Market Data

August 13, 2015

Update on the Chinese Yuan

Written by Peter Wright

The following article was written by Peter Wright, consultant and instructor associated with Steel Market Update. Mr. Wright writes a more detailed article for our Premium level clients that spells out details of currency changes for all of the steel trading nations. He noticed that the Chinese government is intervening in the value of their currency which has an impact on Chinese export pricing to the United States and elsewhere.

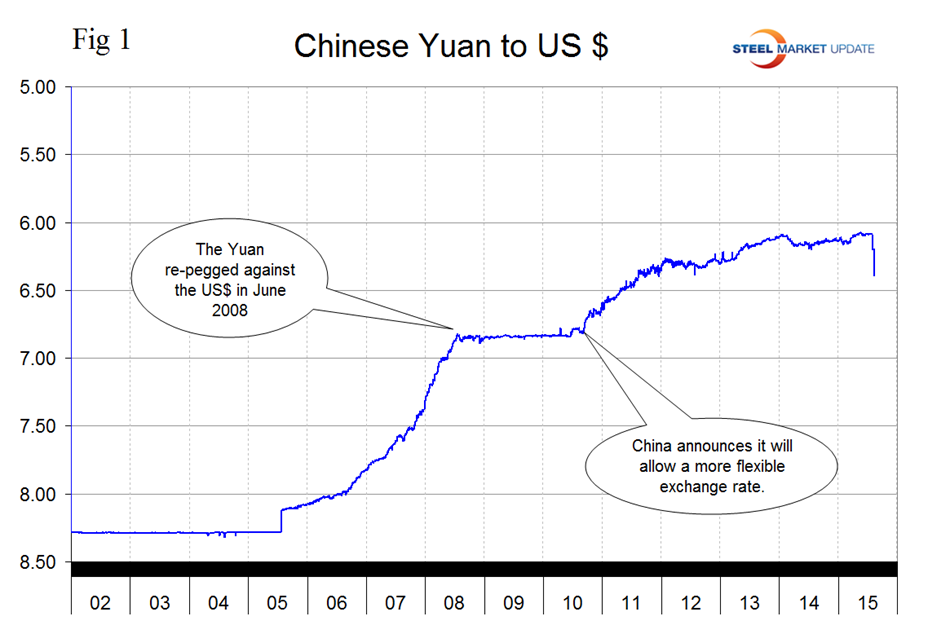

On Wednesday the Yuan was devalued for the second day in a row making a two day total of 3.0 percent (Figure 1).

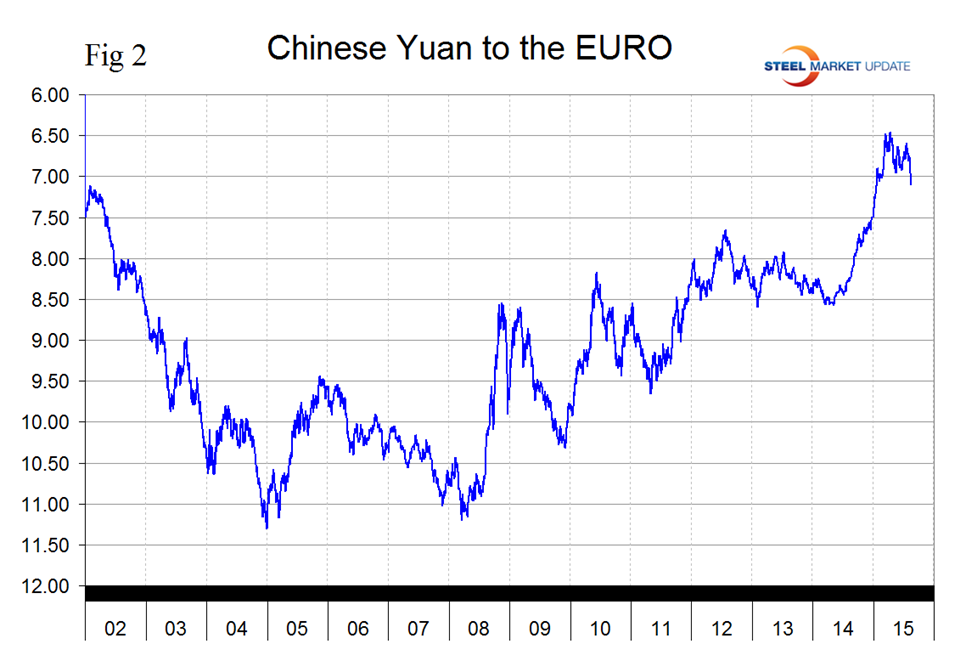

The problem with a peg to the US $ is that as the dollar appreciates, China’s goods become more expensive on the world market. The EU is China’s largest trading partner. On April 14th the Yuan was at an all-time high against the Euro with a value of 6.4602 / Euro (Figure 2).

The Yuan now stands at 7.1048 / Euro. A similar situation exists in the Yuan to the Yen comparison.

On Wednesday New York Fed President William Dudley commented as follows: “obviously if the Chinese economy is weaker than what the Chinese authorities anticipated, it’s probably not inappropriate for the currency to adjust in consequence to that weakness. It’s very early days to judge what’s happening in China in terms of the changes in their currency policy. Clearly what was happening is the Chinese yuan was appreciating along with the U.S. dollar.”

On August 12th Scott Grannis wrote in Seeking Alpha, “with the central bank’s decision to peg the yuan to the dollar (a peg which has been adjusted, mostly upwards, many times over the past two decades), comes the obligation to purchase any net inflow of foreign currency, and to be a net seller of foreign currency in the event of net outflows. Even though the yuan has been getting stronger and stronger for years, China experienced an almost constant net inflow of foreign capital; the economy was booming and everyone wanted to get a piece of the action. China’s foreign exchange reserves increased from almost nothing in 1995 to about $3.5 trillion today. But over the past year, China’s forex reserves have dropped from $4 trillion to $3.5 trillion, which means China is now experiencing net outflows of capital.

“As long as China’s reserves were rising, it made sense for the central bank to allow the currency to appreciate. But now that reserves are falling, it makes sense to allow the currency to depreciate. Capital outflows are the world’s way of saying that the yuan is “too strong.” China is no longer booming, it’s merely growing more rapidly than most other economies. The yuan will probably continue to fall against the dollar until it reaches a level that equilibrates capital inflows with outflows. And there’s nothing wrong with that. That’s how currencies compensate for differences in the economic performance and relative attractiveness of economies.

“The yuan is not suddenly collapsing or being devalued, it’s simply adjusting to the new reality of slower Chinese growth.

“A somewhat weaker yuan will make Chinese goods a bit cheaper for U.S. consumers, and there’s nothing wrong with that either.”

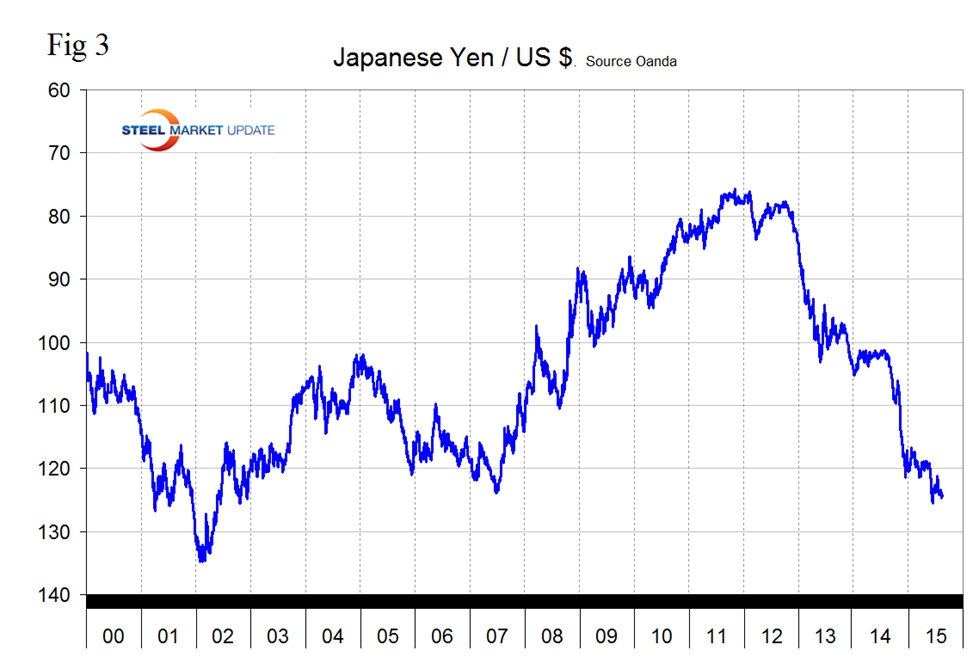

SMU comment; The Yen has depreciated by 18.1 percent against the US $ in the last year (Figure 3) and by a similar amount against the Yuan because of the currency peg.

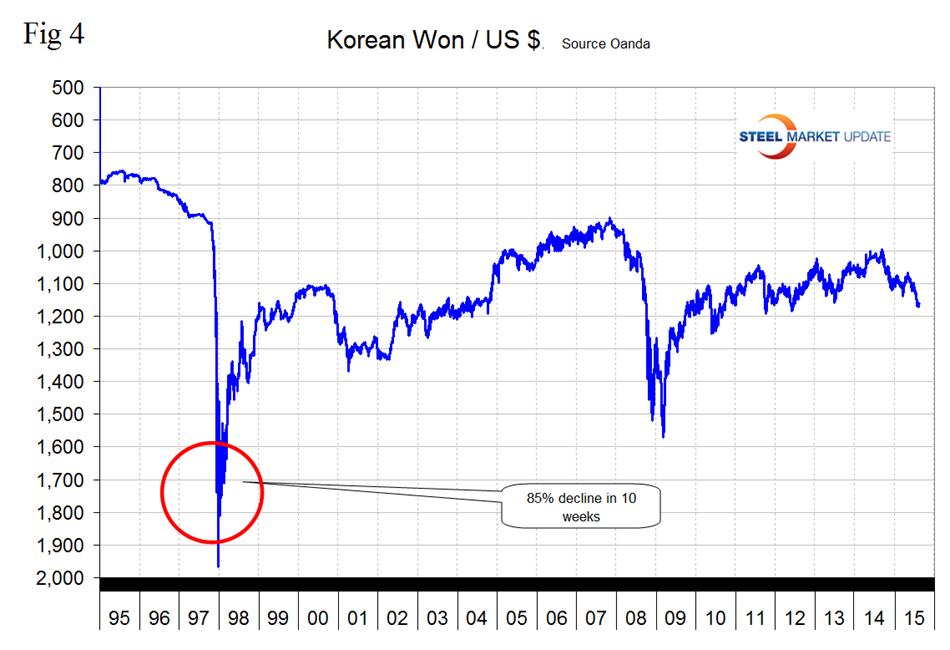

The Korean Won is down by 10.9 percent in 12 months (Figure 4).

The depreciation of the Yuan may result in further devaluations by its trading competitors in the Far East which will expose the US $ even more than it is today in the global currency stakes. This is not good news for the global competitiveness of US steel producers.