Market Data

September 3, 2015

SMU Steel Buyers Sentiment Index Feeling the Strain…

Written by John Packard

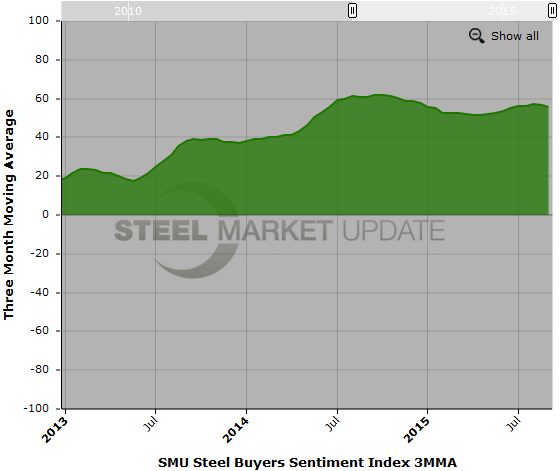

Buyers and sellers of flat rolled steel continue to remain optimistic about their company’s ability to be successful in the current market conditions. However, we have seen a weakening of that position especially when we look at the numbers based on a 3-month moving average.

The SMU Steel Buyers Sentiment Index measures how flat rolled steel buyers and sellers feel about their company’s ability to be successful both in the existing market conditions (current) as well as three to six months into the future.

Our most recent market analysis indicates that current Steel Buyers Sentiment is +50, well within the optimistic range of our index, yet down 3 points from our last survey and down 6 points from one month ago. One year ago our index was +53 or, essentially the same.

When looking at the numbers from a 3-month moving average we can see the easing trend that has been developing for some time. The 3MMA this week is +55.67 down from 56.83 reported during the middle of August and below the +57.33 we saw one month ago. Last year at this time the 3MMA was +60.67.

Steel Buyers Future Sentiment Index

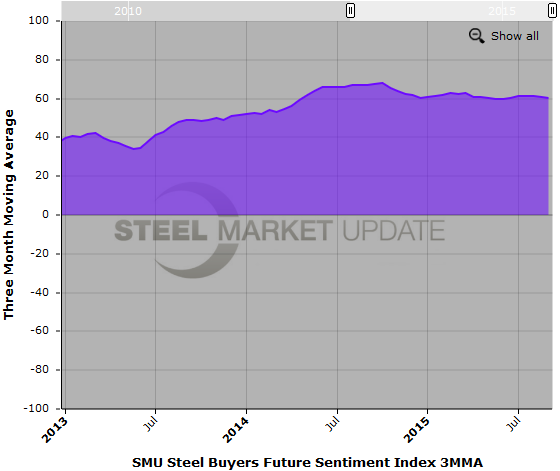

We see a similar path in our future (3 to 6 months into the future) Steel Buyers Sentiment Index. Future Sentiment is being reported this week at +56 which is down 2 points from our last survey and down 3 points from one month ago. One year ago future Sentiment was +65.

Looking at future Steel Buyers Sentiment from a 3 month moving average perspective our new number is +60.33 which is well within the optimistic range of the index. Pulling back and looking at how it has changed over the past month we see Sentiment has been very slowly dropping in its intensity. Our mid-August survey reported future Sentiment (3MMA) as being +60.67 and one year ago it was +67.17.

What Our Respondents are Saying

“Our business is seasonal and we are now going into the busiest part of it. Time to make hay!” Manufacturing company

“Like last year, business slowing down too early.” Manufacturing company

“Business is fair, not great, but better still need pricing power, but this is difficult in an over produced market.” Manufacturing company

“PLATE market will heat up in Q4.” Service center

“Not a lot of demand.” Service center who went on to say that the only reason why people are buying is strictly for price.

“Improvement in highway construction vehicles are increasing plate demand. Large mining/excavation remains weak due to pricing from Oil/Energy sectors. Very optimistic outlook for Calendar Q4.” Steel mill

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 43 percent were manufacturing and 44 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.