Prices

August 30, 2015

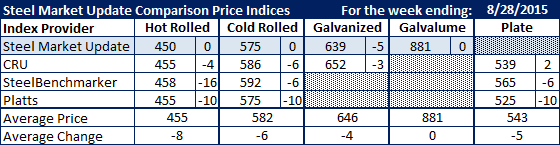

Comparison Price Indices: Everyone Moving Lower

Written by John Packard

Virtually all of the indexes followed by Steel Market Update have begun to note the falling prices on flat rolled steels in North America.

Benchmark hot rolled continues to be the most volatile product, dropping by as much as $16 per ton according to SteelBenchmarker (who only reports prices twice per month) and even Platts, which had held on to their $465 per ton average for a number of months, finally took their average down to $455 per ton. The various indexes are showing hot rolled coil as averaging $450 to $458 per ton with $455 being the average of the four indexes (down $8 per ton compared to last week).

Cold rolled coil prices also dropped according the three of the four indexes. The range of pricing is now $575 (SMU, Platts) to $592 per ton (SteelBenchmarker) with CRU taking the middle ground at $586 per ton.

Galvanized price averages dropped by $5 per ton (SMU) and $3 per ton (CRU) and combined the two indexes average $646 per ton for .060” G90.

Galvalume was unchanged while plate prices fell at two of the three indexes while CRU reported plate prices as rising by $2 per ton. There is a wide variance between the high and the low as Platts reported plate as being $525 per ton, CRU $539 per ton and SteelBenchmarker at the high end at $565 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.