Prices

September 8, 2015

SMU Price Ranges & Indices: Quiet After Our Late Week Change

Written by John Packard

SMU adjusted our flat rolled price indices on Thursday of last week due to information we gathered after the conclusion of our Steel Summit Conference. We noted then that the market has been very slowly leaking, with the bottom of our hot rolled range hitting $420 per ton. One of the mills with which we spoke today reported their products were drifting lower by about $5 per ton per week as they struggle to keep their customers competitive.

Most customers are reporting that there are potentially cheaper options out there IF they had business to place. Inventories continue to be referenced as being inflated. We are seeing this in our market surveys and we are hearing this in the conversations we have with buyers around the country:

We heard from an executive with a Northern based service center, “Leading up to the holiday as well as today has been extremely quiet. We have not seen any change from our mill sources and have heard talk of possible reductions available if we would place spot orders. Currently HR 450, CR 560 and no GALV inquiries… There is still too much inventory floating around for anyone to be all that concerned about supply. None of my customers seem concerned and no forward orders have been placed that we can tell.”

While another service center located in the South Central USA told us, “With respect to your questions, there is still weakening in prices but there is a very sluggish feel out there, with neither the mills not the buyers trying to get aggressive deals going. Mills are producing ahead (in one case our October is nearly all made) and I find myself now attempting to hold up shipments from arriving early. I think there’s enough inventory around and folks are awaiting outcome of labor talks. Labor Day holiday froze things in place as well, so we’ll see what transpires. Foreign prices are about the same, so spread is thinning as US prices fall.”

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $420-$460 per ton ($21.00/cwt- $23.00/cwt) with an average of $440 per ton ($22.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range are unchanged compared to our last published prices. Our overall average is the same compared to last Thursday. SMU price momentum for hot rolled steel is Neutral at the moment but we are seeing short term pockets of weakness which could take prices lower over the next couple of weeks.

Hot Rolled Lead Times: 2-5 weeks.

Cold Rolled Coil: SMU Range is $550-$600 per ton ($27.50/cwt- $30.00/cwt) with an average of $575 per ton ($28.75/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range are the same as they were last Thursday. Our overall average is unchanged compared to our last published price. SMU price momentum on cold rolled steel is at Neutral but, like hot rolled above, we could see a weakening in prices over the next two or three weeks.

Cold Rolled Lead Times: 4-8 weeks.

Galvanized Coil: SMU Base Price Range is $27.00/cwt-$29.50/cwt ($540-$590 per ton) with an average of $28.25/cwt ($565 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range are unchanged compared to our last published prices. Our overall average is the same compared to last Thursday. Our price momentum on galvanized steel is Neutral with some pockets of short term weakness.

Galvanized .060” G90 Benchmark: SMU Range is $609-$659 per net ton with an average of $634 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-7 weeks.

Galvalume Coil: SMU Base Price Range is $28.75/cwt-$30.50/cwt ($575-$610 per ton) with an average of $29.625/cwt ($593 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range are the same as they were last Thursday. Our overall average is unchanged compared to our last published price. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards Neutral but with a short term downward tilt.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $866-$901 per net ton with an average of $883.5 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-7 weeks.

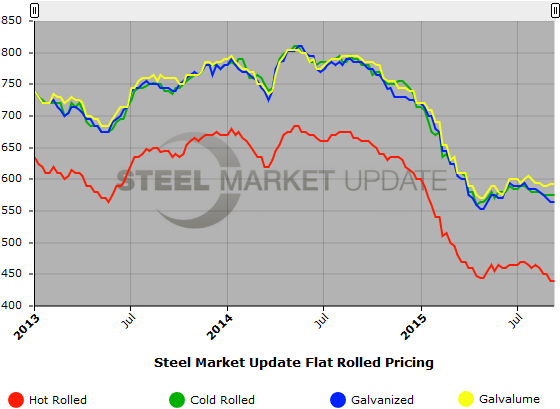

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.