Prices

September 20, 2015

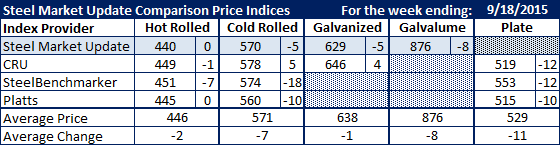

Comparison Price Indices: Slow Slide Continues

Written by John Packard

Flat rolled and plate prices continued to slip as all of the indexes followed by Steel Market Update reported pricing this week.

The CPI benchmark hot rolled average dropped $2 to end the week at $446 per ton ($22.30/cwt). We now have SMU with the lowest average at $440 per ton followed by Platts ($445), CRU ($449) and SteelBenchmarker ($451).

Cold rolled prices moved lower on three of the four indexes. Platts now has the lowest average price on their index at $560 per ton ($28.00/cwt) followed by SMU ($570), SteelBenchmarker ($574) and CRU which actually saw prices up $5 per ton this past week ($578).

SMU and CRU saw galvanized prices moving in opposite directions with SMU down $5 per ton to $629 per ton for .060” G90 while CRU had prices moving higher by $4 per ton to $646 per ton.

Galvalume prices for .0142” AZ50, Grade 80 were $8 per ton lower this past week than the week prior.

Plate prices were seen as down big by all three of the indexes following the product. Platts has the lowest average at $515 per ton (down $10) followed by CRU at $519 (down $12) and SteelBenchmarker at $553 (down $12).

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.