Prices

August 23, 2015

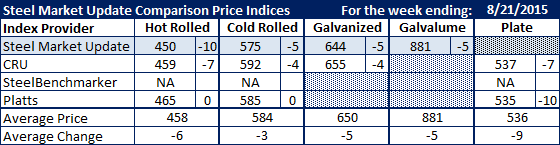

Comparison Prices Indices: Slip Sliding Away

Written by John Packard

With the exception of Platts, all of the other indexes reporting (and followed by SMU) saw flat rolled products as losing ground this past week.

Steel Market Update (SMU) is leading the way with their benchmark hot rolled coil (HRC) average dropping by $10 per ton to $450 per ton. This is $5 higher than the low for the year which was produced at the end of April. CRU also saw HRC as being lower dropping their index by $7 per ton to $459 per ton. Platts kept their average the same at $465 per ton.

Cold rolled had similar results as hot rolled. SMU and CRU both saw CRC as being down modestly for the week ($5 and $4 respectively). Platts kept their number the same at $585 per ton.

SMU & CRU both saw galvanized prices as being lower by $5 and $4 respectively. However, there is an eleven dollar per ton spread between the two indexes.

SMU also saw Galvalume prices as being $5 per ton lower than the prior week.

Both CRU and Platts saw plate prices as being lower this past week. CRU saw plate down $7 per ton to $537 per ton while Platts dropped their index by $10 per ton to $535 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.