Analysis

September 22, 2015

US Vehicle Sales and NAFTA Vehicle Production in August 2015

Written by Peter Wright

In August, vehicle sales reached a new recovery high of 17.8 million units on a seasonally adjusted annualized basis. This was the highest pace since July 2005, when incentives caused sales to surge. The August sales figure was particularly driven by light trucks which increased from 9.7 to 10.1 million units annualized. Autos fell from 7.8 to 7.7 million. The light truck share at 57 percent was the highest in 10 years.

So far this year, the sales pace average is 17.1 million units and it is likely that 2015 will have the best pace since 2001. Pent-up demand for vehicles is being quickly absorbed and the decline in gasoline prices is encouraging consumers to jump in. The Ford F series has maintained its #1 spot in spite of reservations about the F150 aluminum body. Year to date, Ford F series sales through August were 461,491 units, the Chevy Silverado was 387,179 units and the Dodge Ram was 284,956 units. The only car to make it into the top four was the Toyota Camry with 291,843 units.

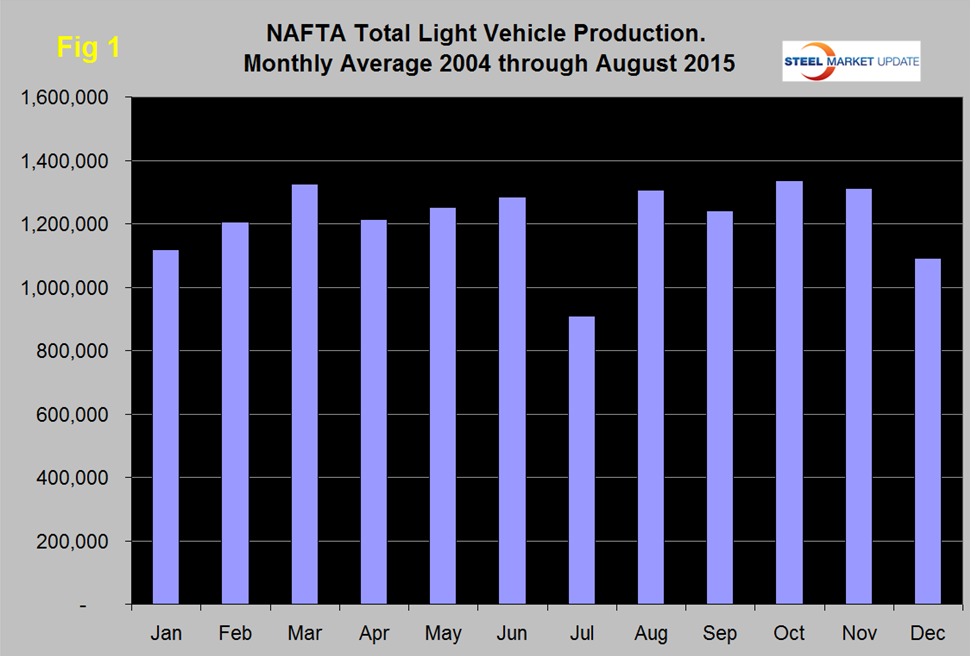

Total light vehicle (LV) production in NAFTA in August was at an annual rate of 18.042 million units, up from 15.557 in July but down from 18.543 in June. On average since 2004, August’s production has been 43.6 percent higher than July due to a return from summer tooling and maintenance shutdowns. This year some manufacturers curtailed their shutdowns so the July production decline was less than normal. That resulted in the August pick up being less than normal and this year the M/M change was + 15.8 percent (Figure 1).

Note that these production numbers are not seasonally adjusted, the sales data reported above are seasonally adjusted.

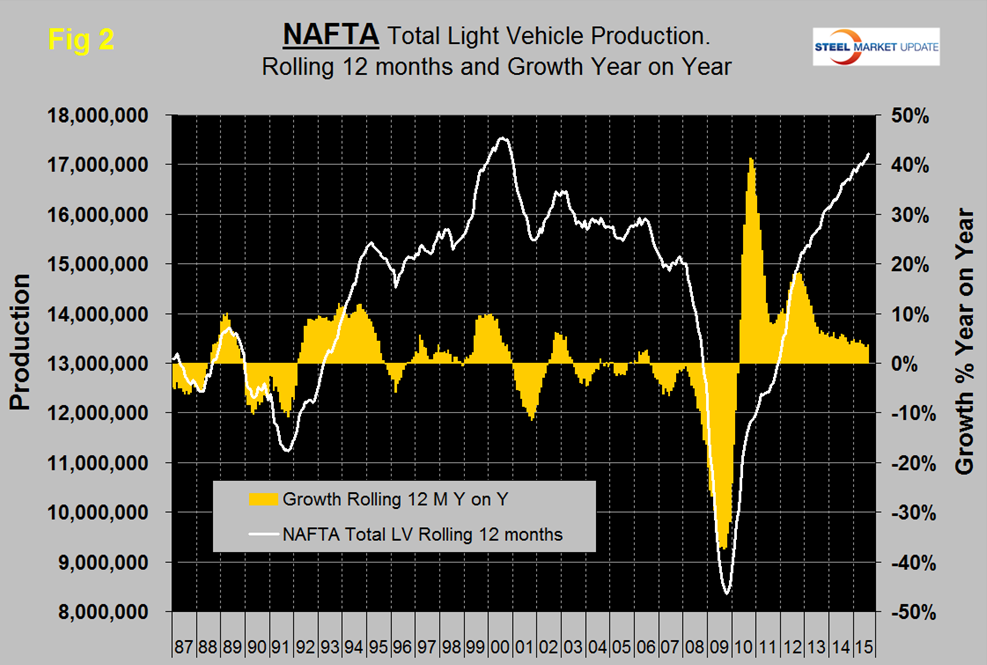

On a rolling 12 months basis y/y LV production in NAFTA increased by 3.7 percent through August. LV production in NAFTA is now well above the pre-recession peak of Q2 2006 and is heading for the all-time high of mid-2000 (Figure 2).

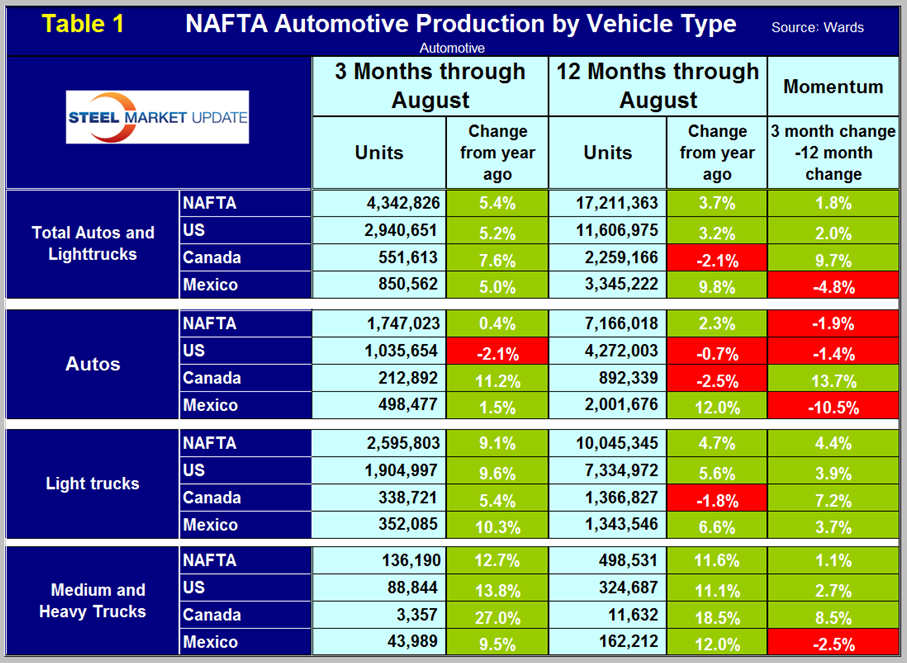

On a rolling 12 months basis y/y the US is up by 3.2 percent, Canada is down by 2.1 percent and Mexico is up by 9.8 percent (Table 1).

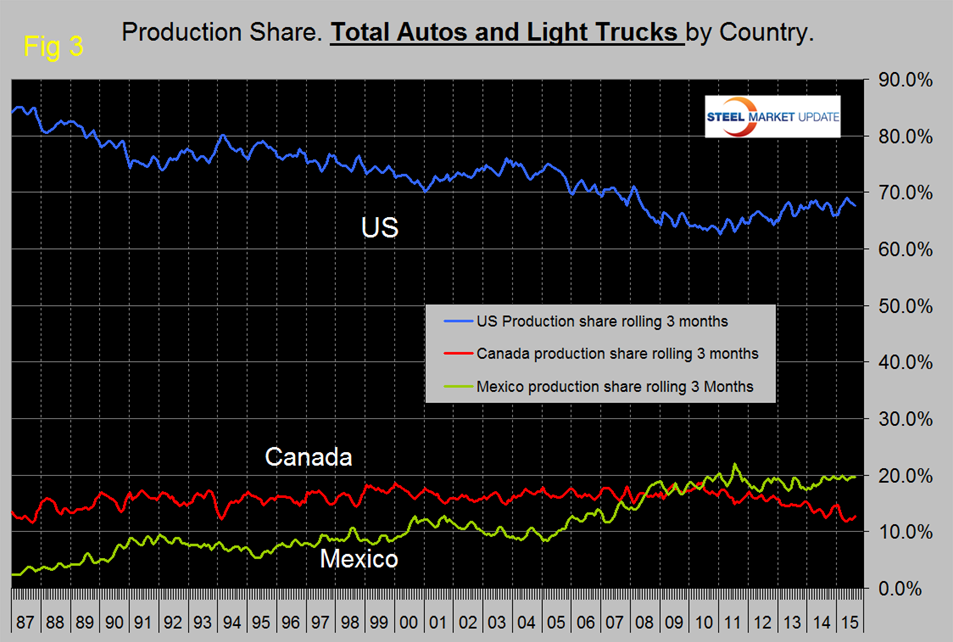

Growth rates in 3 months through August y/y indicate that the US and Canada have positive momentum but that of Mexico is negative. Mexico has had negative momentum for four straight months and in five of the last six months. The US has gained production share in the most recent 3.5 years (Figure 3) and, so far in 2015, that gain has accelerated at the expense of Canada.

Mexico’s share has been fairly flat. A close examination of Canadian and US share this year in Figure 3 shows that they are a mirror image of each other suggesting that the auto companies routinely move production from one side of the border to the other. In August on a rolling three month basis, the US production share of total light vehicles was 67.7 percent, Canada’s was 12.7 percent, and Mexico’s was 19.6 percent.

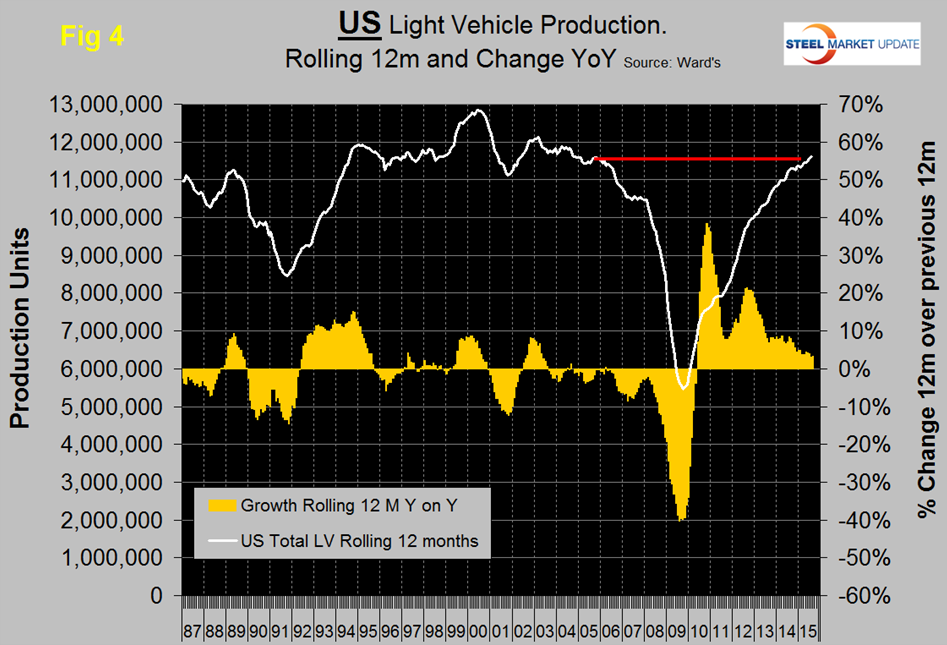

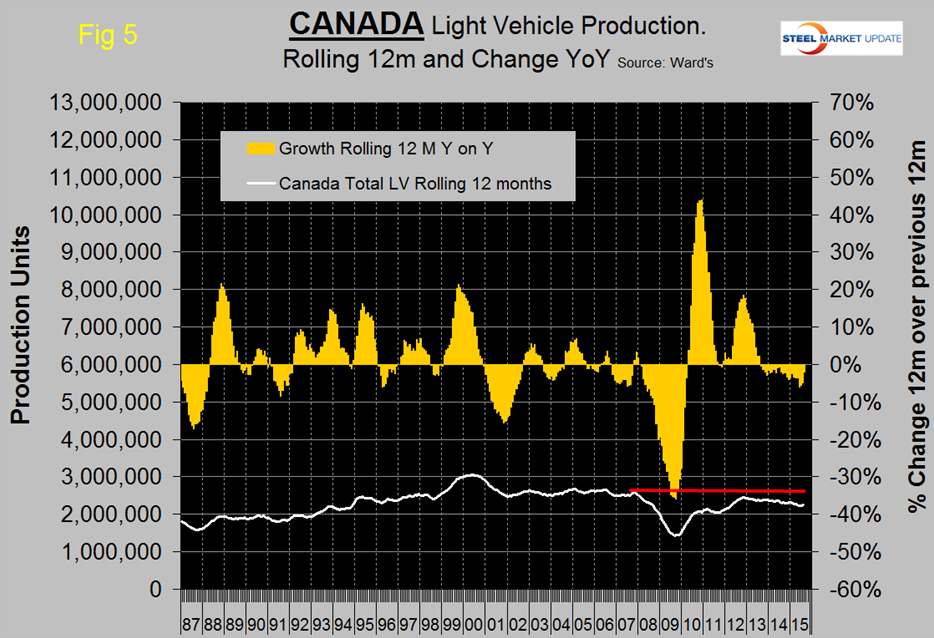

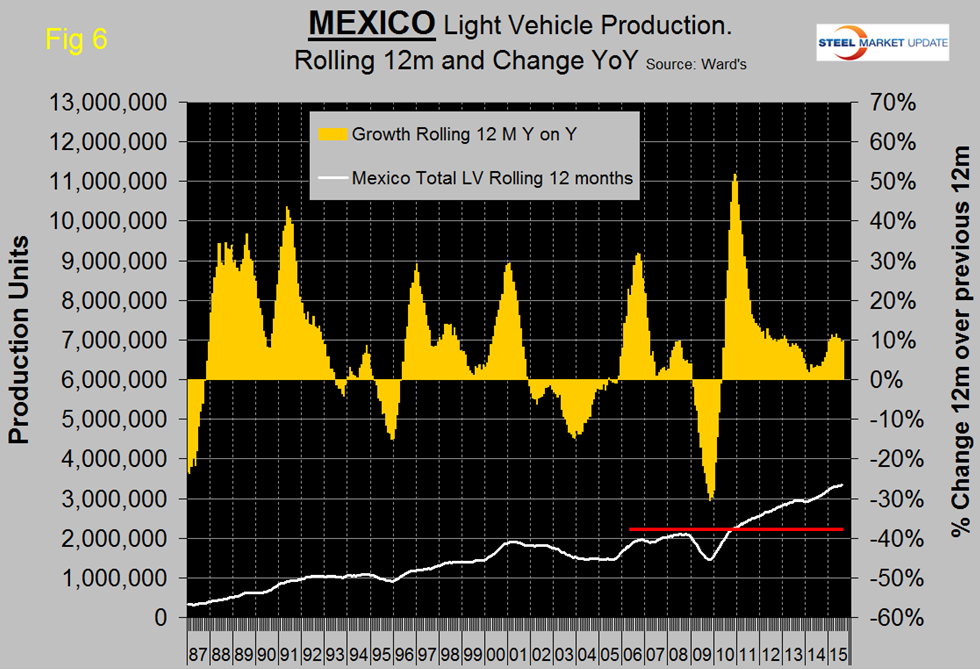

Figure 4, Figure 5 and Figure 6 show total LV production by country with y/y growth rates and on each the red line shows the change in production since Q2 2006.

Note the scales are the same to give true comparability and that Mexican growth is surging at more than twice the rate in the US and Canada continues to contract. In the last two years US growth has slowed and contraction in Canada has accelerated. Mexico experienced a strong growth surge last year but has been stable in the 10 percent range this year. During the recession Mexico declined by less than the US and bounced back by more during the recovery. This caused Mexico’s production share to surge until Mid-2011 at the expense of the US. So far in 2015, Mexico’s growth rate in total LV production has been more than twice that of the US. This has been at the expense of Canada who have had negative growth for over a year.

In the 12 months through September 22nd, compared to the US $ the Canadian $ has depreciated by 17.1 percent and the Mexican Peso by 20.7 percent. These decline must be causing auto assemblers to look at moving production to Mexico in particular. We believe there is spare capacity both sides of both borders for the automotive manufacturers to play this game. This isn’t happening so much in Canada in spite of the depreciation of the Loonie because (in our opinion) the labor relations situation in Canada is causing manufacturers, in general, to reduce their exposure. US steel is a case in point.

The mix of light vehicles is very different by country (Figure 7).

The percentage of autos in the Mexican mix in the last three months was 58.6 percent but only 35.2 in the US and 38.6 percent in Canada. This was the lowest percent of autos in the US mix since September 2011 as buyers preference tilts towards light trucks driven by declining gas prices.

Ward’s Automotive reported last week that total light vehicle inventories in the US decreased by 3 days of sales from 58 at the end of July to 55 at the end of August, and the same as the end of August last year. Month over month FCA (Fiat Chrysler Automotive) was down by 8 days to 74, Ford was down by 3 days to 62 and GM down by 1 days to 63.

The SMU data file contains more detail than be shown here in this condensed report. Readers can obtain copies of additional time based performance results on request if they wish to dig deeper. Available are graphs of auto, light truck and medium and heavy truck production and growth rate and production share by country.