Prices

September 8, 2015

Service Center Spot Price Offers Beginning to Drop

Written by John Packard

Last week Steel Market Update conducted our early September flat rolled steel market analysis. One of the areas we watch very closely is how are distributors handling spot flat rolled steel purchase prices to their manufacturing customers? We have found that as service center spot prices weaken, so do mill prices until they reach the point of “capitulation” – the point where almost all spot prices are falling and there has been enough pain and trauma within the industry which provides a spark for the mills to raise prices.

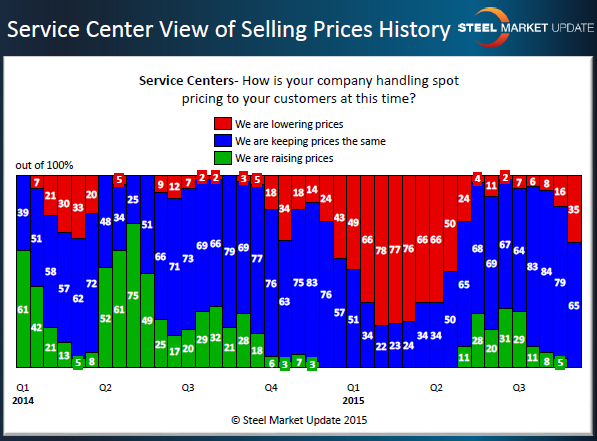

We saw the service centers reach the point of capitulation (which we have defined as 75 percent or more of the distributors reporting their company as lowering spot flat rolled pricing.

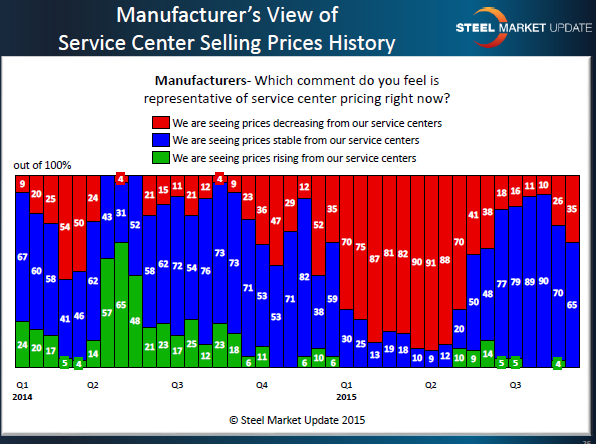

First, we check the manufacturing segment of the industry to see what they are reporting when it comes to spot prices out of the service centers. This past week 35 percent of the manufacturing respondents reported distributors as lowering spot prices. This is an increase of 9 percentage points from mid-August and is 25 percentage points higher than what was reported just one month ago.

You can see the change in the trend in the graphic below.

We then asked service centers to report on whether their company was lowering, raising or keeping spot prices the same and we found very similar results as what was being reported by the manufacturers. As you can see by the graphic below, 35 percent of the responding distributors reported their company as lowering prices.

Our expectation is for this trend to continue unless something dramatic happens (such as an extended steel mill lockout) or other supply disruption.

The practice of dropping spot prices is a way for service centers to eliminate excess inventories. Until they remove excess inventories they do not have the need to buy more material from the domestic steel mills which keeps their lead times lean and their anxiety levels high making them more prone to negotiate steel pricing for future delivery.