Market Data

September 27, 2015

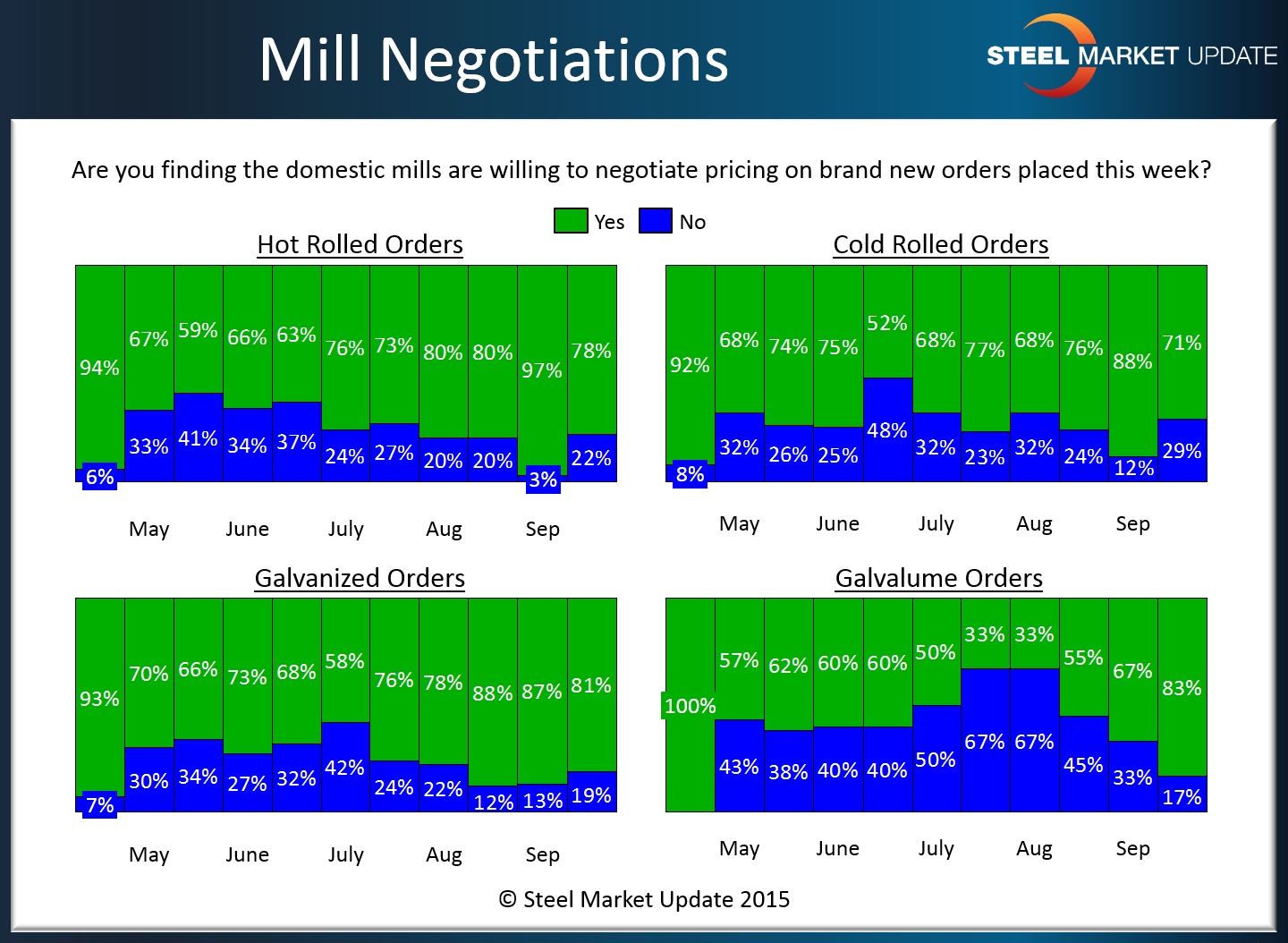

Steel Mills Continue to Negotiate Flat Rolled Steel Spot Pricing

Written by John Packard

According to the respondents to our recent flat rolled steel questionnaire concluded this past week, U.S. and Canadian steel mills continue to entertain adjusting (or negotiating) prices on hot rolled, cold rolled, galvanized and Galvalume steels.

The percentage of respondents who reported hot rolled pricing as negotiable dropped from 97 percent to 78 percent. Cold rolled dropped from 88 percent to 71 percent. Galvanized dropped from 87 percent to 81 percent while Galvalume increased from 67 percent to 83 percent.

Bottom line, the mills are willing to talk about pricing on virtually any product.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.