Prices

September 29, 2015

Nucor First to Reduce Galvanized Coating Extras

Written by John Packard

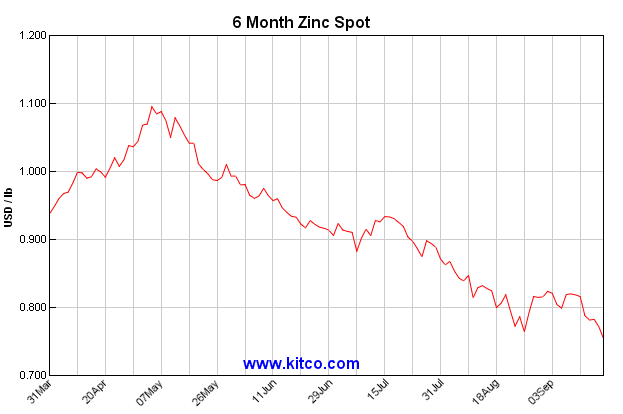

After zinc spot pricing peaked in May of this year at $1.10 per pound, it has been steadily moving lower, closing at $0.7363 per pound at the end of trading on Monday, September 28th. Steel Market Update has been writing about the drop in spot LME zinc (as well as aluminum which impacts Galvalume, Aluminized and Galfan pricing) advising that it was only a matter of time before the domestic mills would adjust their extras. We anticipate other mills may follow the Nucor lead although the end result may be slightly different extras.

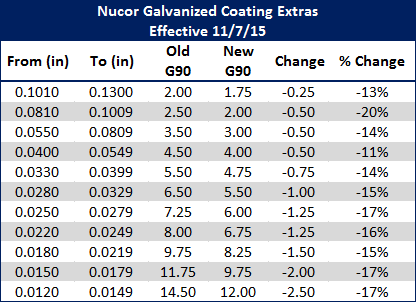

Nucor, recognizing the changes in the value of zinc (and thus their reduced costs to coat galvanized steel), sent out a letter to their customers on Monday advising that they were adjusting their coating extras effective with orders acknowledged to ship the week ending November 7, 2015 (the first week of November).

Steel Market Update did a quick analysis of the differences in the coating costs on G90 product based on the old and new Nucor coating extras. As you can see from the table below the new extras run $0.25/cwt on .101” to .130” at the heavy end of the scale to $2.50/cwt on .012” to .0149”.

We have both the old and new Nucor extras posted on our website and they can be access by clicking on this link.

It will be interesting to see what the other mills do in reaction to the Nucor announcement. Many mills follow the U.S. Steel lead when it comes to coating extras so they are (at this moment) the mill to watch.

The next question will be regarding Galvalume as not only has zinc tanked, aluminum has as well…