Market Data

September 3, 2015

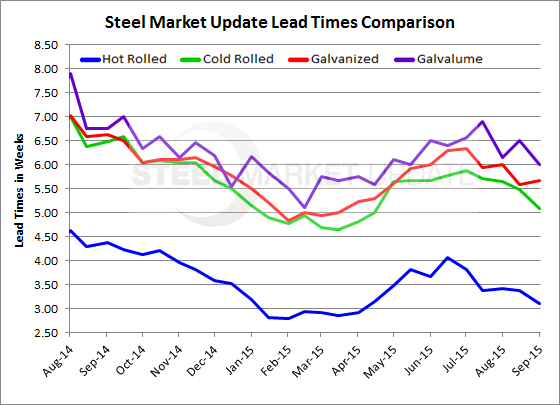

Lead Times Remain a Week Shorter than One Year Ago

Written by John Packard

Domestic steel mill lead times continued to be relatively short based on the consolidated results of our most recent flat rolled steel market analysis just completed earlier today. It is our opinion the short lead times are influencing negotiations and most likely explain the weakness we saw in our flat rolled prices that were just adjusted for the second time this week.

Hot rolled lead times averaged 3.11 weeks which is down modestly from the 3.41 weeks reported at the beginning of August. When we took a look at the beginning of July, HRC lead times were at 3.82 weeks and one year ago they were reported to be 4.37 weeks.

Cold rolled lead times averaged 5.08 weeks according to the results of this week’s flat rolled survey. This is about a half a week shorter than what we reported at the beginning of August and well below the 6.48 weeks reported one year ago.

Galvanized lead times averaged 5.66 weeks which is down slightly from the 6.0 weeks reported at the beginning of August and one week less than the 6.62 weeks we saw one year ago.

Galvalume lead times also dropped by half a week from 6.5 weeks down to 6.0 weeks. AZ lead times are three quarters of a week shorter than what we reported at this time last year.

To see an interactive history of our Steel Mill Lead Time data, visit our website here.