Market Data

September 24, 2015

SMU Steel Buyers Sentiment Index Less Optimistic and Trending Lower

Written by John Packard

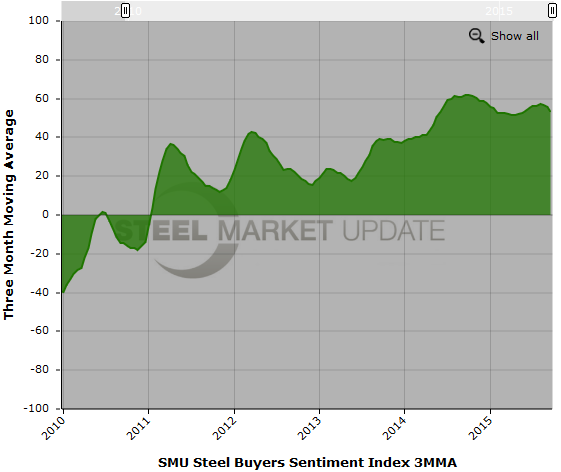

Flat rolled steel buyers and sellers are less enthusiastic about their company’s ability to be successful in both the current and future (three to six months into the future) market conditions. The SMU Steel Buyers Sentiment Index (Current) is being reported as +47, down 6 points over one month ago and well below the +64 reported last year at this time.

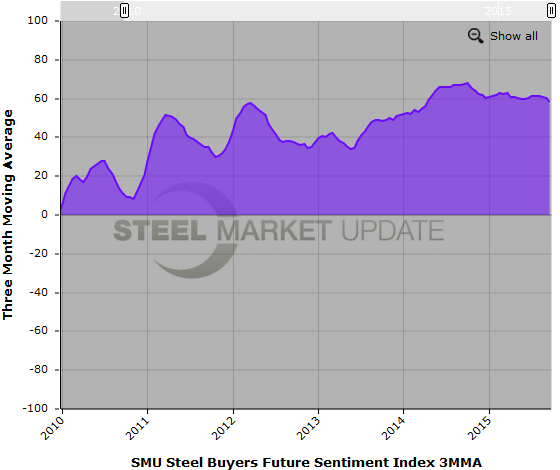

Future Steel Buyers Sentiment Index is being reported as +54, down 4 points over one month ago and 11 points less than what we reported one year ago.

Based on what we have been hearing from the flat rolled steel market participants, slowing demand for flat rolled steel products in the North American markets, higher than expected inventories and tighter margins are impacting Sentiment. Scrap is poised to make another large scale drop in pricing and the added pressure this will bring to flat rolled prices has tempered how comfortable buyers and sellers of steel are regarding business conditions.

When looking at both our Current and Future Indices from a 3-month moving average (3MMA,) we are finding a less optimistic trend has been developing – especially with our Future Sentiment Index where our average is being reported at +58.50 this week, down 2 points from one month ago. However, the last time we saw Future Sentiment 3MMA this low was back in April 2014 (+56.33) when the domestic steel mills where fighting through ice on the Great Lakes and there were equipment problems at a couple of domestic mills.

Our Current Sentiment 3MMA is now +53.33 which is down 3.5 points from one month ago and 8.5 points lower than mid-September 2014.

Our Current Sentiment 3MMA is now +53.33 which is down 3.5 points from one month ago and 8.5 points lower than mid-September 2014.

What Our Respondents are Saying

“Steady, but slower than expected.” Manufacturing company. They went on to say, “We have prices up a bit, even with slower pace we should hit profit plan.”

“September so far has been steady, although slightly weaker than we forecasted.” Manufacturing company

“Weakening.” Service center

“We are approaching the seasonally slow period which negatively impacts our business.” Service center

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 48 percent were manufacturing and 38 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.