Market Data

August 20, 2015

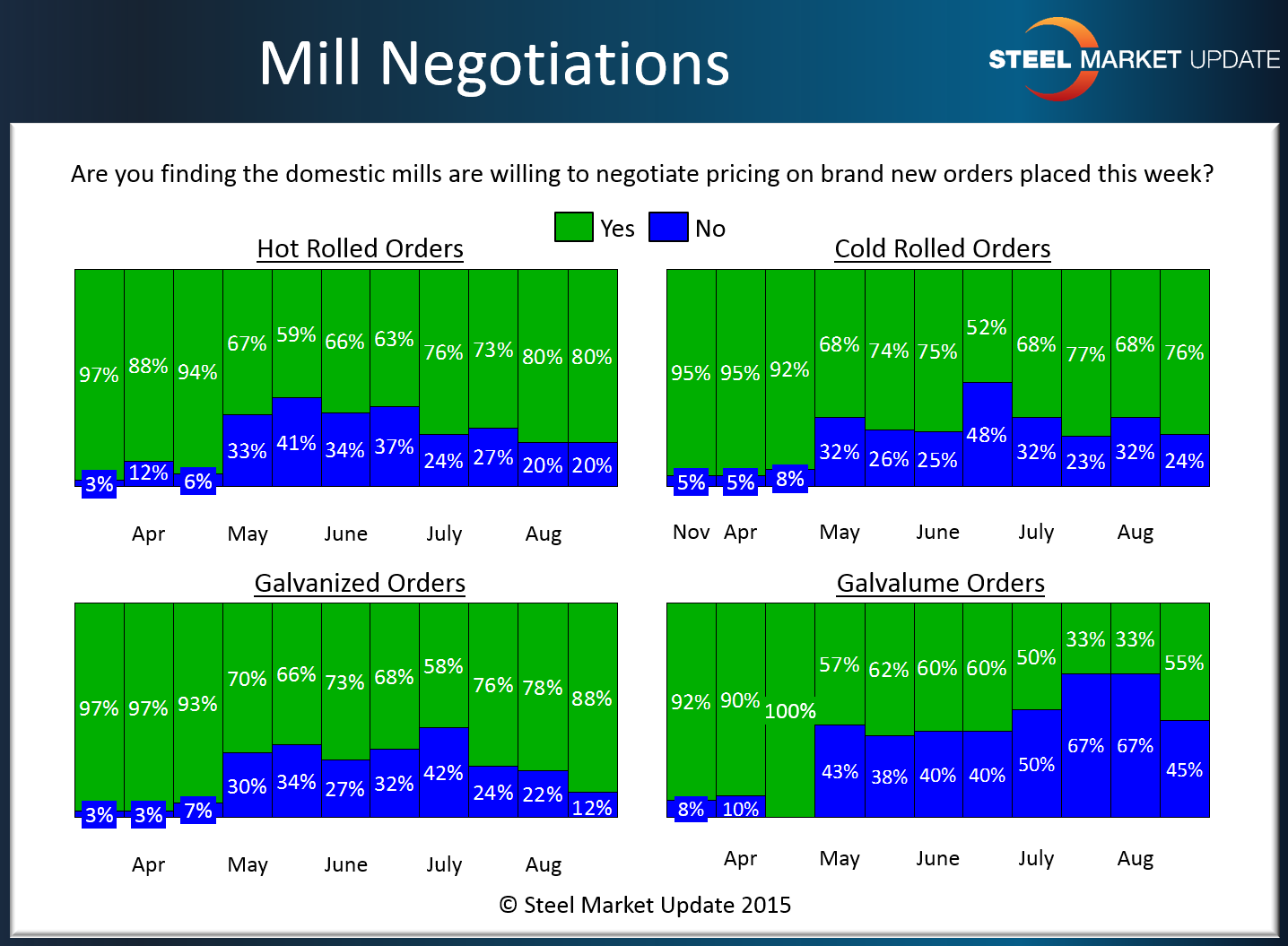

Steel Mills Continue to Negotiate Flat Rolled Steel Pricing

Written by John Packard

Based on the results of our latest flat rolled steel market analysis (survey) the U.S. and Canadian steel mills continue to be willing to negotiate prices of hot rolled, cold rolled, galvanized and Galvalume steels.

Benchmark hot rolled, which has been hit especially hard by the drought in orders from the energy markets, had 80 percent of our respondents reporting the mills are willing to negotiate prices this week. This is the same as what was reported at the beginning of the month and the mills are being slightly more agreeable to flexible steel pricing than what was measured during the months of May, June and July.

Cold rolled is another product where our respondents reported the mills are willing to negotiate pricing. Seventy-six percent of those responding to our queries on cold rolled reported the mills as being flexible. This is up 8 percentage points from the beginning of the month.

Galvanized is another product where a larger percentage of our respondents reported the mills as being willing to negotiate pricing. Eighty-eight percent of those responding reported the mills as being negotiable. This is up 10 percentage points from the beginning of the month and 30 percentage points higher than what we saw at the beginning of July.

Galvalume, which saw a small uptick in lead times, was the one product where a small majority reported the mills as willing to negotiate. Fifty-five percent reported the mills as negotiable. This is up from 33 percent at the beginning of the month and about the same as what we had measured during the months of May, June and the beginning of July.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.