Analysis

September 20, 2015

Housing Starts, Permits and Builder Confidence

Written by Peter Wright

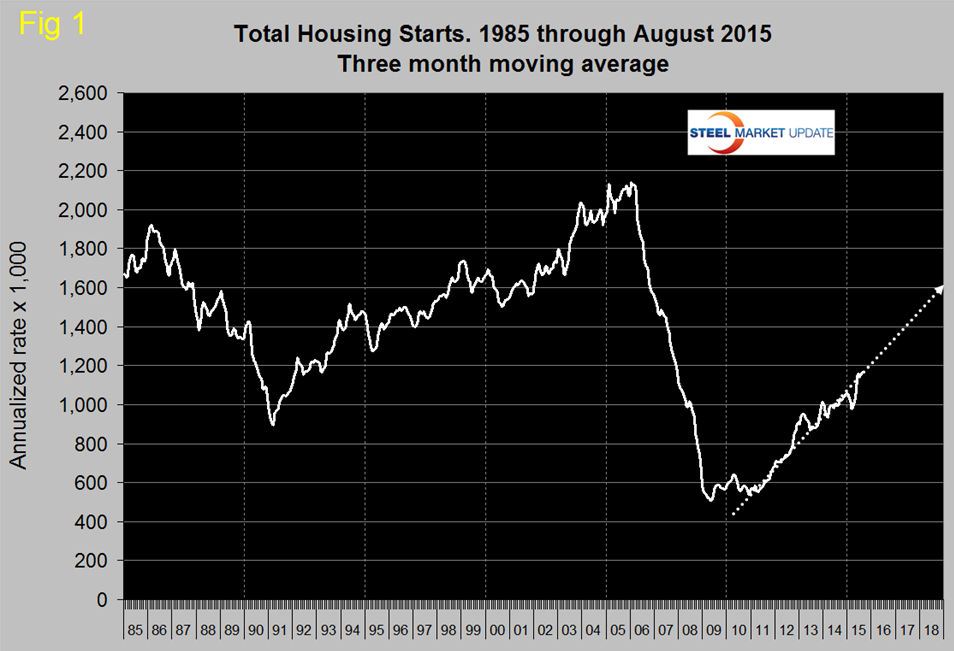

Total housing starts in August were at an annual rate of 1,126,000 which was the third best since October 2007. In August, the three month moving average (3MMA) was 1,166,000 which was the best result since December 2007. Total starts are still on track to reach 1.6 million units annualized by the end of 2018 (Figure 1).

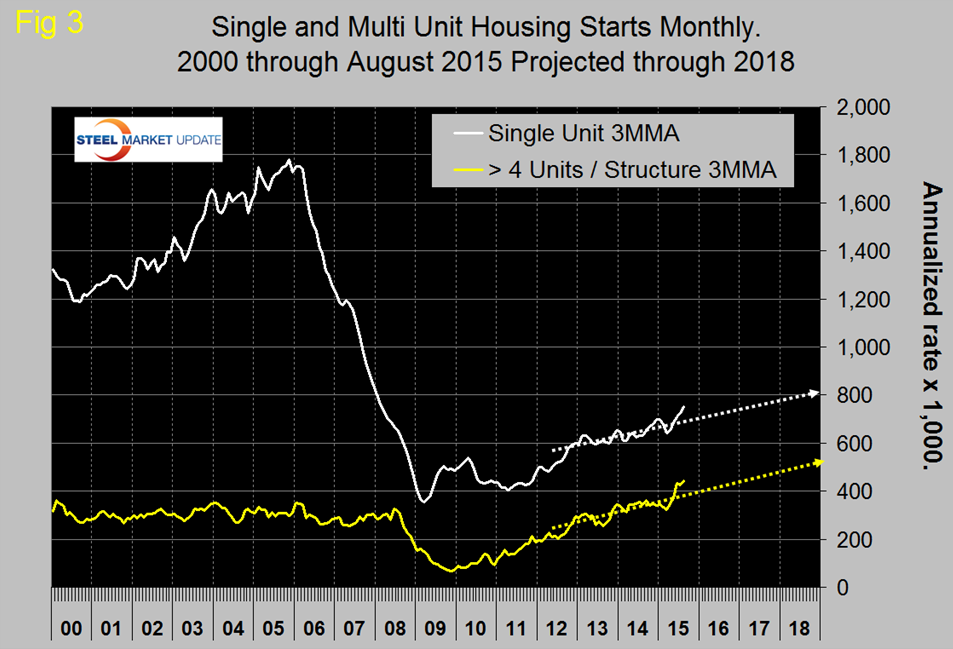

Single family starts in August were at 783,000. The 3MMA was 753,000 and was up by 4.0 percent month over month and up by 19.0 percent year over year but is still 57.0 percent below the peak of late 2005. This was the best y/y growth rate of single family since May 2013.

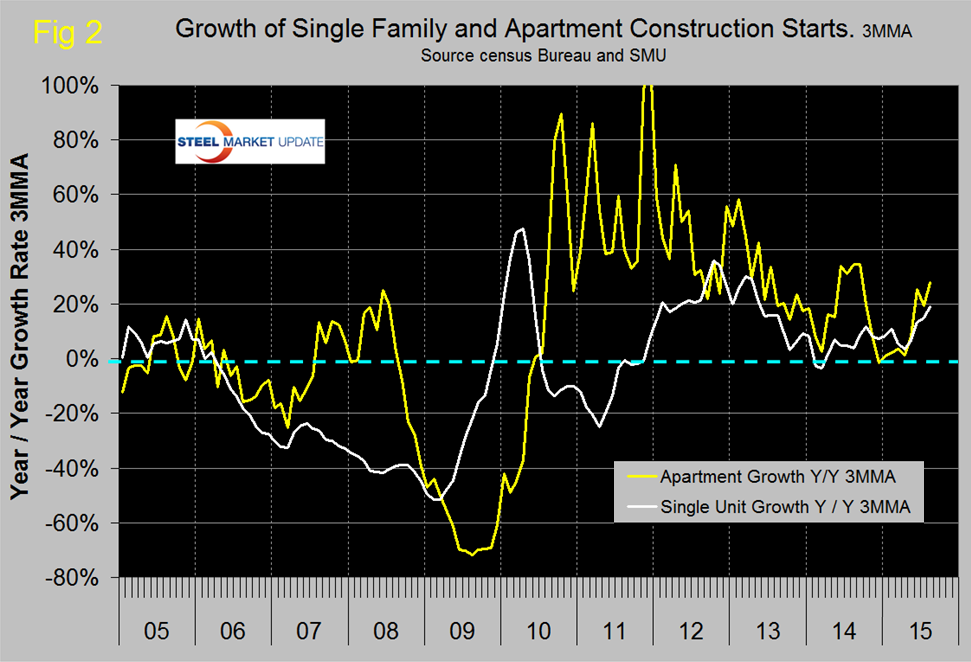

Multifamily (apartments/condominiums) starts in August were 387,000 with a 3MMA of 437. The 3MMA was driven strongly by a freak result in June of 524,000 and will most likely drop significantly in September. The Census Department results are seasonally adjusted and the monthly numbers are annualized. Multifamily starts had lack-luster growth for seven months prior to June but the last three months have returned to the level not seen since October last year, driven strongly by apartment construction in New York (Figure 2).

The trajectory of single family and apartments >4 units are tracking to reach 800,000 and 500,000 by the end of 2018, respectively (Figure 3).

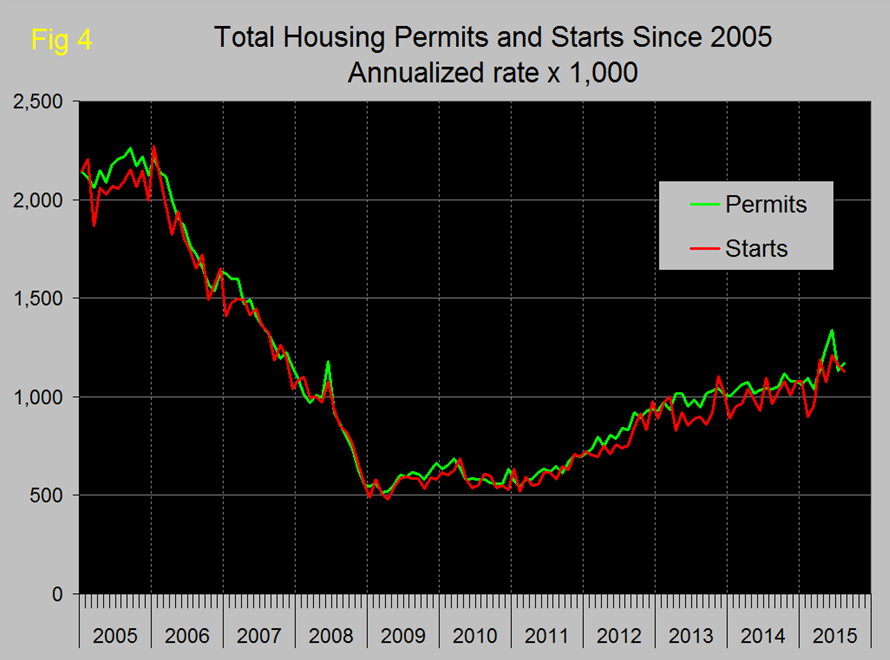

Permit data is useful as a forward look at starts. If permits exceed starts then we anticipate an acceleration in construction and vice versa. Total permits in August were 1,170,000 with a 3MMA of 1,212,000. Permits are back on track with starts after a major divergence in June (Figure 4).

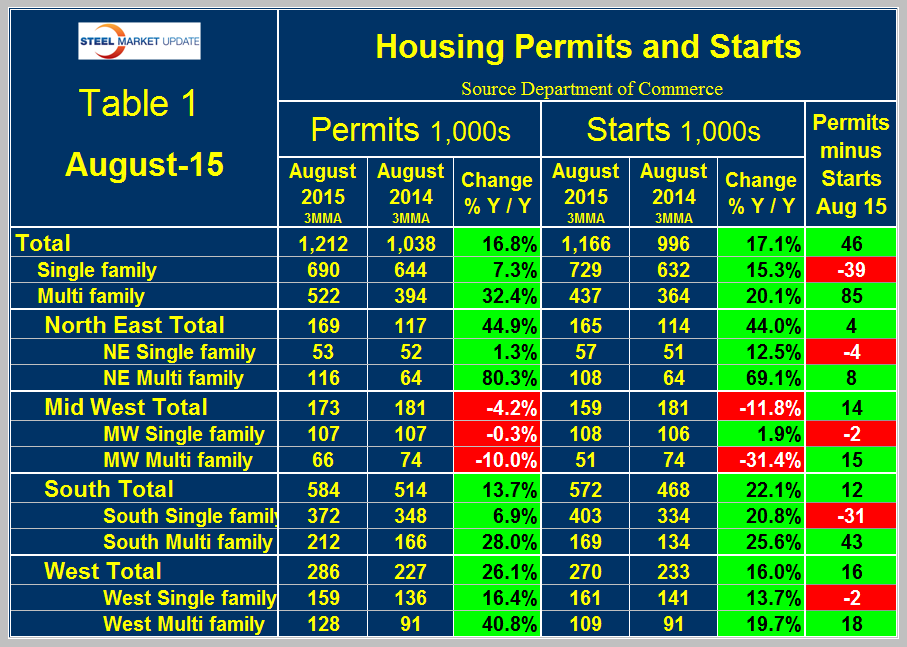

On a 3MMA basis total permits were up by 16.8 percent y/y. Single family were up by 7.3 percent and multifamily by 32.4 percent. Multifamily continued to be strongly influenced by activity in New York. Most economists have been expecting a decline in building permits driven by the end of a tax subsidy in New York State and this can be seen in the data, where permits in the North East fell from 234,000 in June to 53,000 in August.

Table 1 shows total permits and starts nationally and regionally.

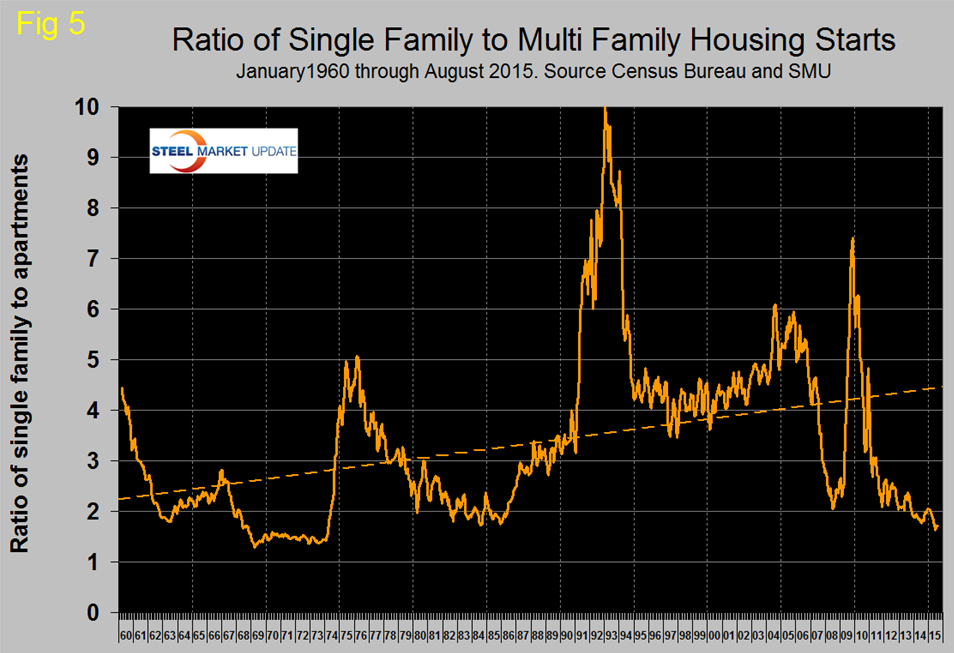

At the national level the differential between permits and starts for single and multi-family units is suggesting that the shift in consumer’s preference towards apartments is ongoing. In August on a 3MMA basis, permits of multi-family exceeded starts by 55,000 in contrast to the negative 39,000 for single family. In total permits were 46,000 more than starts. The differential between permits and starts for multi and single family units was the same across all regions with permits for multifamily exceeding starts and permits for single family being less than starts. The implication is that apartment construction is poised to surge strongly and that single family construction will slow slightly. The ratio of the two sectors is shown in Figure 5 and demonstrates that single family homes continue to be less desirable than at any time since March 1974. Based on permit data the ratio will not change any time soon.

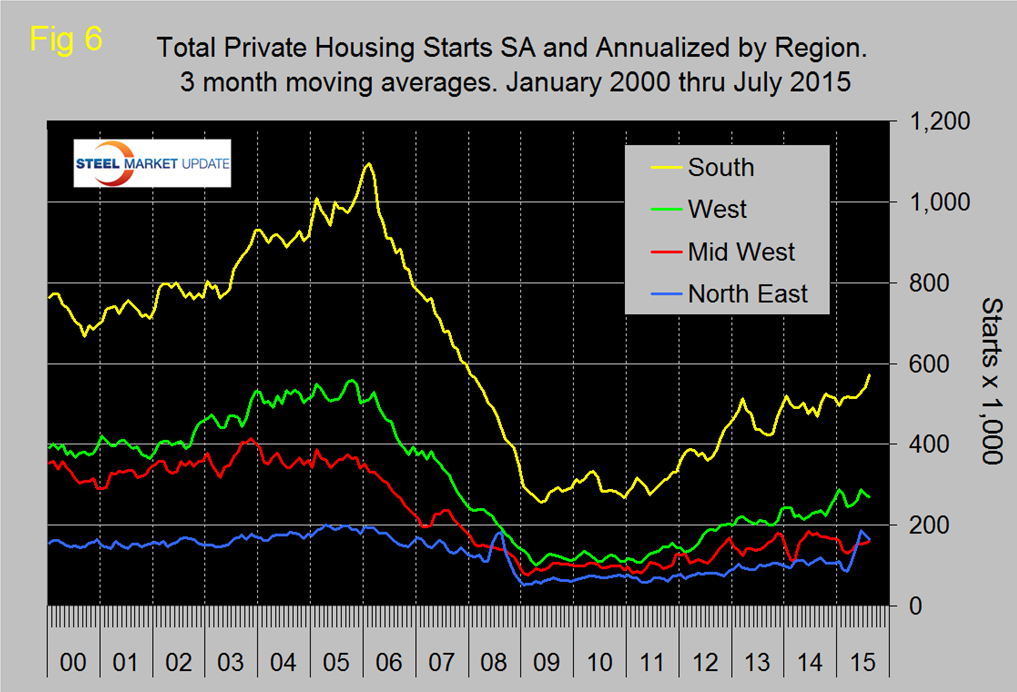

Figure 6 shows the regional situation for the 3MMA of total residential starts since February 2000. In 2015 the North East has the highest growth rate driven as mentioned above by apartment construction in New York state.

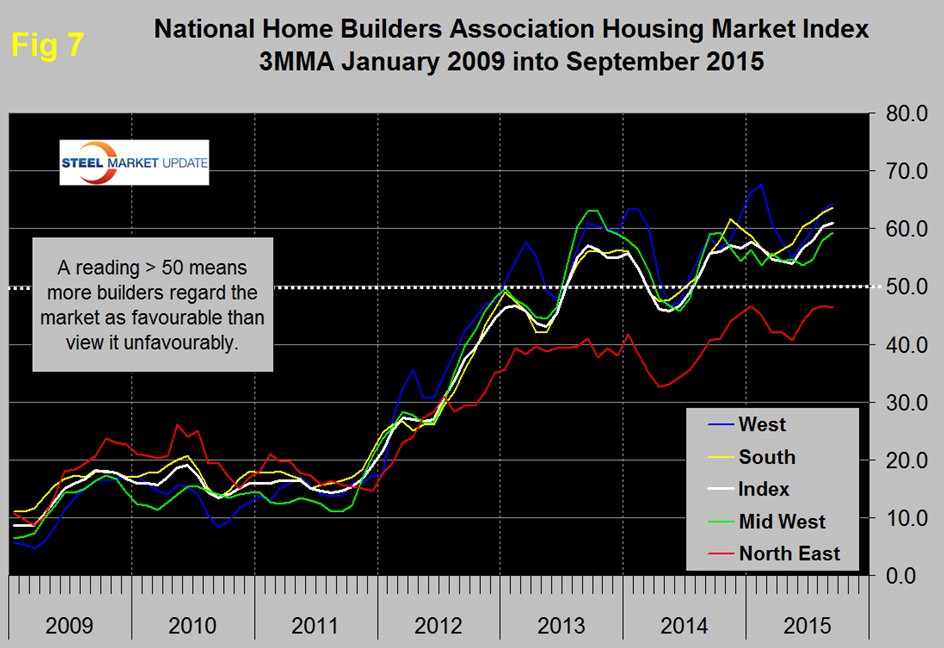

The National Association of Home Builders (NAHB) confidence report was released on Wednesday. Any value above 50 indicates an overall positive business confidence. The national average gained one point to 62 with a 3MMA of 61 which is the highest value since our data stream began in January 2009. All regions enjoyed an increase in confidence on a three month moving average basis except the NE which declined slightly in September (Figure 7). The South and west continue to be the strongest regions.

The official release from the NAHB was as follows:

Builder Confidence Continues to Rise

Builder confidence in the market for newly constructed single-family homes continued its steady rise in September with a one point increase to a level of 62 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). It is the highest reading since October 2005.

“The HMI shows that single-family housing is making solid progress, said NAHB Chairman Tom Woods, a home builder from Blue Springs, Mo. “However, our members continue to tell us that they are concerned about the availability of lots and labor.”

“NAHB is projecting about 1.1 million total housing starts this year,” said NAHB Chief Economist David Crowe. “Today’s report is consistent with our forecast, and barring any unexpected jolts, we expect housing to keep moving forward at a steady, modest rate through the end of the year.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Two of the three HMI components posted gains in September. The index measuring buyer traffic increased two points to 47, and the component gauging current sales conditions rose one point to 67. Meanwhile, the index charting sales expectations in the next six months dropped from 70 to 68.

Looking at the three-month moving averages for regional HMI scores, the West and Midwest each rose one point to 64 and 59, respectively. The South posted a one-point gain to 64 and the Northeast dropped one point to 46.