Market Data

September 27, 2015

Steel Mill Lead Times: Weaker than Last Year

Written by John Packard

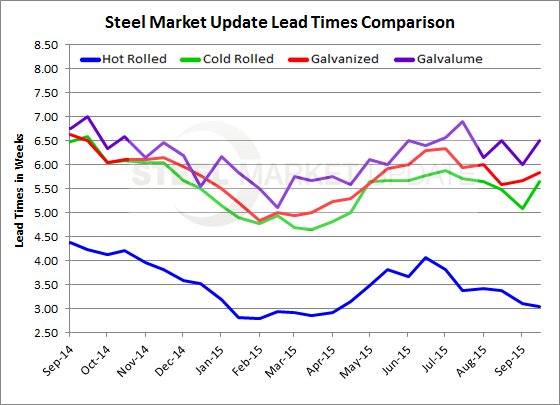

Over the course of this past week Steel Market Update (SMU) conducted our flat rolled steel market analysis. Part of that analysis was focused on the domestic steel mill lead times for new orders placed last week for future delivery. We follow lead times as they are one of the early key indicators as to changes in mill order books which are then translated to their lead times.

At first glance at last week’s result, what we found is hot rolled lead times continue to be short and are not making any headway. Cold rolled and galvanized lead times continue to be about one week shorter than what we saw one year ago. Galvalume is now being reported as being one half a week shorter than this time last year.

Here is where we see lead times averaging this past week and how they compare to the past year.

To see an interactive history of our Steel Mill Lead Time data, visit our website here.