline follows two months of expansion and the speed of descent is a cause for concern said MNI Indicators.

The production index plummeted by double digits to its lowest level since July 2009 pushing the headline PMI into negative territory. New orders dropped significantly and manufacturer backlogs remained in contraction indicating business are working below capacity.

“While activity between Q2 and Q3 actually picked up, the scale of the downturn in September following the recent global financial fallout is concerning,” said MNI Indicators Chief Economist Philip Uglow. “Disinflationary pressures intensified and output was down very sharply. We await the October data to better judge whether this was a knee jerk reaction and there is a bounceback, or whether it represents a more fundamental slowdown.

Of the five components of the barometer, only supplier deliveries and employment remained in expansion in September. Supplier deliveries were unchanged from August. Employment levels rose for the third month in a row but MNI says most survey respondents reported no change in staffing levels.

Prices paid fell to their lowest level since July 2009, impacted by global pressure on crude oil and commodity prices.

The MNI Chicago Business Barometer, a closely watched leading indicator of U.S. economic activity, is published by MNI Indicators and is based on a survey panel of purchasing/supply chain professionals, primarily drawn from membership of the Institute for Supply Management-Chicago (ISM-Chicago). The Chicago Business Barometer is a composite diffusion indicator made up of the Production, New Orders, Order Backlogs, Employment and Supplier Deliveries indicators and is designed to predict future changes in gross domestic product (GDP). An indicator reading above 50 indicates expansion compared with a month earlier while below 50 indicates contraction.