Prices

September 29, 2015

Service Center Spot Prices Continue to be Under Pressure

Written by John Packard

Both manufacturing companies and flat rolled steel service centers reported the percentage of distributors offering lower spot pricing on flat rolled steels as growing. This is a key indicator followed by Steel Market Update (and no other publication) as falling spot prices out of the distributors are usually due to high inventories leading to competitive pricing pressures between distributors as they attempt to move excess items. This is also a sign of weakness at the mill level, as distributors are able to replace tons sold with less expensive steel.

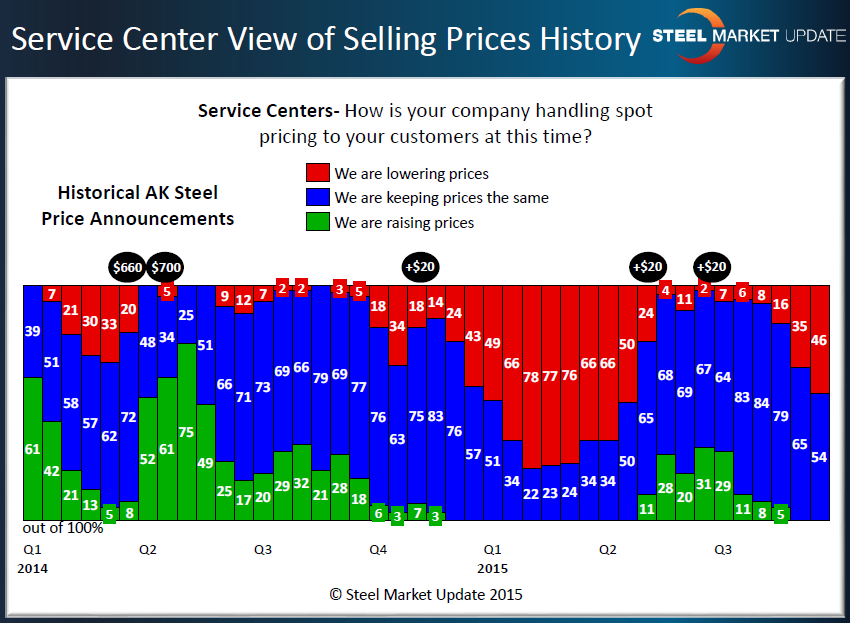

As market prices continue to weaken, the percentage of service centers dumping high priced inventories grows until we hit a point of “capitulation,” which we have pegged at approximately 75 percent of distributors reporting their spot prices as being lowered. At this point, we traditionally have seen the domestic mills able to raise prices as the service centers realize they cannot continue to drop prices and survive and, therefore, begin supporting the move for higher prices.

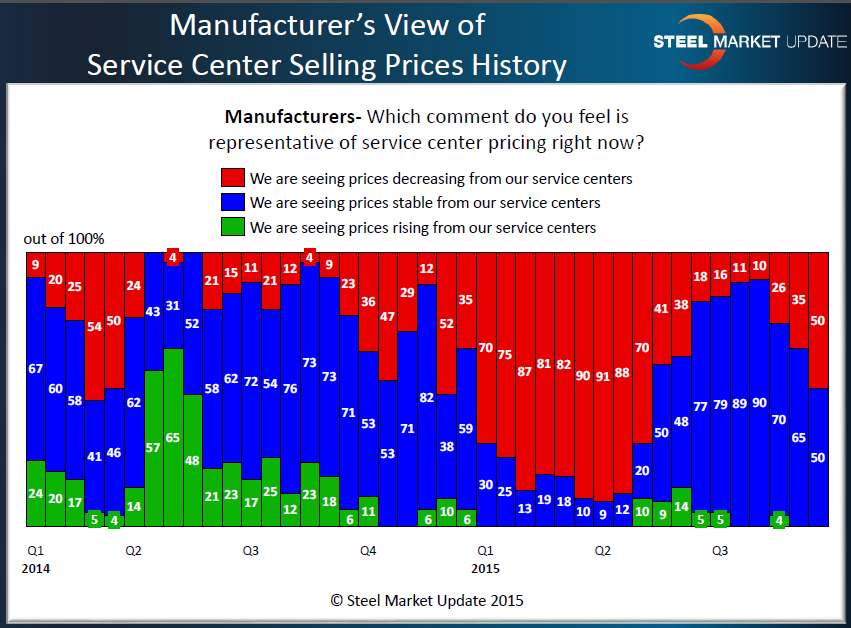

Fifty percent of manufacturing companies who responded to last week’s questionnaire reported distributors as lowering spot prices. No manufacturers reported spot prices as increasing from any service centers. The trend for the past two months is for a growing percentage of service centers to find that they must drop prices in order to compete or to eliminate excessive inventories.

As you can see by the graphic below, we saw the highest percentage of manufacturing companies ever reporting service centers as dropping prices back in 1st Quarter 2015 and into early 2nd Quarter. The domestic mills were able to briefly raise prices at that point, stabilizing the markets for a couple of months.

However, we use the results of the service centers themselves to gauge at what point they reach “capitulation”.

Last week 46 percent of the service centers reported their company was lowering spot prices to their customers. Very much like the manufacturers shown in the graphic above, the service center spot price has been trending toward lower prices.

SMU expects this trend to continue until we reach the point of capitulation (and, as you can see by the graphic below, depending on how badly over-inventoried the distributors are, they can remain at 75 percent levels for some time before they are able to support higher mill prices). The black ovals above the red bars represent AK Steel price increase announcements – remember that AK Steel is not always the leader and others may announce increases one to three weeks prior to AK.