Prices

September 27, 2015

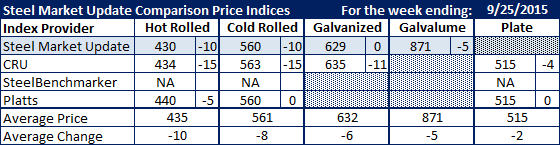

Comparison Price Indices: CRU Plays Catch Up

Written by John Packard

Last week three of the four steel indices followed by Steel Market Update reported flat rolled steel price averages for the week. We saw large double digit declines in the CRU on hot rolled, cold rolled and galvanized while Platts only saw movement in hot rolled. Steel Market Update captured declines in hot rolled, cold rolled and Galvalume.

Benchmark hot rolled prices dropped this past week. SMU had the lowest average at $430 per ton followed by CRU at $434 and then Platts at $440 per ton. Combined the average was $435 per ton which is down $12 per ton from the previous week.

Cold rolled saw the tightest spread between the three indexes as SMU and Platts were at $560 per ton and CRU was three dollars higher at $563 per ton. The average for the week as down $13 per ton from the previous week.

Galvanized saw CRU catching up to where Steel Market Update has been for awhile. CRU dropped $15 per ton to $635 per ton for .060” G90 galvanized coil. SMU remain unchanged at $629 per ton.

SMU dropped Galvalume pricing by $5 per ton to $871 for .0142” AZ50, Grade 80 product.

Plate prices matched up last week as CRU dropped their average by $4 per ton to $515 per ton and Platts remained the same at $515 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.