Prices

September 13, 2015

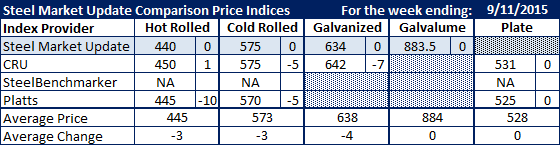

Comparison Price Indices: Basically a Flat Week

Written by John Packard

The flat rolled steel indexes followed by Steel Market Update saw prices as being relatively flat this past week with the exception of Platts which is playing catch-up as they move their prices to be more in line with the other indexes.

SMU kept all of our indices the same as the prior week as we adjusted our prices twice during that week (the last time being the Thursday before Labor Day Weekend). We now have our hot rolled price average at $440 per ton. Platts lowered their HRC number to $445 per ton and now CRU is the highest at $450 per ton (up $1 from the week before).

The indexes are all seeing cold rolled at $575 per ton (CRU down $5 others remained the same).

The galvanized spread is getting narrower as CRU adjusted their .060″ G90 pricing by $7 per ton down to $642 per ton. SMU average is $8 per ton less than the CRU number.

Galvalume also remained the same at $883.50 for .0142″ AZ 50, Grade 80 material.

Plate prices also remained the same at $525 for Platts and $531 for CRU.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.