Market Segment

August 18, 2015

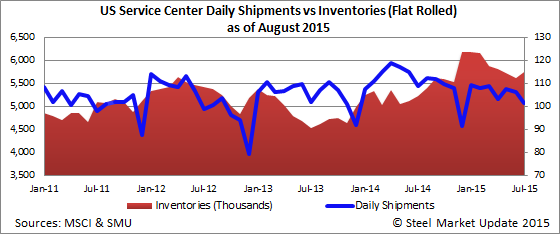

MSCI Flat Rolled Shipments Drop & Inventories Rise

Written by John Packard

The Metal Service Center Institute (MSCI) reported July steel service center shipments and inventory data for the month of July. Expectations had been running high that shipments would decent for the month and that inventories, which had been dropping over the past six months, would continue that trend. Unfortunately, 2015 is turning out to be the year where dreams do not come true.

Let’s take a moment and first look at the overall picture. Total steel shipments (all products) for the month of July totaled 3,442,300 tons or 156,500 tons per day. Shipments were down 7.0 percent compared to the previous year when the U.S. service centers averaged 168,300 tons of shipments per day.

Total steel inventories (all products) came in at 9,180,200 tons which are 5 percent higher than one year ago. The number of months on hand rose from 2.6 to 2.7

Carbon Flat Rolled

Distributors shipped a total of 2,230,400 tons of flat rolled during the month of July or, 163,200 fewer tons than during the same month last year. The 101,400 tons of shipments per day were at the lowest level seen since December 2014.

Flat rolled inventories totaled 5,747,700 tons at the end of July. The service centers built back all of the steel reductions made going back to May and broke the six month destocking trend which began in January of this year. For the first time this year service centers built inventories which rose by 140,200 tons. The months on hand now stand at 2.6 months, up from 2.4 months at the end of July.

Plate

Carbon plate shipments totaled 381,600 tons at an average of 17,345 tons per day. Shipments were higher than the prior month by 3.7 percent and the previous year by 1.6 percent.

Distributors held 1,065,800 tons of plate in inventory as of the end of July. This is down slightly from the 1,118,800 tons reported at the end of June. Total months on hand dropped from 3.0 months to 2.8 months.

Pipe & Tube

U.S. service centers shipped a total of 228,200 tons of pipe and tube during the month of July. This equates to an average of 10,372 tons per day. Pipe and tube shipments were down 5.5 percent compared to one year ago.

Pipe and tube inventories stood at 698,100 tons at the end of the month which is unchanged from the prior month. Inventories were up 6.6 percent compared to one year ago. The domestic service centers are now holding 3.1 months of inventory on their floors as of the end of July. This is slightly higher than the 3.0 months reported by the MSCI one month ago.