Distributors/Service Centers

August 22, 2015

Service Centers Beginning to Discount Spot Pricing

Written by John Packard

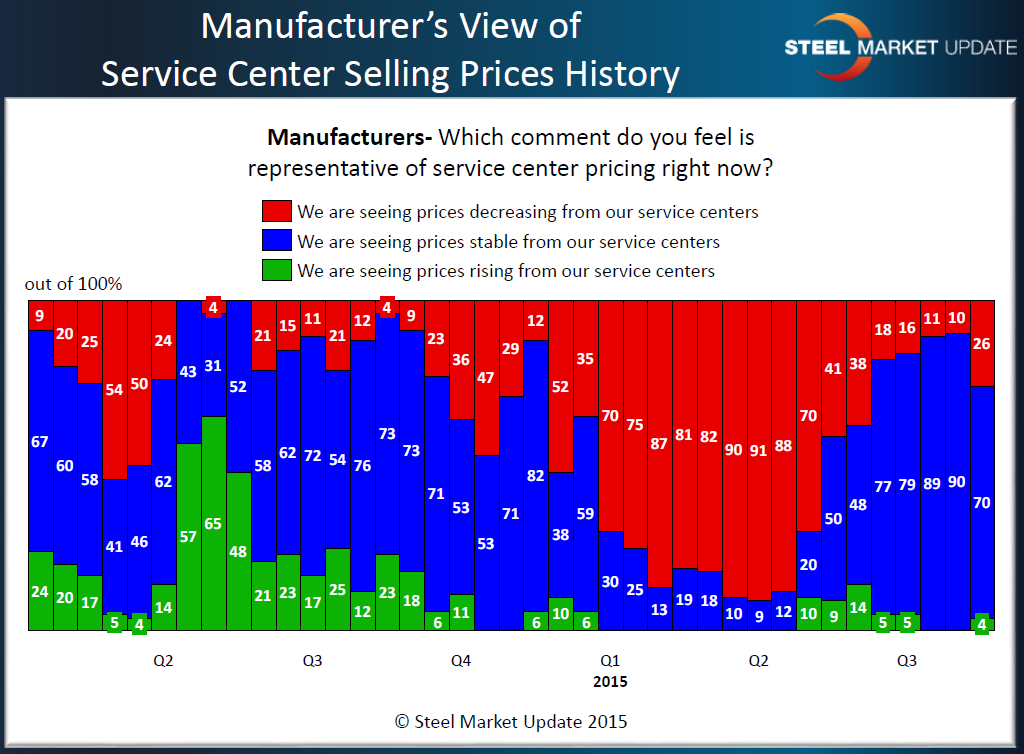

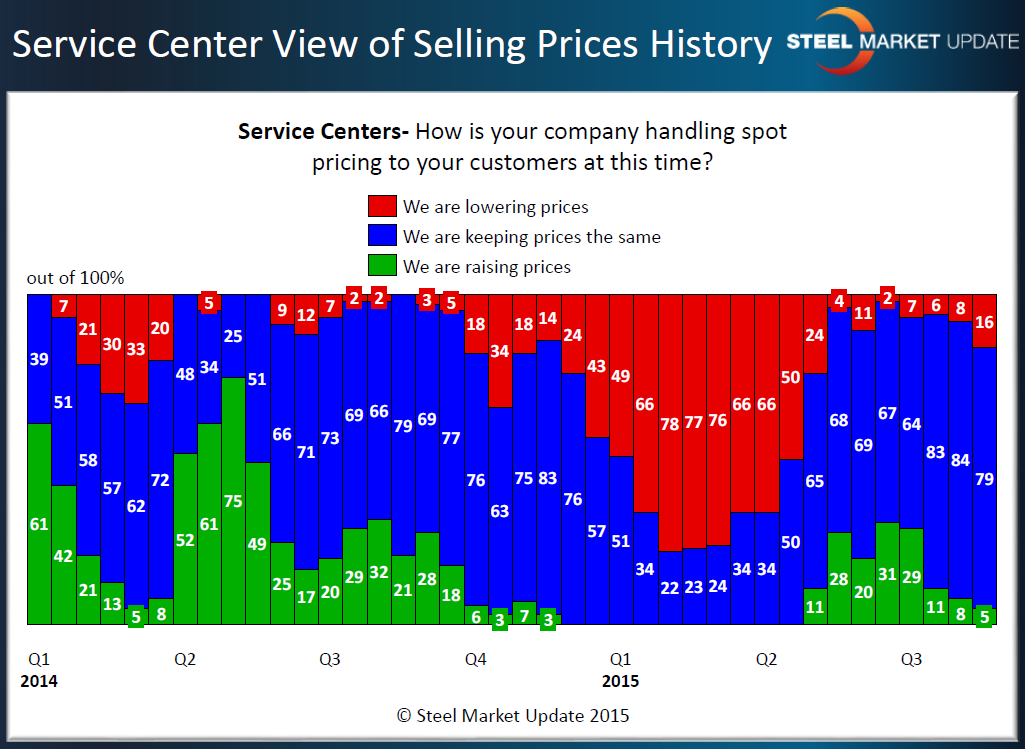

Throughout the first four months 2015, service centers were dumping steel into their manufacturing customers (and each other) as mill and international prices fell. Domestic mill spot prices bottomed at the end of April as the domestic mills announced their first of two $20 per ton price increases.

Service centers responded to those price announcements by reducing the amount of discounted steel being offered into the spot markets. This move was then reinforced by the antidumping petitions filed on coated, cold rolled and hot rolled steels.

However, we have seen a weakening trend developing in the markets. During last week’s flat rolled steel market analysis conducted by Steel Market Update, we asked our participants if they were seeing flat rolled steel prices as weakening in spite of the trade suits. Fifty-seven percent of the total respondents responded that they were seeing a weakening market.

Separate from our survey, SMU asked a number of large service centers and manufacturing companies if they were seeing any signs of a weakening market. One service center told us, “Last two weeks, something seems to have given way to a lot more pessimism to creep into the market.” In a separate note the same steel buyer told us, “I think the post trade case analysis is yielding more and more to the observer a lack of demand than a case of oversupply. It won’t be surprising to see levels from US mills start trending lower again.”

Over the weekend a manufacturing company submitted the lead times from one of the southern mills and a comment, “7 day lead time for Hot Roll; WOW! Mills are calling all day for orders and not making much progress.”

During the survey process one service center respondent was quite candid when they left behind this comment, “Doing anything to get the order.”

We will need to be vigilant in the coming weeks to see if demand has dropped off and is the drop off affecting more than just the energy markets.

The Power Point graphics shown above are part of the presentation which is given to those who participate in our questionnaire as well as our Premium level members. If you would like to learn more about our Premium product please contact us at: info@SteelMarketUpdate.com or by phone: 800-432-3475.