Market Data

September 3, 2015

Steel Summit Conference: Expect 2016 to be a Good Year for Steel

Written by John Packard

Earlier this week, Steel Market Update hosted our 5th Steel Summit Conference. We had a record crowd in attendance tipping the scales at close to 300 people. We had 26 speakers over the course of the two day conference (including Peter Wright and John Packard of SMU) and, from our perspective, the longer term forecast (2016) is actually bullish for steel demand.

However, those directly involved in the steel industry and our economists who looked at the short term (balance of 2015) as well as the longer term, suggested that the industry will have some headwinds over the next few months.

As you can imagine, there was a lot of discussion about the flat rolled steel trade cases and what the consequences would be should the US International Trade Commission (ITC) rule that penalties or duties should be collected from a number of the countries named in the antidumping suits filed (by the way the duties that are collected go to the US government’s general revenue funds).

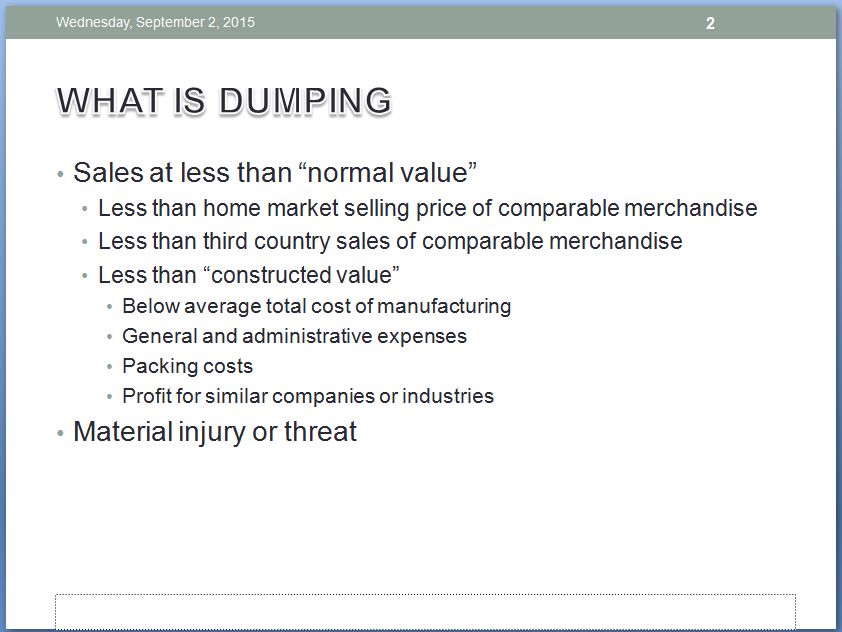

As we moved about the conference hall and spoke to traders, steel mills, distributors and end users, the consensus of opinion was that China would be hit with duties and probably hit hard. However, the room was split as to whether all of the other countries named in the suits were really dumping (explanation of dumping from trade attorney Lewis Leibowitz presentation shown below).

Lewis Leibowitz also pointed out in his remarks that it is not illegal to sell steel below domestic mill pricing nor is it illegal to sell products with subject steels (such as cars made with galvanized steels). His point being that by blocking the sale of steel you force countries to instead go up the value chain and sell finished products, which in turn hurts many more jobs in the United States than just those in the steel mills.

Dan DiMicco and others spoke about the need for the United States to have a vibrant steel industry for security and economic reasons.

Our second day economic and business cycle keynote speaker Alan Beaulieu provided a forecast which call for business conditions to be better than 2015 (we will be happier but not ecstatic). There are still some challenges in the energy markets but he was forecasting higher energy costs (including a rising oil price by the end of 2016).

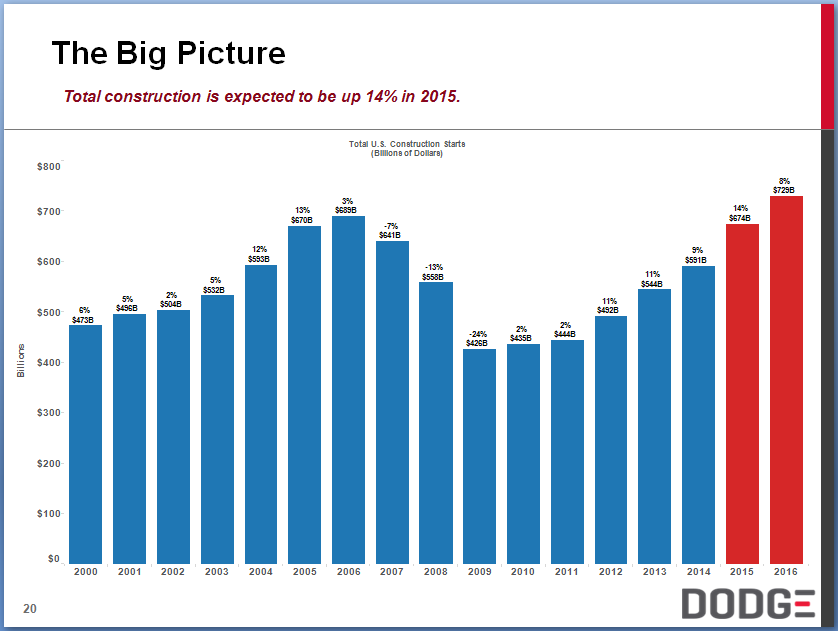

Richard Branch of Dodge Analytics is forecasting growth in many key areas of construction:

Commercial construction starts for 2016 are forecast at $99.7 billion up 12 percent over 2015 (which will be up 11% over 2014). The peak of the last cycle was 2007 at $100.7 billion so we are nearing the pre-Great Recession peak.

Office building starts are forecast to rise by 14 percent in 2016 to $36.2 billion which is above the 2007 pre-Great Recession peak of $32.6 billion.

Retail building (shopping and strip malls) have been slower to recover but are expected to rise in 2016 by 13 percent YOY. The $21.5 billion projected number is well below the 2007 peak of $29.4 billion.

Industrial construction (+11%), educational building (+13%), healthcare (+9%) are all forecast higher.

Multi-family housing starts also are forecast to increase by 7 percent to 476,000 units.

When looking at construction, which is approximately 60 percent of the overall steel market, Dodge projects total expenditures of $729 billion.

The forecast from CAR (Center for Automotive Research) for light vehicle builds for 2016 was also quite compelling for the steel industry. The industry is not only forecast to continue at 17 million plus units but the other good news is the majority of these vehicles have a “hatch” (trucks or SUV’s) and these are the units that contain the most steel.

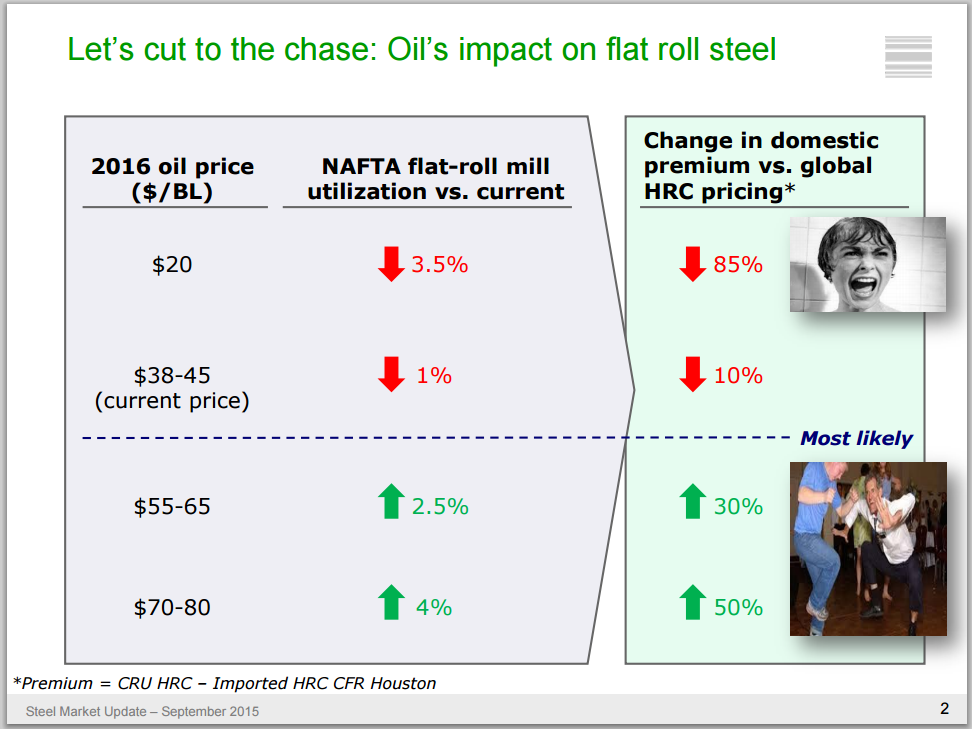

The one area that continues to be a concern is the energy market – especially oil rigs. Sachin Shivaram of Tenaris share a particularly useful point of view about what oil prices will mean to the flat rolled steel market. Sachin told the group if oil stays at its current price level of $38-$45 per barrel it would have a negative one percent impact on the domestic mill utilization rates from current levels. On the other hand, if oil prices were to rise to $55-$65 per barrel as many analysts are predicting for late 2016, it would result in a 2.5 percent improvement in utilization rates and would also have an impact on pricing.

The dotted line is where Tenaris believes the market will settle in 2016.