Analysis

September 10, 2015

Construction Labor Shortage Becoming Critical

Written by Sandy Williams

Construction firms are finding it increasingly difficult to find qualified craft workers, according to a new report by the Associated General Contractors of America. More than 2 million construction workers were laid off in the 2008 recession with many of those never returning to the industry.

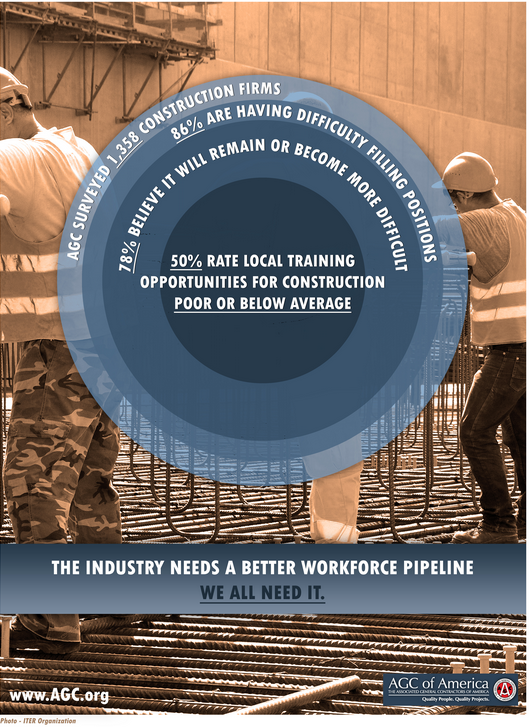

In a survey of 1,358 construction firms, 86 percent said they are having difficulty finding hourly craft or salaried professional positions. The problem is most critical for hourly craft positions with carpenters in greatest shortage, followed by sheet metal workers, concrete workers, electricians, and equipment operators. In the salaried category, 55 percent of respondents had difficulty finding project managers/supervisors, followed by estimating professionals and engineers.

“Few firms across the country have been immune from growing labor shortages in the construction industry,” said Stephen Sandherr, chief executive officer for the Associated General Contractors. “The sad fact is too few students are being exposed to construction careers or provided with the basic skills needed to prepare for such a career path.”

Construction workers who left during the recession for jobs in the energy sector are not likely to return due to wages that are nearly double of those in the construction industry, said Michael Sireno, President of Baker Triangle in San Antonio, Texas. During an AGC media call, Sireno noted that workers who are currently laid off in the oil and gas industry downturn are waiting for the industry to pick up rather than seeking lower paying construction jobs.

Increased wages and benefits are one method that the construction industry is using to attempt retain and recruit new workers. Fifty-six percent of survey respondents said they are increasing base pay rates for hourly craft professionals and 48 percent are raising pay for salaried professionals. In addition, firms are offering incentives and bonuses, improved benefits and higher overtime pay.

Nearly half of those surveyed reported have increased their use of subcontractors to fill empty positions. A strategy that has backfired in some cases when subcontractors were unable to fill labor positions either. Safety has also come into question when using less skilled workers, such as those from staffing companies.

A contractor in the Nashville area related a situation in which his company recently had a major subcontractor walk off the job because he could not find enough workers. A replacement subcontractor had to be brought in at a huge premium due to the intense competition for workers.

Contractors on the AGC media call also noted that the shortage requiring the use of less skilled labor can lead to mistakes requiring work to be redone, costing both time and money.

Most contractors are open shops but unions are also seeing a shortage of workers. Simonson reported that a Cincinnati firm recently told him that the “union benches are empty with no additional workers available.” The same situation was found in Seattle—a significant change from a year or two ago when plenty of labor was available from the union market.

Contractors say they are squeezed between owners who want low prices on projects and the need to increase wages to attract and retain workers. Margins have remained the same, making it hard to find a balance. Owners are increasingly pushing risks and regulations on to contractors, leading some contractors to back off from bidding on potential projects. The situation is becoming more prevalent in public sector construction according to the contractors on the AGC call.

There is no quick or easy solution to the labor shortage. AGC is working to increase funding for vocational education and make it easier to establish construction-focused schools. Firms are creating apprenticeship programs, at their own cost, to train workers.

When asked if the recruitment focus should be on training new workers or regaining those lost to the recession, it was noted that technological advances in construction during the past four years would require nearly as much training for workers who left as for new workers coming out of schools.

Another approach to the shortage is an increased reliance on pre-fabricated construction components that can be assembled in a factory and then shipped to construction sites for installation with fewer workers in a shorter time span. An example of this is pre-casted brick skins for buildings that can be shipped to the site and shorten by 4-5 months the time it would take laborers to lay the bricks in the field. Another example was pre-cast concrete prison cells that were trucked to the site and assembled “like a tinker toy operation.”

AGC notes that as construction demand grows, the labor market conditions will get worse.

“Finding a way to rebuild the once-robust pipeline for preparing and training new construction workers will do more than help firms,” says AGC. “Expanding career and technical education opportunities across the country will provide thousands of students another path to success that could lead to high-paying careers.”